The USD And Oil Were On A Tear, But The Dollar Fell Overboard

The dollar fell following lower-than-expected US inflation data, to the advantage of black gold. What else is driving crude oil prices these days?

Slowing U.S. Inflation vs. the Greenback

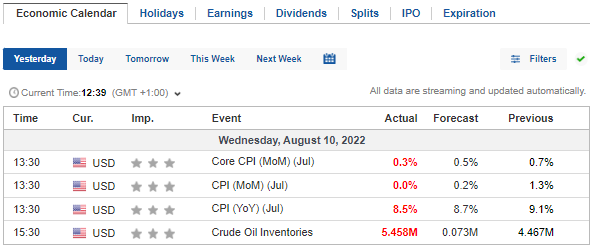

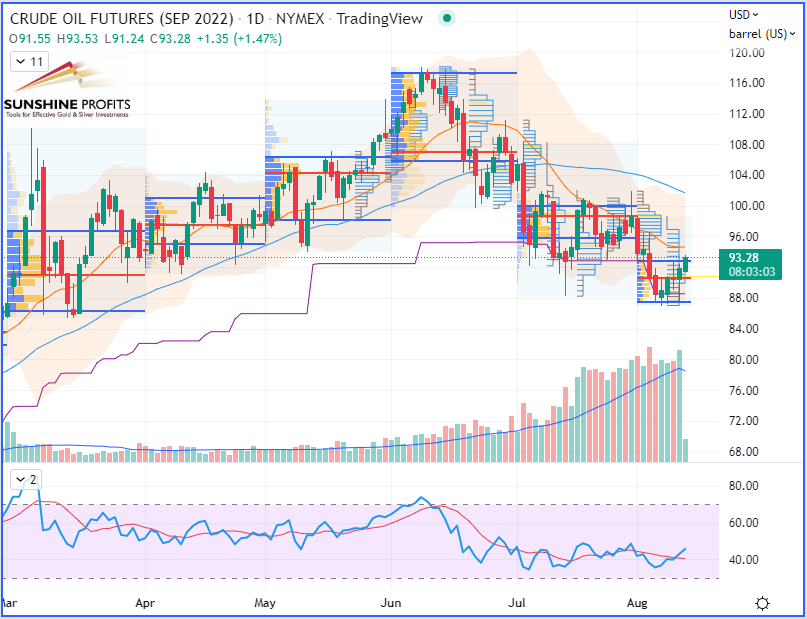

WTI crude oil futures rallied back above the $90 mark this week on the NYMEX as the US dollar weakened. On Wednesday, the safe-heaven currency indeed lost some strength after a lower-than-expected US July inflation figure convinced investors to move towards riskier assets, hence the bound of U.S. equity indexes. The outcome of the Consumer Price Index (CPI) report could potentially lead the Federal Reserve to get a little less aggressive with its interest hike cycle since the CPI in July in the United States slowed its course to 8.5% year on year from 9.1% in June.

(Source: Economic Calendar, Wednesday Aug-10,

)

When all the data turns into bearish territory for both legs – the greenback and black gold – it is usually the optimism (or pessimism, depending on which point of view we take aside) triggered by the macroeconomic perspective that leads the markets. In that case, as the news was bearish for the US dollar as well, it is probably the one which will set the tempo for the rest of the day. Therefore, despite bearish inventory data for crude oil, the drop in the US dollar gets stronger to push other assets towards the upside.

Fundamental Analysis

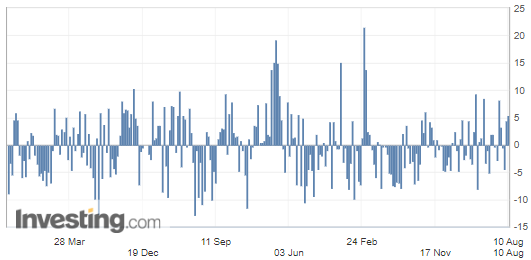

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

U.S. Crude Oil Inventories

Even if we saw the commercial crude oil reserves in the United States sharply rising to 5.458M barrels while the expectations were barely showing a rise (0.073M barrels), the impact was rather mitigated and left in the background as the more optimistic equity indexes were soaring.

US crude inventories have thus decreased by not even half a million barrels in volume, which is not a very significant deviation to mention a greater demand and is not really a strong bullish factor for crude oil prices, since the drop can be explained, in part, by the increase in oil exports.

(Source: Investing.com)

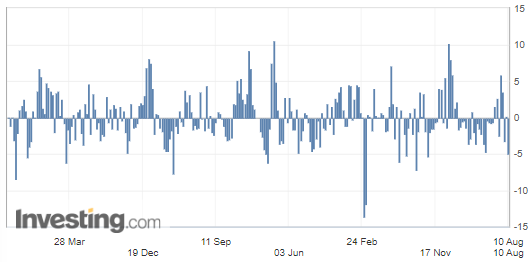

U.S. Gasoline Inventories

In addition, the U.S. gasoline demand figures probably helped to support rising oil prices:

This is precisely where we could eventually see a rise in demand marked by an unexpectedly sudden drop in gasoline reserves, since the latter were reduced by almost 5 million barrels.

Geopolitics

On the geopolitical scene, investors are monitoring the ongoing US-China tensions over Taiwan. On a more positive note, we are facing a potential return of Iranian crude to the market with the ongoing negotiations of the nuclear agreement with the different trade partners.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

RBOB Gasoline (RBU22) Futures (September contract, daily chart)

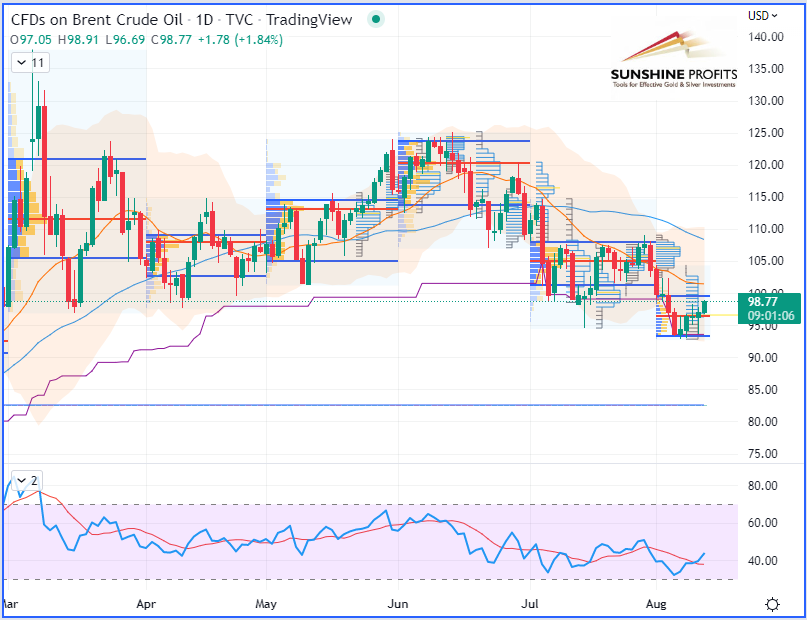

Brent Crude Oil (BRNU22) Futures (September contract, daily chart) –Contract for Difference (CFD) UKOIL

More By This Author:

Crude Oil Hesitates After Briefly Dropping Below $90

Crude Oil Returns To Its Diving Lessons. CPI Hits New High

Rebounding Crude Oil Gets Far Away From The Bearish Side

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more