Weekly Forex Forecast – S&P 500 Index, Gold, Silver

Image Source: Unsplash

Fundamental Analysis & Market Sentiment

I wrote on 31st August that the best trades for the week would be:

- Long of the S&P 500 Index if we see a daily (New York) close above 6,515. This did not set up.

- Long of Gold or following a daily (New York) close above $3,500 for more cautious traders. Gold rose by 4.10% over the week.

- Long of Silver or following a daily (New York) above $40 for more cautious traders. Silver rose by 3.19% over the week.

These trades produced an overall gain of 7.29%, equal to 2.43% per asset.

Last week saw very low directional volatility in the Forex market, even though it was the first week of September when markets usually get a burst of volatility.

A summary of last week’s most important data:

- US Average Hourly Earnings – increased by 0.3% month-on-month as expected.

- US Non-Farm Employment Change – only 22k net new jobs, much lower than the 75k which were widely expected, reinforcing the JOLTS data earlier in the week.

- US JOLTS Job Openings – 7.18 million was below the 7.32 million figure which was widely forecasted.

- US ISM Services PMI- this was a little better than expected.

- US ISM Manufacturing PMI – approximately as expected.

- Australian GDP – at an increase of 0.6%, this was slightly higher than the 0.5% which was expected.

- Swiss CPI (inflation) – this was expected to show no change at all, but the index shrunk by 0.1%, which is deflation.

- US Unemployment Rate – rose to 4.3% as expected.

- Canadian Unemployment Rate – this rose by more than expected, from 6.9% to 7.1%.

- US Unemployment Claims – slightly higher than expected.

There was less directional volatility than has been usual over recent weeks. A quiet market got even quieter.

There were record highs in Gold and in the US S&P 500 stock market index, and a 14-year high in Silver. The US economy is seen as starting to weaken, due mostly to the lower-than-expected jobs data, and this has boosted the market’s expectation of Fed rate cuts at its next meetings. Markets now see a 100% chance of a cut in September, an 80% chance of a cut in October, and a 73% chance of a cut in December. There is even a minority expecting a 0.50% rate cut at the next meeting later this calendar month. These expectations are dovish and should logically weaken the US Dollar over the coming weeks, in line with the Greenback’s long-term bearish trend, and strengthen US stock markets, in line with that bullish trend.

This is likely to be a good time to trade or invest.

The Week Ahead: 8th – 12th September

The coming week will likely be busier, not really in terms of quantity of data points but in the likelihood that at least a few of these points could really roil the market.

This week’s important data points, in order of likely importance, are:

- US CPI

- US PPI

- US Preliminary UoM Inflation Expectations

- US Preliminary UoM Consumer Sentiment

- European Central Bank Main Refinancing Rate & Monetary Policy Statement

- UK GDP

- US Unemployment Claims

Monthly Forecast September 2025

(Click on image to enlarge)

For the month of September 2025, I forecasted that the EUR/USD currency pair will rise in value if we get a daily close above $1.1806.

This has not yet set up.

Weekly Forecast 8th September 2025

I made no weekly forecast last week.

There were no unusually large price movements in currency crosses last week, so I have no weekly forecast this week.

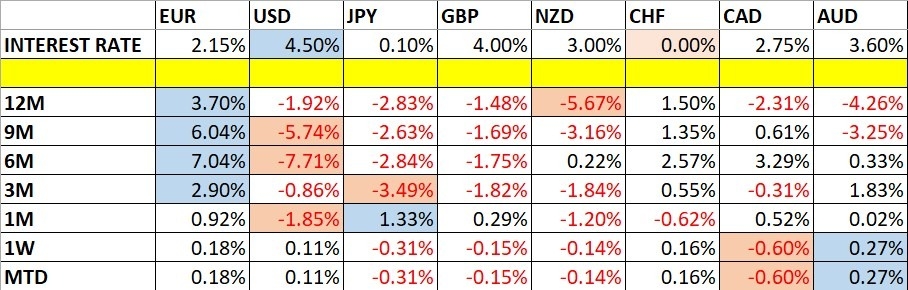

The Canadian Dollar was the strongest major currency last week, while the Australian Dollar was the weakest, although the overall directional movement was very small. Volatility was low last week, with none of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to increase as we get deeper into the new month of September.gld

Technical Analysis

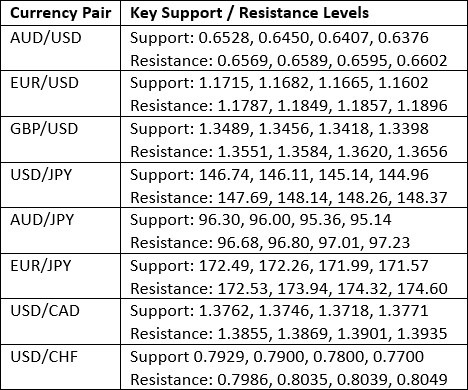

Key Support/Resistance Levels for Popular Pairs

US Dollar Index

Last week, the US Dollar Index yet again printed a bearish pin bar, so we are now seeing very bearish price action, and in line with the long-term bearish trend. Lower prices in the US Dollar look likely technically, however the price action is congested within its current area which may mean there is not much further downside to come. But a short-term fall is supported by more dovish market sentiment which arose last week following worse than expected US jobs data.

Markets are now expecting rate cuts at each of the forthcoming Fed meetings remaining in this calendar year, with some even expecting a rate cut of 0.50% at the meeting this month. There is increasingly a feeling that the Fed has come to cutting rates a bit late. So. sentiment might be working with the trend and could trigger a downwards move now to the next support level at 94.61.

I think it is wise to trade with the long-term trend and short-term price action right now, so trades short and not long of the US Dollar will probably be a good idea over the coming week.

(Click on image to enlarge)

S&P 500 Index

The S&P 500 rose a bit higher to close at a new record high last week, also printing a new all-time high price above the big round number at 6,500.

The weekly candlestick is a pin bar pointing upwards, which usually signifies a bullish outlook.

The index reached its record high after the worse than expected US jobs data was released on Friday, but gave up some of its gain towards the end of the day. The poor jobs data is now making markets expect the Fed to start rate cutting in earnest at their next meeting.

Although things look bullish, the bullish action remains weak above 6,500 so I would want to see a daily close above 6,515 which takes out the record high and convincingly ends the day above the big round number at 6,500 before entering a new long trade.

(Click on image to enlarge)

XAU/USD

Gold rose very strongly last week, rising by more than 4% in value and closing vary near the top of its range, which was a new all-time record price at $3,600.

The weekly chart below shows this strong bullish breakout, backed by a persistent long-term bullish trend over months, and a very solid and bullish looking consolidation pattern building over recent weeks, which could be a reason to have more faith in this breakout as remaining explosive.

It may be that we are due a pullback, but I think the combination of rising stock markets and a likely more aggressive rate cutting approach from the Fed, could provide the bullish sentiment needed to drive this strong advance to even higher all-time high prices.

(Click on image to enlarge)

XAG/USD

Precious metals were led higher by Gold last week, but Silver was following up in a decisive second place as it powered higher to new 14-year high prices above $41 per ounce.

The price ended the week not far from its high, and the weekly candlestick is breaking out of a bullish price channel (linear regression analysis), although it is worth noting that the channel does not look symmetrical, so I don’t have a lot of faith in it.

Silver looks like a weaker buy than Gold, but it looks like it is still worth buying. As a precious metal, it also has the fundamental and sentimental factors working in its favour that I outlined in my Gold analysis previously.

Very cautious traders might want to wait for a higher daily close than any we saw last week, or to start now with a smaller than usual position size.

(Click on image to enlarge)

Bottom Line

I see the best trades this week as:

- Long of the S&P 500 Index if we see a daily (New York) close above 6,515.

- Long of Silver.

- Long of Gold.

More By This Author:

Forex Today: Gold Makes New Record Above $3,578

EUR/USD Forex Signal: Will Another Breakout Lead To More Gains?

Forex Today: Gold Makes New Record Above $3,547

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more