Trading Gold Is Unlike Trading Anything Else

Image Source: Pixabay

Gold has its own laws in trading. The most emotional of all financial assets is traded unlike anything else. Unlike any other commodity, every ounce newly mined adds to the existing stock of Gold. It moves from vault to vault, in various forms. Occasionally it is melted down and given a new form as jewelry, ingots, coins or something else. It is thus not consumed and is not lost. Every year, around 3,500 tons of new Gold are mined, which are added to the existing stock.

This is in stark contrast to all other raw materials, such as Silver, Copper or other metals, which are constantly being lost due to their consumption or processing. Unlike Gold, other metals are not recycled at a rate of around 99.9%. A large proportion of the annual production is therefore consumed and does not return to the market.

This means that demand can rise and fall for various cyclical reasons. The more the price rises, the lower the demand, because it is now considered too expensive. The more the price rises, the more willing Gold owners are to realize their profits. This makes it increasingly difficult for the Gold price to rise. Or the more it falls, the less the Gold holders are willing to sell their holdings because they perceive it as too cheap. On the other hand, the willingness to profit from the favorable price increases. That the Gold price can thus rise to USD 10,000, as certain market observers dream, is thus a very difficult proposition. Many Gold owners would be overjoyed to sell their holdings at USD 5,000 an ounce. But the higher the price rises, the fewer investors are willing to buy at these prices.

While Gold holdings have historically always increased, the same could be said of financial assets such as equities. But equities rise and fall with the company's earnings per share. If a company's earnings per share rise, a higher price is justified. This is not the case with Gold. There is no earnings per ounce and no interest rate. It is the pure perception of the investor as to whether the ounce is currently too cheap or too expensive.

Naturally, an investor views an ounce of Gold at around USD 2800 as expensive if the price has risen by 30% or more in recent months. This makes the owner of the Gold more willing to sell it. The opposite applies to potential buyers: the more the price of Gold has risen, the less willing they are to pay the now high price for an ounce of Gold.

We have arrived at this level in recent weeks. Before the US elections, the high level of uncertainty meant that there was still a willingness to pay a much higher price. After the elections, which were obviously decided clearly, there are clearly fewer reasons to invest in Gold. At least in the short term.

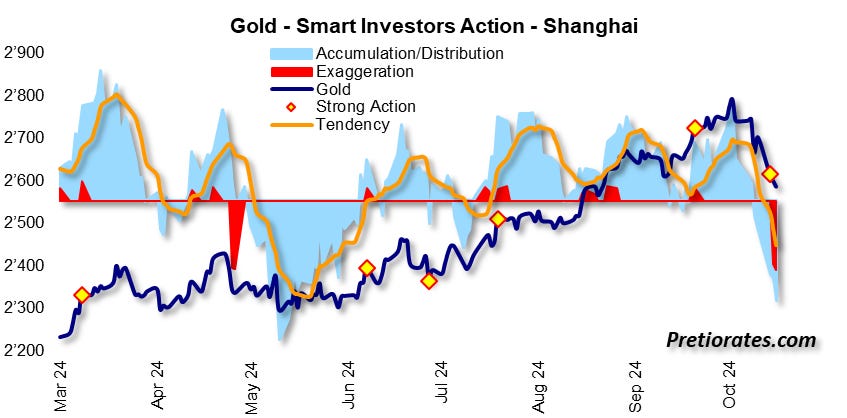

The selling pressure has been so strong over the last ten days that the Smart Investors Action in Chinese Gold trading has reached a massive level of ‘exaggeration’. This alone suggests that a countermovement is likely. Potential sellers have missed the ideal moment to sell, while potential buyers could increase their exposure at much lower prices...

(Click on image to enlarge)

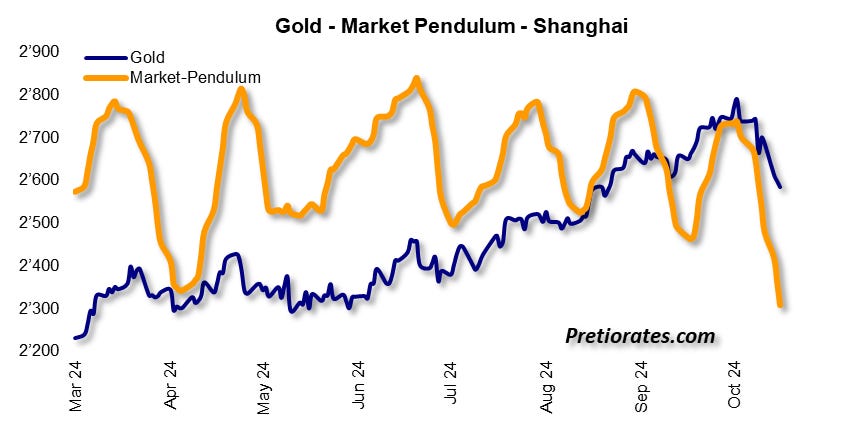

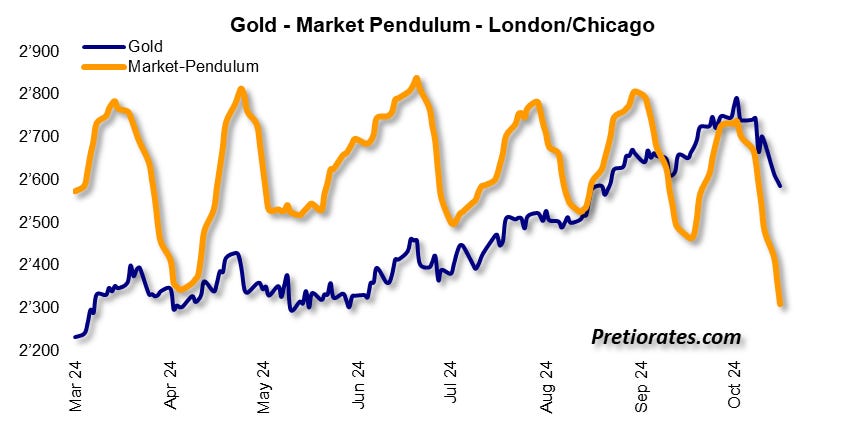

The stock market, regardless of the asset, is a real seesaw. And the selling pressure has been so strong recently that the ‘market pendulum’ has fallen to its lowest level in over eight months. This also indicates a high chance that the Gold price will recover in the coming days...

(Click on image to enlarge)

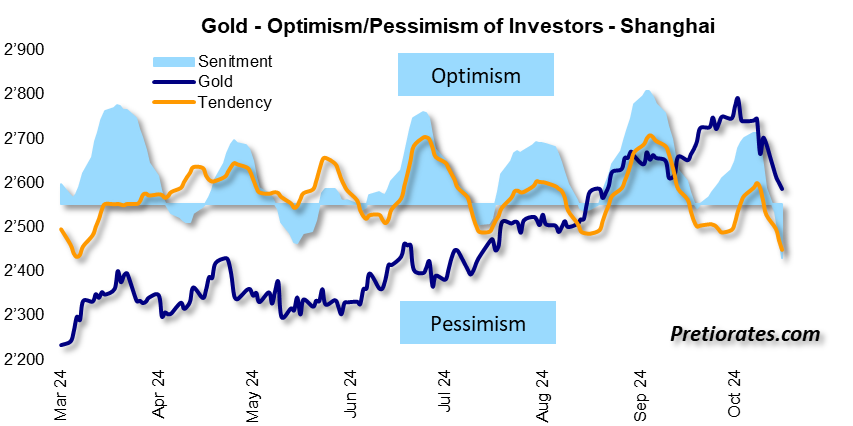

Of course, the euphoria of the last few weeks has come to an end with the strong correction. The sentiment indicator also shows that Gold trading is at its most pessimistic level in almost three quarters...

(Click on image to enlarge)

In recent months, China has been the center of the Gold trading world. However, Chinese investors are no longer willing to chase the sharply risen Gold price. Accordingly, the Gold price in Shanghai is trading at a discount compared to Western markets...

(Click on image to enlarge)

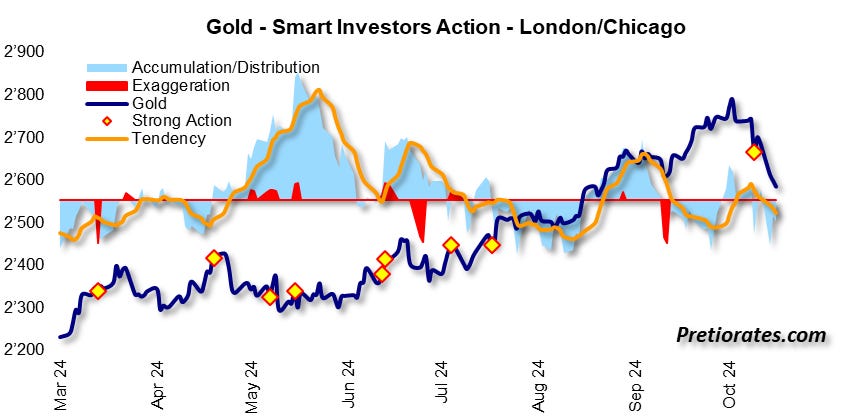

And the West, which basically missed the rally in precious metals, continues to show no major action. The small movements of the 'Smart Investor Action' suggest indifference...

(Click on image to enlarge)

But the 'market pendulum' of the market price has also swung to an extremely low value here, which actually suggests nothing other than a stronger countermovement...

(Click on image to enlarge)

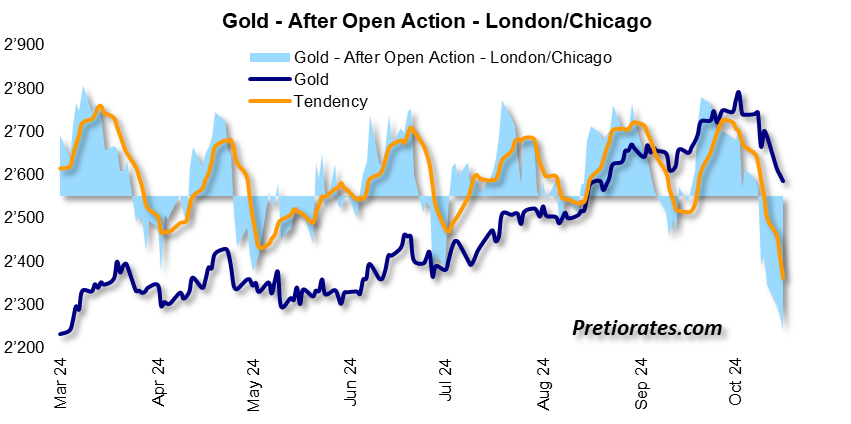

The 'After Open Action' in Western trading has even reached a negative extreme. This suggests that the big investors – who usually trade after the opening (After Open Action) – could now be jumping on the long-term precious metal rally...

(Click on image to enlarge)

In the case of Silver, Chinese investors (or solar companies?) are still willing to pay a premium of over 5% compared to Western physical trading. It has decreased significantly, but it is still a positive indication from the world's largest buyers of Silver...

(Click on image to enlarge)

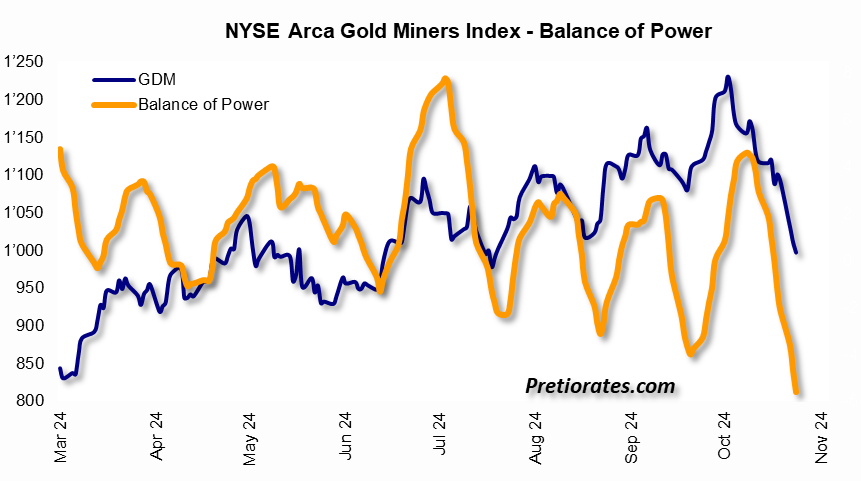

With the strong correction in precious metals, mining company stocks also fell to a hard floor. But here, too, the 'balance of power' is shifting: the indicator fell to a multi-month low – a countermovement is on the horizon...

(Click on image to enlarge)

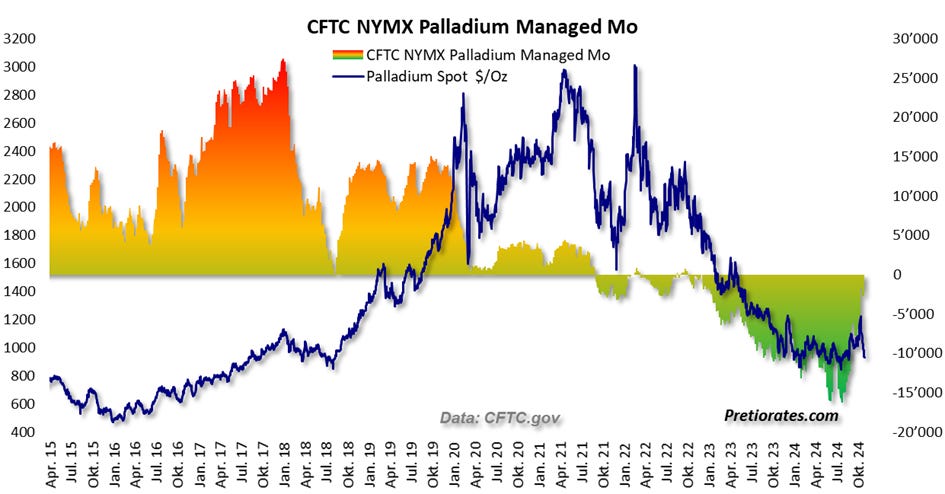

The last word belongs to palladium: although the market price recently fell back below USD 1000 per ounce, the massive reduction in short positions in futures positions by 'non-commercials' (investment funds) shows that sentiment here is changing from deeply pessimistic to confident again...

(Click on image to enlarge)

More By This Author:

Buy When The Cannons Thunder And Sell When The Angels Sing

Buy When The Cannons Thunder And Sell When The Angels Sing...

Higher Volatility Ahead

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more