EUR/USD Forex Signal: Will Another Breakout Lead To More Gains?

Image Source: Pixabay

Today’s EUR/USD Signals

Long Trade Idea

- Long entry between $1.16220 and $1.16445, the intra-day low of the re-test and the upper band of its horizontal support zone.

- Place your stop loss level 10 pips below your entry level.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Idea

- Short entry if price action reverses and falls below 1.16030, ten pips below the lower band of its horizontal support zone.

- Place your stop-loss level 10 pips above your entry level.

- Adjust the stop-loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

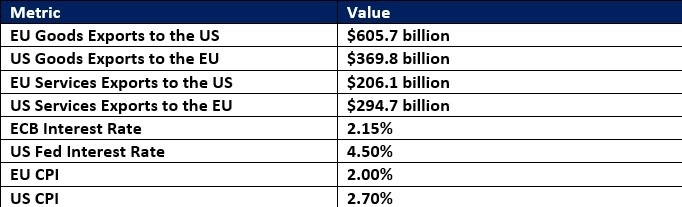

EUR/USD Fundamental Analysis

Economic Data worth considering:

- Economists predict a slowdown in the Eurozone services sector for August, with the Spanish PMI expected to decrease to 54.4 from 55.1, the Italian PMI to 52.1 from 52.3, and the German PMI to 50.1 from 50.6. The Expectations for the French PMI are for an improvement to 49.7 from 48.5, but it is the only core economy with a contracting services sector. Finally, economists predict the Eurozone PMI to decrease to 50.7 from 51.0.

- Inflation data from the Eurozone for July should moderate to an increase of 0.2% month-over-month and 0.1% year-over-year. Forex traders can compare this to a rise of 0.8% and 0.6% reported in June, respectively.

- The US economic data will focus on July factory orders, expected to decrease 1.3% for July, following June’s plunge of 4.8%.

- Forex traders will also await JOLTS job openings data for July, where economists anticipate a decrease to 7.380 million jobs versus June’s 7.437 million.

So, why am I still bullish on the EUR/USD after its sell-off?

On Monday, I predicted a continuation of the EUR/USD rally, which quickly fell apart, and my alternative short trade played out. After realizing a small loss on my long positions, countered by booking profits from my short trade, I believe we are due for another reversal.

Price action began another breakout attempt, and the Bull Bear Power Indicator has been improving for 23 hours. The ascending trendline and mounting upside momentum should confirm the breakout with a bullish crossover in this technical indicator.

Bullish trading volumes have risen, confirming the current breakout attempt, which has also pushed price action above its descending 50.0% Fibonacci Retracement Fan level. I will monitor price action for a potential momentum switch if it reverses below 1.16220. Forex traders should get 25 to 35 pips from this long position.

Concerning the USD, there will be a release of JOLTS Job Openings data at 3pm London time. There is nothing of high importance due today concerning the Euro.

More By This Author:

Forex Today: Gold Makes New Record Above $3,547GBP/USD Forex Signal: Will The Breakdown Lead To More Downside?

Forex Today: Gold, Silver Breakout To New All-Time Highs

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more