Wealth-Building, Inflation, Interest Rates, And Markets - Where Are We Going?

Image Source: Unsplash

The Joy of Ignoring the Moment

An interesting thing happened in the stock market this year. Worry has been all over the news-recession fears, inflation jeers, high-interest rates, and values tempting fate. But the market is up. In fact, it's a pretty good year so far, by historical standards.

Now, it all might come crashing down tomorrow. None of us have a crystal ball, despite our best attempts to make sense of it all. But that is the point. We cannot help but make predictions, but we should take our own predictions with a grain of salt. There are thousands of cross-currents affecting the market. Not the least of which is thousands of different companies in different industries with exposure to different parts of the world. No one is smart enough to untangle that web with any accuracy.

Instead, what we can do is focus on the fundamentals and the things we can control. We believe it is much easier to figure out if a business is a good one and the valuation is reasonable than to figure out what the market will do. It is much easier to save money through our own effort, invest consistently, and design a resilient financial plan than to try to time the market.

It reminds me of a story I read once about a janitor and gas station attendant in Vermont named Ronald Read. He worked most of his 92-year life in blue-collar jobs and lived a frugal life, but one that brought him joy. He was able to save consistently and buy a blue chip, dividend-paying stocks. He was old fashioned and kept his stock certificates in paper form, piled 5 inches high in a safety deposit box. When he passed in 2014, he had accumulated $8 million, which went to a local library and hospital, as well as to his caregivers and step-children.

Ronald Read is a great example of the type of millionaire you find in The Millionaire Next Door by Thomas Stanley and William Danko. What is so remarkable about him is that there is nothing remarkable about him. Except for the fact that he left his fortune to charity in the end, no one would have ever heard of him. In fact, the vast majority of millionaires in the United States are like that-unknown people who just save and invest steadily in quality investments. The power of persistent savings and long-term compounding is real.

Investing does not take heroics. It just takes consistency, temperament, and sound principles. I read a wide variety of publications and annual reports not to predict what the market will do, but to learn about the background and underlying trends affecting the companies I research. I believe this is useful for choosing investments and constructing a resilient asset allocation. But the magic of investing is in the steady application of key principles, not in watching all the price gyrations.

Key Wealth Principles

- Spend less than your income

- Invest in quality businesses at an attractive price

- Build a portfolio of good businesses in different industries

- Maintain appropriate reserves and income sources

- Consider your financial circumstances, goals, and risk exposure

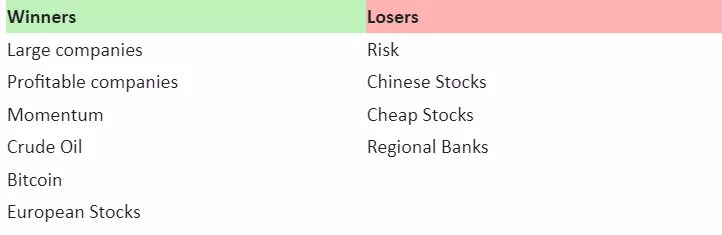

Last Month’s Winners and Losers

The main market trends continued this year, favoring large and profitable companies. A lot of the big tech companies that were down last year have been bouncing back so far this year, though many companies are still well below their 2021 highs.

The other major trend has been ongoing weakness at regional banks. There are many good banks hit as well, but there are real fundamental problems with the banks that issued loans at 2-3% and are now stuck with them while they must pay depositors 4-5%. The banks that managed the risk better either sold the loans while rates were still low, hedged well or stuck with variable-rate loans.

Equities: Surprising Strength, But Narrow

There has been a huge disparity in performance so far this year, with large cap growth (represented by the Russell 1000 Growth index) returning 15.5% and small cap value (represented by the Russell 2000 Value index) returning -3.1%. To put this in context, large cap growth was down 29% last year, so some of this is just a bounce back. Furthermore, the small cap value index includes a large proportion of regional banks, which have their own unique problems.

So, I would interpret these disparities as related to the circumstances of the sectors in question rather than a broad market trend.

I think it is appropriate to be somewhat cautious, minimize debt, and maintain adequate safety reserves. But I am still seeing plenty of good quality companies trading at 5-7% earnings yields and offering expected earnings growth of around 7-10% a year. At those earnings yields and growth rates, I am happy to invest for the long term.

* “Earnings yield” is an investor’s share of earnings for every dollar invested (i.e., earnings per share/price per share). It’s the same as the more famous Price / Earnings (P/E) ratio but expressed as a yield rather than as a multiple. I use it to compare stocks more clearly with bonds and other asset classes.“Equity Risk Premium” equals the Earnings Yield minus the 10-year Treasury Inflation-Protected Securities yield.

Merchant

Source: Rasiel Suarez at English Wikipedia.

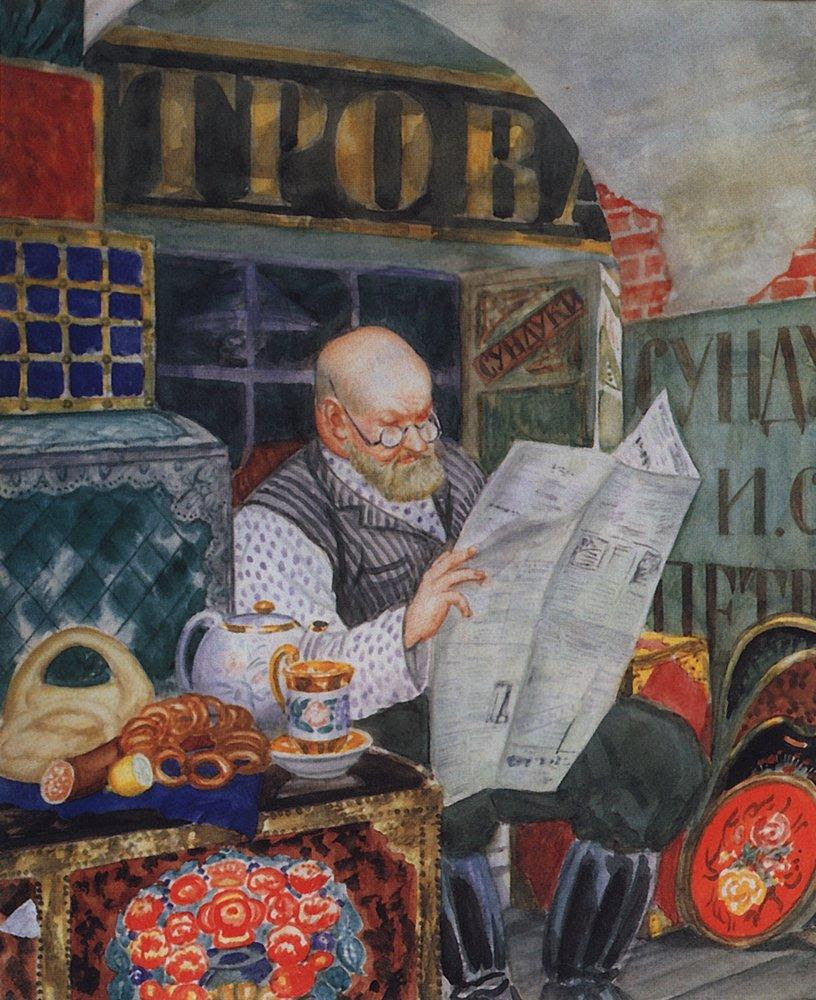

Income: Short-Term Is Where It's At

The effect of the problems at regional banks continued with the insolvency of First Republic, which was taken over by J.P. Morgan. They were one of the banks I reviewed which would have had a significant loss had their assets been marked down to fair value (in fact, their equity would have become negative).

Despite this, the Federal Reserve raised rates another 0.25%. The consensus is that this will be the last rate rise for the remainder of the year and they will watch the effects closely. It is a tightrope as they do need to raise rates if they want to get inflation down further, but banks are beginning to be stressed and failing from the rapidly rising rates.

No one knows exactly how much more the system can tolerate, but I would guess that we are close to the borderline. In other words, I do not think the Federal Reserve can raise rates too much without causing more severe problems in the banking sector. Furthermore, the issue so far has just been interest rates, not credit quality. I believe that there are problems in the commercial real estate sector that will start to impact the credit quality of commercial real estate loans.

So, the question is whether the current level will be sufficient to bring down inflation to the 2% level. I don't think so—my base case expectation is that we'll end up in the 3-5% range for inflation.

Based on that, I believe it is prudent for investors to stick with short-term Treasury securities and Treasury Inflation Protects Securities (TIPS) to preserve the real capital value of their fixed income allocation as much as possible.

* Implied inflation expectations are derived from taking the 10-Year Treasury rate and subtracting the 10-Year Treasury Inflation Protected Securities (TIPS) rate. For example, if the yield on 10-year treasuries is 2.8% and the yield on 10-year TIPS is 0.4%, they are roughly equivalent investments if inflation comes in at the difference (2.8% - 0.4% = 2.4%).

Quote

“Commerce is a game of skill, which everyone cannot play, and few can play well.”—Ralph Waldo Emerson, “The Conduct of Life” (1860).

The Long View

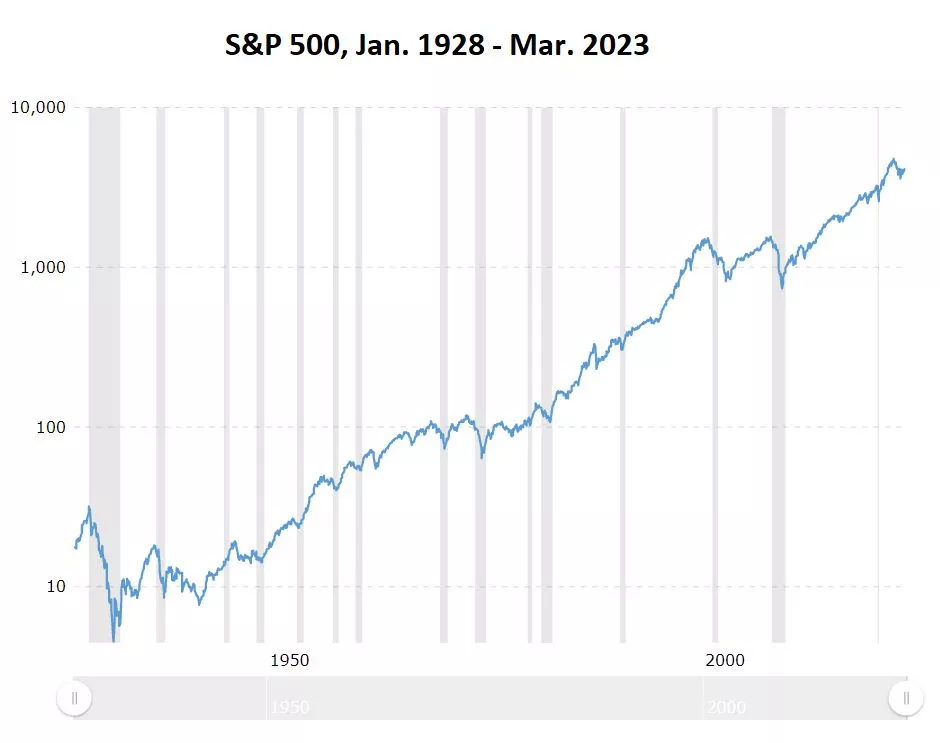

(Click on image to enlarge)

Source: MacroTrends.net

For the last 20, 30, and 100 years, stocks have averaged around an 8-10% return, driven by dividend yield, reinvestment of earnings, and earnings growth. Long-term bonds have yielded about 5% on average over the last century while inflation has been about 3%.

Throughout this period, there have been major upheavals, such as the Great Depression, World War II, The Korean War, The Vietnam War, the dropping of the gold standard, 1970s high inflation, the 1987’s Black Monday Crash, the Dot.com bust, the 9/11 terror attacks, the Global Financial Crisis, and the Covid Crash, among others.

These events led to severe market downturns about once every decade, with a median price decline of 33% and a median time to recover back to the previous high of 3.5 years. If we were to include dividends, the recovery to previous highs is actually a little faster. *

Meanwhile, a 3% inflation rate results in a 59% decline in the value of a dollar over 30 years. Meaning that people who retire at 60 years old on a fixed income face a high risk of a lower quality of life as they get further into retirement. *

* Source: Morningstar Direct via cfainstitute.org, FactSet. Past performance is not necessarily indicative of future performance. Depreciation of the dollar: $1 / (1 + 3%)^30 = $0.41 real value 30 years later.

Market Outlook

Now I’ll put on my “Nostradamus Hat” and make some predictions, for whatever they’re worth:

- Inflation will average 3-5% over the next 10 years. Inflation currently exceeds this range but core inflation has fallen below 6% recently.

- Interest rates will fall in the 3-5% range for 10yr Treasuries over the next several years, in line with inflation and historical experience.

- The economy will grow 2-3% in real terms over the next several years, though we will probably slip into a recession this year.

- Stocks will average an 8-10% return over the next 10+ years. After subtracting inflation, this will translate into about a 5% real return. There is likely to be at least one big decline every decade or so.

From the standpoint of where you and your family will be in 30 years, none of this matters. What matters is finding good quality investments that are likely to grow over the decades. For this reason, I largely ignore my own general market forecast and invest whenever I find a business that I am confident in and that trades at an attractive valuation.

25 Years of Research into Value Creation

My mission is to help people accumulate wealth in a prudent way so they can achieve financial independence and a comfortable retirement.

What makes me different from many financial advisors is that I bring a background of over 25 years in money management and investment research seeking to understand the market’s value drivers. During this time, I have tested hundreds of factors and thousands of models combining factors. I have also read thousands of annual reports and earnings announcements. Finally, I have made hundreds of investment decisions in all kinds of markets, good and bad. This combination of research and real-life trial-and-error has informed my approach to investing.

I believe that the best way for most people to create enduring wealth is by investing in productive assets. My focus is on investing in the shares of high-quality, well-established businesses that can grow earnings and generate an attractive return on capital. My experience allows me to invest directly in high-quality individual stocks, creating well-balanced portfolios with only the advisory fee and not a second layer of indirect fees brought by owning equities indirectly through mutual funds and ETFs.

Because I do my own research and select investments for my clients, they have a personal money manager. Whether the investments go right or wrong, I am responsible and make corrections when I believe necessary. I regularly communicate the logic of any changes and am available to answer any questions that arise.

With inflation and volatility high, I see more people at risk of running out of money in retirement and being unable to achieve financial independence. Many could improve their outlook by reviewing their goals, risk exposures, asset allocations, and investment strategy. Financial plans and investment strategies should be reviewed at least annually.

What Can a Financial Plan Do for You?

Having a well-designed financial plan and investment strategy is important for your financial future. It can help improve your security, confidence, and peace of mind. It can answer questions like:

- How much will you need to be financially independent?

- What are the odds that you will run out of money?

- How will you handle unique circumstances, such as executive compensation, kids’ college education, elderly parents, special needs children, and other elements of life?

- Should you change any savings or investing habits?

- Could you improve any of your current investment choices?

If you do not have an existing relationship, we recommend talking with at least three financial advisors in order to conduct thorough due diligence and to get a better sense of what will be the best fit for you.

I typically work with people having $1 million or more in investable assets but am happy to talk with anyone. If you have never had a financial plan run for you or have not reviewed yours recently, we would be happy to create a complimentary financial plan and investment strategy for you.

More By This Author:

The Birch Lane PerspectiveInvesting in Yourself

Bank Failures and the Strength of the Financial System

Disclosures: Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request ...

more