Rebounding Crude Oil Gets Far Away From The Bearish Side

Demand for crude oil is accelerating – a bullish sign for its prices. What may the current energy market environment say about the black gold’s outlook?

A Chinese Panda’s Appetite

On the Asian continent, the lifting of health restrictions in China could signal to resume of oil demand for the world’s top consumer. Given the context of tight supply, this has partially triggered a rebound in crude while driving prices higher.

Geopolitical Scene

The Libyan National Oil Company (NOC) warned that they could declare a state of "force majeure" on the facilities in the Gulf of Sirte – blocked due to the political crisis that has been hitting the country for months.

In Ecuador as well, the spectre of a halt in oil production is becoming clearer following the blockades and demonstrations initiated by a movement protesting the rise in the cost of living.

OPEC+ Struggles to Increase Volumes

The United Arab Emirates assured that they were at maximum capacity, while Saudi Arabia stated it could pump an additional 150,000 barrels per day. It is important to note that these two producing countries are indeed the two OPEC+ members perceived to have the sparest oil production capacity. The 23 members of OPEC+ are just starting a series of two-day e-meetings on Wednesday (they should also meet on Thursday by videoconference) to decide on a new adjustment to their total volume of production of black gold. However, analysts expect the status quo despite numerous calls for action.

Fed’s Recession Denial?

The US economy is slowing down, but not to the point of falling into recession, the president of the New York branch of the Federal Reserve (Fed) said to CNBC Tuesday. The mighty Federal Reserve has raised rates three times since March. The latter is now in a range between 1.50% and 1.75% after remaining close to zero during the COVID-19 pandemic.

Fundamental Analysis

On Tuesday, the American Petroleum Institute (API) released its weekly oil stock figures.

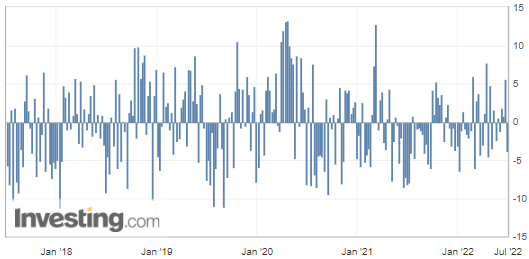

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States dropped to -3.8M barrels while the forecasted figure was just about -0.110M, according to figures released on Tuesday by the US American Petroleum Institute (API).

US crude inventories have thus decreased by over 3.799 million barrels, which firmly shows accelerating demand and could be considered a strong bullish factor for crude oil prices. This figure would indeed signal a rise in fuel consumption. As a result, demand is now holding up well as the peak of the summer driving season approaches with many trips.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

RBOB Gasoline (RBQ22) Futures (August contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – here it is represented by its Contract for Difference (CFD) UKOIL

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more