Using Teleconnections To Predict The End Of The Midwest Drought For Grain

One of the most volatile weather markets I have seen in my 38 years in the business in corn and soybeans can be attributed to the following bullish factors: Tight stocks of grains, great China demand, the potential for summer weather problems later; bearish factors.

This is the time of the year that weather outweighs all other fundamental factors and drought easing rains are coming for many key U.S. corn and soybean growing areas. Also, too many specs long the market when weather is key this time of the year. They all have to run for cover.

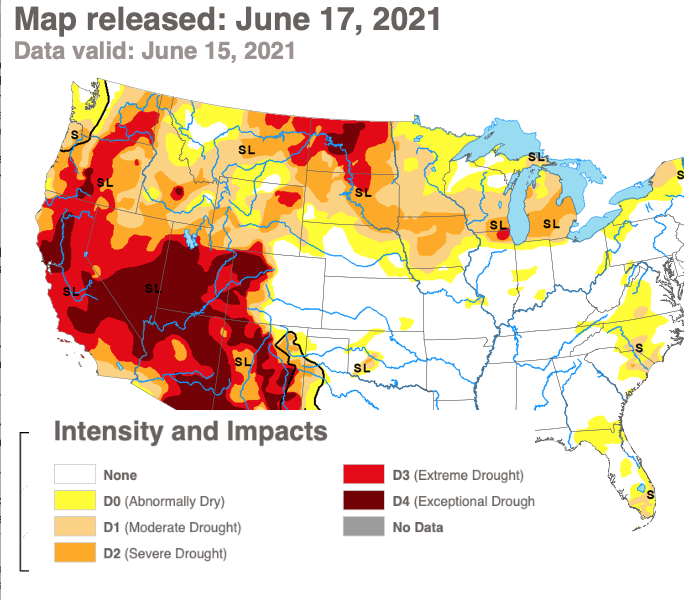

One can see the drought areas above extending well into Midwest corn and soybean regions. So why then has corn broken close to $1.00 the last 2 weeks, as well as soybeans? After all, look at this forecast by many other weather forecast firms out there two weeks ago for the drought to continue in the Midwest.

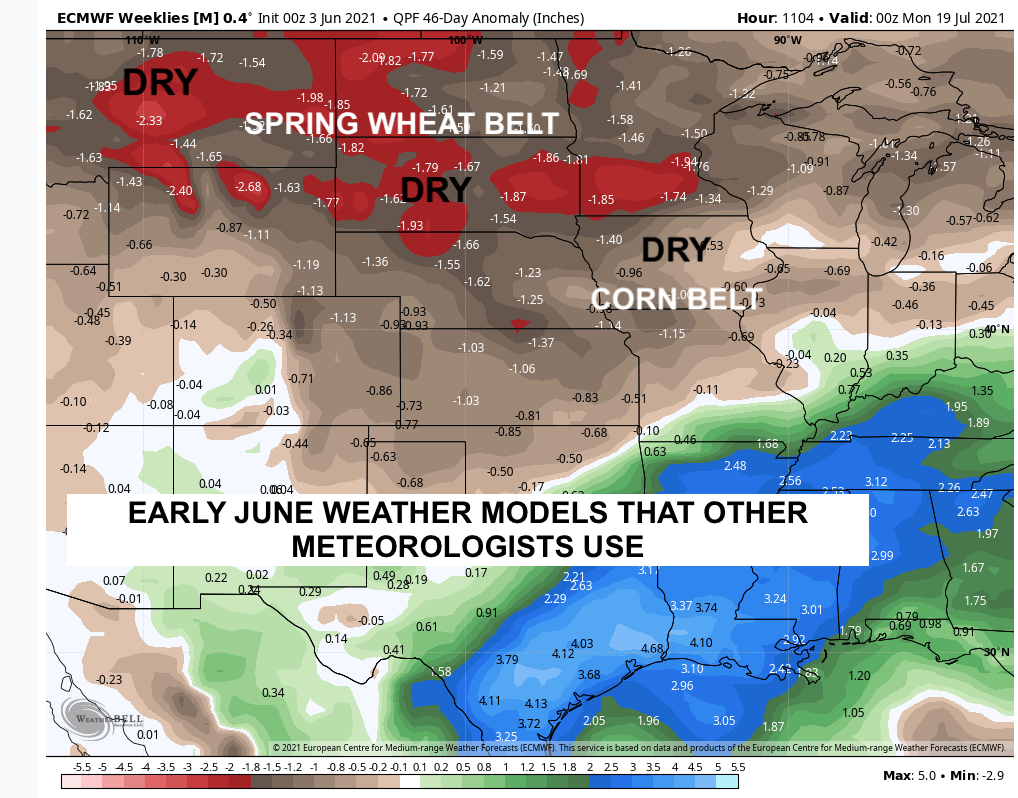

(Click on image to enlarge)

The forecast by most firms was for drier than normal weather (red) in key U.S. grain areas of Iowa, Nebraska, and points west and north. Believing standard computer models is something we try to second guess for our clients and give them expert trading strategies based on our 38 years of experience gauging market psychology.

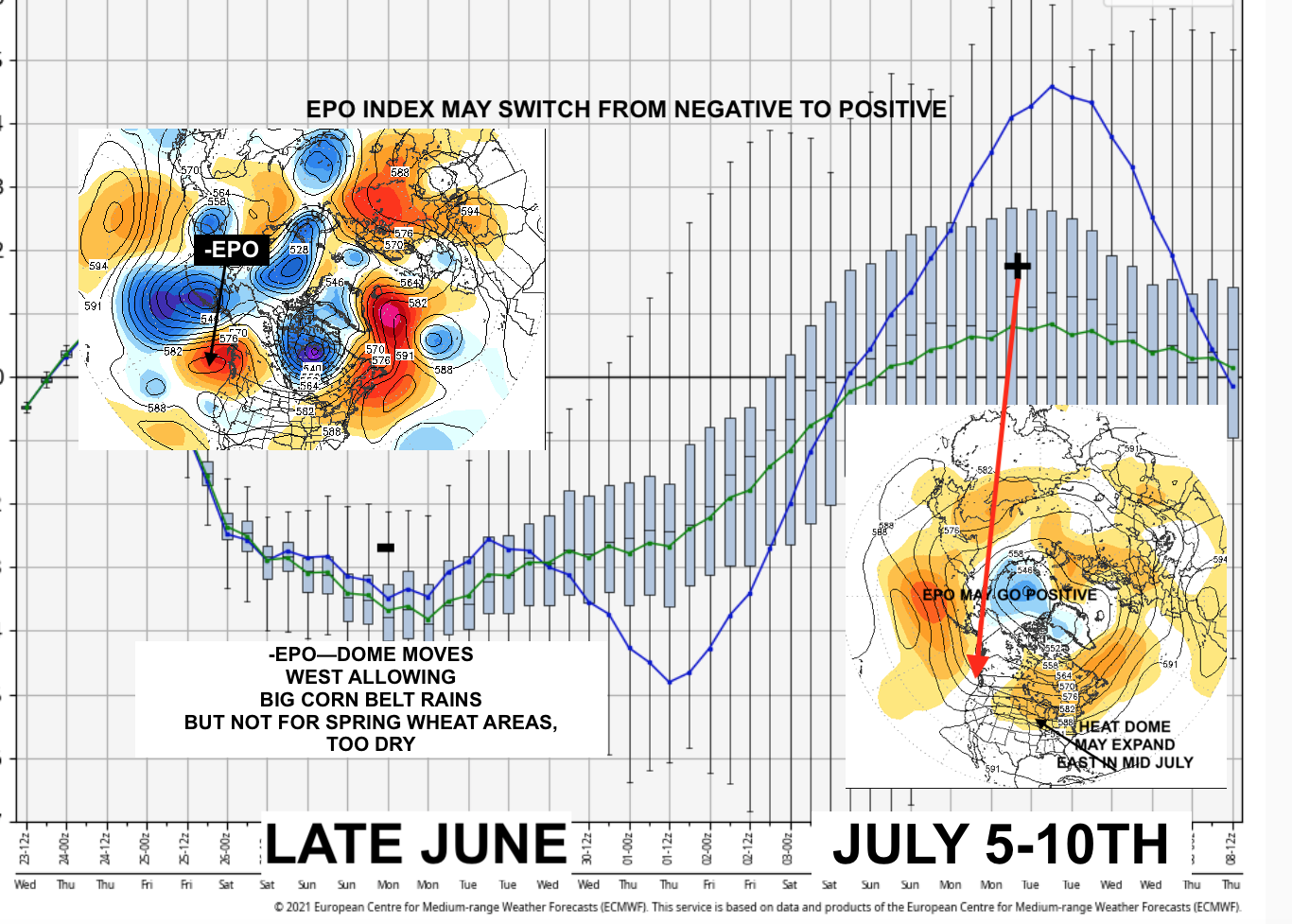

I use something called Teleconnections to out predict standard weather models, sometimes weeks in advance. A teleconnection is a global climatic variable (Arctic Sea Ice, La Nina, El Nino & ocean temperatures thousands of miles away) that can affect weather patterns. One of the key teleconnection I used to predict at least a temporary end to the Midwest drought is the EPO index (Eastern Pacific Oscillation Index). Show on this map below, a negative phase of the EPO means the hot, dry-blocking drought ridge moves to the west to California and the Pacific Northwest. This ridge is resulting in historical heat and drought out west that is stressing the electric grid and a bullish impetus for natural gas prices.

(Click on image to enlarge)

Notice the EPO phase deeper into July. If it goes positive from its current negative phase, this would move the corn belt ridgeback east and could set a floor on grain prices in a couple of weeks. But will this happen? This is what we advise our clients about with our Weather Wealth newsletter and how to trade.

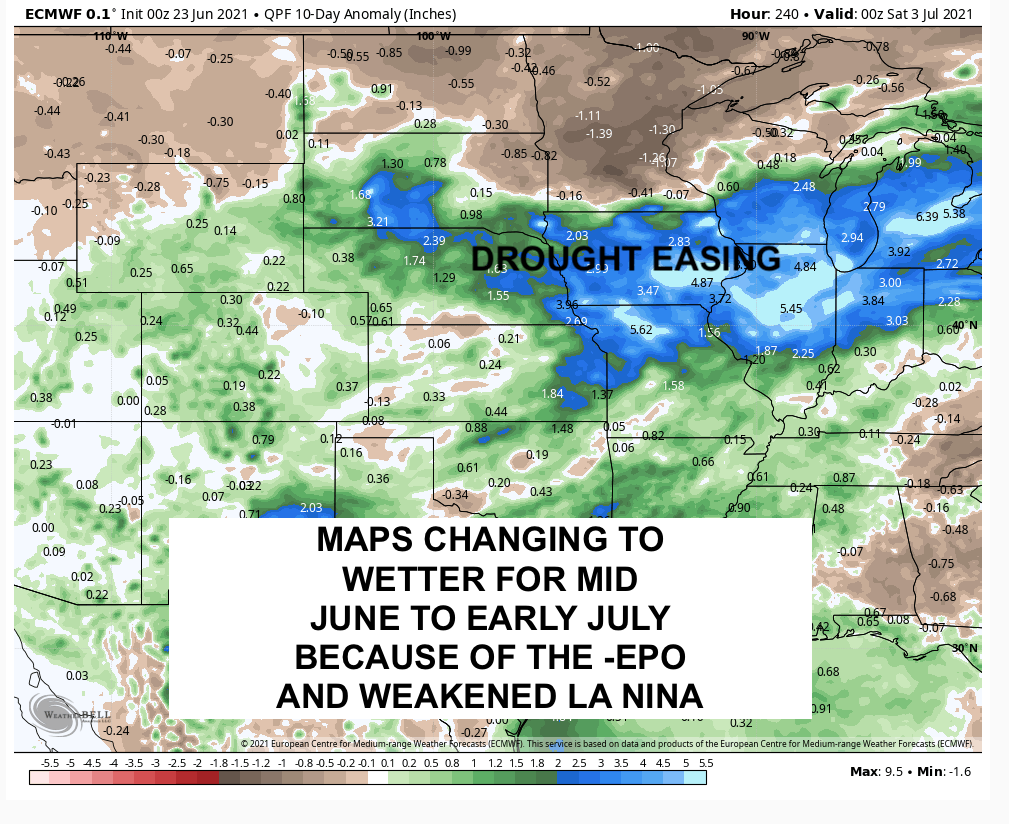

Anyway, notice the forecast now for up to 3-6" of rainfall over corn belt states, and now models changed, as I was lucky enough to predict two weeks ago.

(Click on image to enlarge)

Corn prices have since tanked when we first advised clients about the EPO going negative.

Mr. Roemer offers the only commodity newsletter in the world that teaches expert, novice, and stock/eff traders how the power of weather can help you capitalize in trading agricultural and energy ...

more