Why Gold Isn't Going Up, But Black Gold Is

An oil derrick at dusk. Image via Laredo Petroleum.

All Inflation Isn't The Same

Demand-side inflation is a surfeit of money, making money cheaper and everything else (including gold) more expensive. What we have now is supply-side inflation. We made this point earlier this month (Supply-Side Inflation Hits Home), in which we referred to economist Alan Cole's post ("How I Reluctantly Became An Inflation Crank"). Cole quoted the soon-to-be-retired Boston Fed President Eric Rosengren, speaking about a previous bout of supply-side inflation in 2011:

Because my analysis suggests that recent food and oil price increases have their roots in concerns about wheat harvests in Russia and oil production in Libya and the like, I do not believe that monetary policy is the appropriate tool to respond to these disruptions. While many observers see food and energy prices rising and assume the Fed should tighten policy - raise the cost of money and credit - to head off inflation, I would suggest taking a step back and recognizing that tighter U.S. monetary policy will do nothing to stabilize Libyan oil production, reduce uncertainty about political stability in the rest of the Middle East, or increase the wheat harvest in Russia.

As Cole pointed out, "COVID-19 has created a similar outcome, just with different supply-side bottlenecks".

Gold Versus Oil And Natural Gas

An obvious difference between gold (often tracked via GLD) and oil and natural gas is when oil and natural gas are consumed, they're gone, whereas practically all the gold ever mined on earth is still around. So supply-side bottlenecks caused by COVID had a much bigger impact on oil supplies, for example, than gold. For a while, this was partly masked by declining demand for oil due to lockdowns (fewer workers commuting, etc.), but the supply bottlenecks were significant. For example, the Baker Hughes rig count now shows 521 active drilling rigs in the U.S. That's up from 261 active rigs in September of 2020; before the COVID lockdowns in March of 2020, the U.S. rig count was 790.

Bullish On Energy In 2021

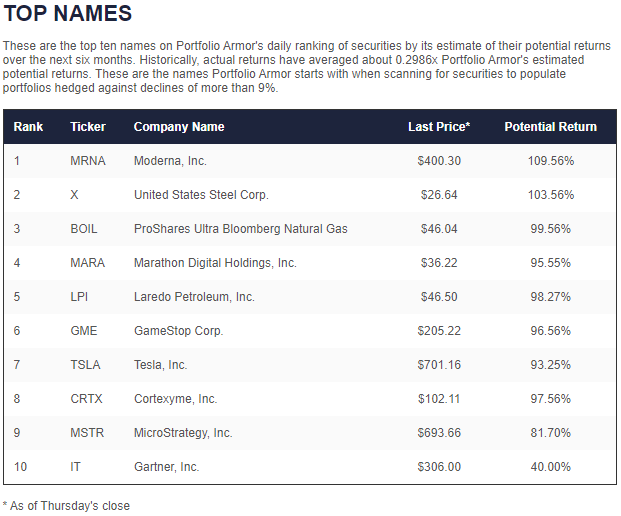

We first mentioned our oil top name, Laredo Petroleum (LPI) here last February (Trouble In Texas). We first mentioned our natural gas top name, the ProShares Ultra Bloomberg Natural Gas ETF (BOIL) here in July (A Structural Inflation Shock). But if you didn't buy them then, it wasn't too late to make some gains. Both appeared in our top ten names at the end of August.

Screen capture via Portfolio Armor on 8/26/2021.

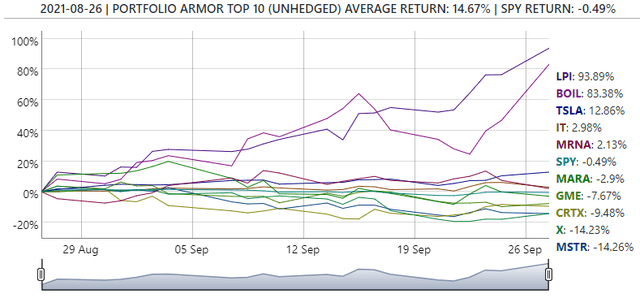

Since then, LPI was up about 94% as of Monday's close, and BOIL was up about 83%.

And, as we mentioned over the weekend (Is China Repeating A 600-Year-Old Mistake?), the un-levered United States Natural Gas ETF (UNG) started appearing among our top names in September. It was up more than 12% on Monday.

Safety First

As always, we suggest readers consider hedging if they are going to buy our top names, especially volatile ones such as BOIL. It was up nearly 25% on Monday, but it can swing down just as hard. We posted a video showing how to optimally hedge it with our iPhone app earlier this month.

You would, of course, want to scan for a current hedge if you hedge BOIL now, but you can use the same process shown in the video above.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more

This article makes several good points woth recognizing and considering. A very rational analysis indeed. Thanks!