World's Largest Uranium Producer Warns Of Production Woes

Image Source: depositphotos

The world's largest producer of uranium issued a warning about production delays and escalating shortages of essential chemicals needed for extracting the heavy metal, predicting a near-term decrease in production levels. This development is likely to support higher uranium prices.

NAC Kazatomprom wrote in an earnings report Thursday that 2024 uranium production volumes are expected to be in the range of 21,000 to 22,500 tons. It reduced its production guidance for the year by 12% to 14%.

"Adjustments to the previously announced production intentions are due to challenges related to the availability of sulphuric acid and construction delays at the newly developed deposits," Kazatomprom said. As a result, production at most of its uranium-mining operations will be 20% below the levels allowed by permits for this year.

The company pointed out inventory levels are at "comfortable levels" to fulfill "existing contractual commitments in 2024."

"However, a swift return to a 100% production volume level relative to subsoil use agreements may be at risk," it said.

Spot prices for uranium concentrate used in nuclear power generation have recently been hovering over $100 per pound - a 16-year high.

Shares of Global X Uranium ETF jumped as high as 7.5%, the highest intraday level since 2014, on the news.

Earlier this month, BofA's metals and mining team told clients: "Uanium's third bull market set up for a promising 2024."

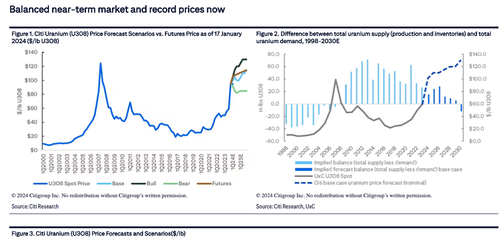

And Citi analysts stated a growing uranium supply gap will boost prices. They laid out three scenarios for prices:

The report from Kazatomprom today only means the uranium market is getting tighter.

Let's revisit our December 2020 note to readers: "Buy Uranium: Is This The Beginning Of The Next ESG Craze," since then, everything uranium has soared.

More By This Author:

GM Shifting From EVs To Plug-In Hybrids, Following Industry Trends

Apple Slides On Plunging China Sales, Service Revenue Miss, Disappointing Guidance

Amazon Soars After Beating Estimates, AWS Profit Impresses, Guides Higher

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more