The Birch Lane Perspective

Image Source: Unsplash

A Moment of Calm

When there is graphic news, it is easy for even the best of us to lose our nerves. In the last few years, it seems like there has been a string of events—COVID, inflation, the war in Ukraine, fears of a recession, and a potential banking crisis, among others.

While it is easy for some to take the whiplash of market volatility, there are very legitimate reasons why others cannot. Think of someone in or close to retirement, or someone working with kids and parents to support and struggling with tight finances. Or maybe just someone who doesn’t have the experience and knowledge, so it all appears mysterious and scary.

One of the main reasons why people perform poorly is not because they pick the wrong stock or the wrong fund. It is because they buy and sell at the wrong times—they buy when everyone else is buying and they sell when everyone else is selling. I.e., they buy high and sell low.

It is easy when times are good to think we’ll stick with it, but the psychological pressure can become enormous when our emotions are worn down from lengthy market declines, extended periods of ups and downs, or even repeated crises in the world. This can lead to the proverbial “hiding money in the mattress” mentality or being “gun shy” when opportunities are actually the greatest.

The key to investing success over the decades is temperament. We cannot fight Mother Nature and just will the counterproductive feelings away. But we can put ourselves in a position of strength. With strong finances and a prepared mind, we are more likely to think calmly when we need it the most.

Financial preparation would include things like thinking carefully about the right level of reserves to maintain, limiting exposure to debt, and maintaining an asset allocation that will help you sleep at night and stay the course.

Finally, educating yourself can help prepare your mind for the “surprises” that seem to come along with unsurprising frequency. What drives value creation over time? What can we learn from market history?

On that note, my book recommendation this month is the 7th edition of a classic on market history—Manias, Panics, and Crashes, by Charles Kindleberger and updated by Robert Aliber. As Mark Twain said, “History may not repeat itself. But it often rhymes.”

Key Wealth Principles

- Spend less than your income

- Invest in quality businesses at an attractive price

- Build a portfolio of good businesses in different industries

- Maintain appropriate reserves and income sources

- Consider your financial circumstances, goals, and risk exposure

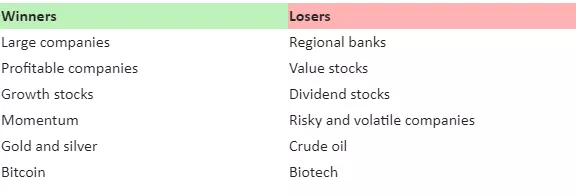

Last Quarter’s Winners and Losers

The two driving themes I saw in the first quarter were 1) a bounce back from some of the assets that did poorly last year and 2) a reaction to stresses in the banking system.

Regarding the first theme, big tech, growth, and Bitcoin all did poorly last year and bounced back somewhat in the first quarter. Value stocks, dividend stocks, and crude oil did well last year but lagged in the first quarter. Some bounce back is natural whenever there has been a big move in one direction.

On the other hand, the stress in the banking system probably benefited gold and Bitcoin, as some people looked for alternatives to holding dollars. It directly hurt regional banks, which were down significantly. It also broadly hurt risky and volatile companies.

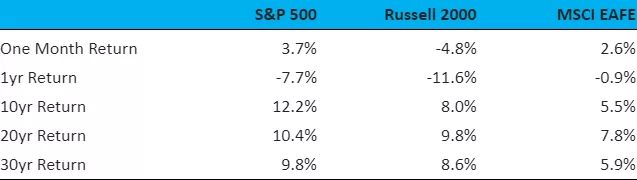

Equities: In Different Directions

Source: FactSet as of 4/1/2023

Source: FactSet as of 4/1/2023. Dividend Yield is an estimate based on the weighted average of all companies in the category (by market cap). Earnings Yield, Earnings Growth, and Return on Equity are estimates based on the median profitable company. The % Losing Money statistic represents the percentage of stocks with negative earnings in the preceding 12-month period. Large Cap stocks are defined here as the stocks in the S&P 500, according to FactSet. Small Cap stocks are defined here as U.S. stocks ranked 1,001 to 3,000 in market capitalization. International Stocks are defined here as the 1,000 largest stocks traded on international exchanges, by market capitalization.

Although stocks have been quite volatile, they have been positive overall this year, except for certain areas. There has been a huge disparity between different types of stocks. Large cap growth stocks, including many of the big tech stocks that were down a lot last year, have been strong. Meanwhile, small cap value stocks, which include many regional banks, have been weak.

I think it is appropriate to be somewhat cautious, minimize debt, and maintain adequate safety reserves. But I am still seeing plenty of good quality companies trading at 5-7% earnings yields and offering expected earnings growth of around 7-10% a year. At those earnings yields and growth rates, I am happy to invest for the long term.

* “Earnings yield” is an investor’s share of earnings for every dollar invested (i.e., earnings per share/price per share). It’s the same as the more famous Price / Earnings (P/E) ratio, but expressed as a yield rather than as a multiple. I use it to compare stocks more clearly with bonds and other asset classes.“Equity Risk Premium” equals the Earnings Yield minus the 10-year Treasury Inflation-Protected Securities yield.

Roman Coin Featuring Marcus Aurelius

Source: Rasiel Suarez at English Wikipedia.

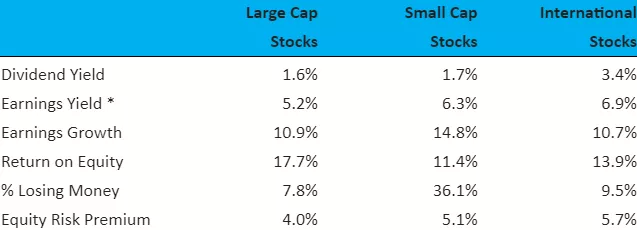

Income: High Rates Strike Back

Source: Interest rates from Raymond James’ Weekly Interest Rate Monitor as of 3/27/2023 and The Wall Street Journal as of 4/2/2023. Source for the Dividend Yields is from FactSet as of 4/1/2023. Common Stocks uses the estimated weighted average dividend yield for the S&P 500. The top 25% yield is the median yield of the top quartile of dividend-paying stocks out of the largest 1,000 stocks. The next 25% yield is the median of the second quartile. Preferred Stocks is the median dividend yield of the 100 largest traded preferred stocks (by dollar volume, per FactSet). REIT and Utilities dividend yields are the median of those sector stocks included in the 1,000 largest common stocks.

Last month I titled this section “Return of the Savers.” Unfortunately for banks, this has become even more pronounced, with billions of dollars flowing out of checking and savings accounts that pay little interest and into money market funds that pay higher rates. The combination of higher rates elsewhere and fears about the strength of the banking system has contributed to deposits leaving the banking system, particularly at regional banks.

There are two reasons why depositors leaving is a problem for many banks. The first is that their assets are tied up in long-term assets. These either cannot be sold easily or, if they can be sold, they would have to sell at a loss. If the bank cannot sell its assets, it may not be able to pay depositors, and therefore become insolvent. If the bank sells its assets at too large of a loss, it may wipe out equity and also become insolvent.

The second problem is declining profits. Even if the bank can pay depositors or the government gives them an emergency loan to pay depositors, the bank is still stuck with long-term assets that pay little. For example, if the bank earns 3% on its mortgages and other loans, but has to pay depositors 4-5% to fund those loans, it will lose money.

Tying this together, the rise in short-term interest rates has stressed the banking system. In my opinion, the Federal Reserve cannot keep raising interest rates without causing more banks to fail. On the other hand, persistent inflation will probably not fall to the Federal Reserve’s target of 2% without further interest rate rises.

So it is a choice between accepting a higher rate of inflation or causing more bank failures.

The Federal Reserve under Jay Powell has emphasized that it is “data-driven.” However, much of the data it looks at is lagging. While I would like to reduce inflation as much as anyone, and I think this whole situation would have been a lot better if the Federal Reserve had stopped “printing” money earlier, I think it is important to recognize market signals. And my reading of those signals is that pushing rates further would be a mistake.

What does this mean for you? I continue to believe that the market is assuming less inflation than I would expect: implied inflation* is around 2.2% over the next ten years whereas I would expect 3-5%. For this reason, I find short-term treasuries and treasury inflation-protected securities (TIPS) attractive for reserves and the fixed income portion of investors’ asset allocation.

While many investors are interested in money market funds, keep in mind that these are not FDIC-insured. For that reason, it is important not just to look at the rate being offered, but to look more deeply into their holdings and assess their quality and liquidity.

* Implied inflation expectations are derived from taking the 10-Year Treasury rate and subtracting the 10-Year Treasury Inflation Protected Securities (TIPS) rate. For example, if the yield on 10-year treasuries is 2.8% and the yield on 10-year TIPS is 0.4%, they are roughly equivalent investments if inflation comes in at the difference (2.8% - 0.4% = 2.4%).

Quote

“Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present.”—Marcus Aurelius

The Long View

For the last 20, 30, and 100 years, stocks have averaged around an 8-10% return, driven by dividend yield, reinvestment of earnings, and earnings growth. Long-term bonds have yielded about 5% on average over the last century while inflation has been about 3%.

Throughout this period, there have been major upheavals, such as the Great Depression, World War II, The Korean War, The Vietnam War, dropping the gold standard, 1970s high inflation, the 1987’s Black Monday Crash, the Dot.com bust, the 9/11 terror attacks, the Global Financial Crisis, and the Covid Crash, among others.

These events led to severe market downturns about once every decade, with a median price decline of 33% and a median time to recover back to the previous high of 3.5 years. If we were to include dividends, the recovery to previous highs is actually a little faster. *

Meanwhile, a 3% inflation rate results in a 59% decline in the value of a dollar over 30 years. Meaning that people who retire at 60 years old on a fixed income face a high risk of a lower quality of life as they get further into retirement. *

* Source: Morningstar Direct via cfainstitute.org, FactSet. Past performance is not necessarily indicative of future performance. Depreciation of the dollar: $1 / (1 + 3%)^30 = $0.41 real value 30 years later.

Market Outlook

Now I’ll put on my “Nostradamus Hat” and make some predictions, for whatever they’re worth:

- Inflation will average 3-5% over the next 10 years. Inflation currently exceeds this range but core inflation has fallen below 6% recently.

- Interest rates will fall in the 3-5% range for 10yr Treasuries over the next several years, in line with inflation and historical experience.

- The economy will grow 2-3% in real terms over the next several years, though we will probably slip into a recession this year.

- Stocks will average an 8-10% return over the next 10+ years. After subtracting inflation, this will translate into about a 5% real return. There is likely to be at least one big decline every decade or so.

From the standpoint of where you and your family will be in 30 years, none of this matters. What matters is finding good quality investments that are likely to grow over the decades. For this reason, I largely ignore my own general market forecast and invest whenever I find a business that I am confident in and that trades at an attractive valuation.

25 Years of Research into Value Creation

My mission is to help people accumulate wealth in a prudent way so they can achieve financial independence and a comfortable retirement.

What makes me different from many financial advisors is that I bring a background of over 25 years in money management and investment research seeking to understand the market’s value drivers. During this time, I have tested hundreds of factors and thousands of models combining factors. I have also read thousands of annual reports and earnings announcements. Finally, I have made hundreds of investment decisions in all kinds of markets, good and bad. This combination of research and real-life trial-and-error has informed my approach to investing.

I believe that the best way for most people to create enduring wealth is by investing in productive assets. My focus is on investing in the shares of high-quality, well-established businesses that can grow earnings and generate an attractive return on capital. My experience allows me to invest directly in high-quality individual stocks, creating well-balanced portfolios with only the advisory fee and not a second layer of indirect fees brought by owning equities indirectly through mutual funds and ETFs.

Because I do my own research and select investments for my clients, they have a personal money manager. Whether the investments go right or wrong, I am responsible and make corrections when I believe necessary. I regularly communicate the logic of any changes and am available to answer any questions that arise.

With inflation and volatility high, I see more people at risk of running out of money in retirement and being unable to achieve financial independence. Many could improve their outlook by reviewing their goals, risk exposures, asset allocations, and investment strategy. Financial plans and investment strategies should be reviewed at least annually.

More By This Author:

Investing in Yourself

Bank Failures and the Strength of the Financial System

Financial Independence And Retirement Planning

Disclosures: Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request ...

more