The Top 5 Most Read Market Ideas Of 2025

Image Source: Pexels

As the year draws to a close, I find it useful to revisit what resonated most with readers over the past 12 months.

As in past years, this isn’t a recap of everything that happened in 2025. Instead, I’m revisiting the five most-read Frank Talks based on views, while offering a brief perspective on how those original ideas held up as the year unfolded. Let’s dive in!

5. The Case for $7,000 Gold

September 29

When this Frank Talk came out in September, gold was already trading at historic highs, driven by forces such as central bank buying, geopolitical risks and strong ETF inflows.

Since then, those forces have only intensified. Global debt has expanded to $346 trillion, tensions around the world have escalated and confidence in fiscal restraint has eroded.

Just last week, the yellow metal broke through $4,500 an ounce for the first time ever; meanwhile, silver and platinum have posted some of their strongest gains in decades.

I still predict $7,000 gold, a milestone we may see at some point before the end of President Donald Trump’s second term. As always, I recommend a 10% weighting, split evenly between physical bullion and gold mining equities.

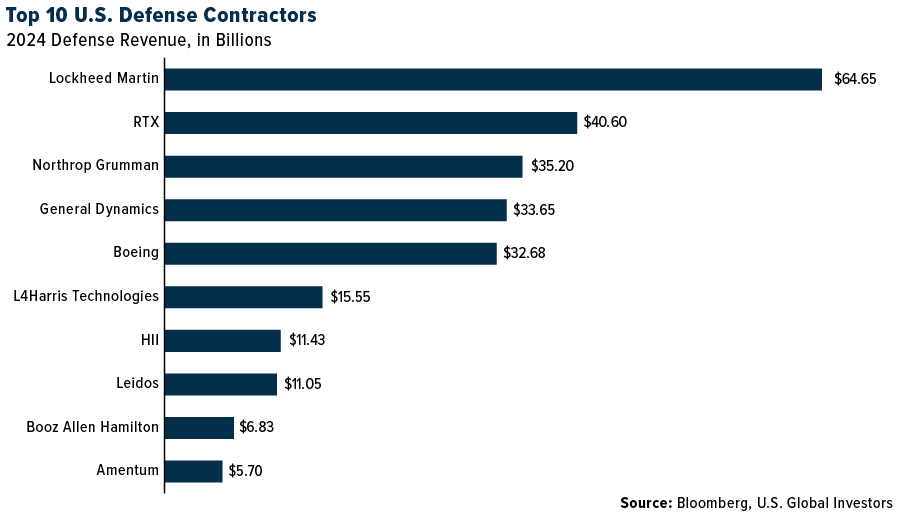

4. Aerospace & Defense Stocks to Watch: The Biggest U.S. Contractors by Revenue

January 13

In this Frank Talk, I ranked the largest U.S. defense contractors by revenue, with Lockheed Martin LMT taking the top spot with a mind-boggling $65 billion in 2024.

(Click on image to enlarge)

At the start of this year, global tensions were rising, but defense spending was still being debated. I argued then that, regardless of politics, the U.S. and its allies were committing to long-term military modernization, and that would flow through to the industrial base.

That thesis gained more momentum as the year went on, and this month, President Trump signed the 2026 National Defense Authorization Act, which accelerates spending on missile defense, space systems, cybersecurity, artificial intelligence (AI) and more. Multiyear contracts and faster acquisition pipelines are also included in the legislation.

3. SpaceX, Palantir and Anduril Lead the Race to Build Trump’s Golden Dome

April 28

When I wrote about Trump’s Golden Dome in April, the program was still more concept than reality… as it remains to this day. The U.S. continues to explore a next-generation missile defense system that relies heavily on space-based lasers and other emerging technologies.

Today, independent estimates suggest costs for the Golden Dome may be far higher than projected—Bloomberg puts it at over $1 trillion, close to six times more than Trump’s early estimate of $175 billion—and hundreds of companies have been invited to participate in early-stage proposals.

Whether the system ultimately meets its ambitions remains to be seen, but I will keep my eyes on the project.

2. America’s Top 10 Busiest Airports

August 20

As many of you know, I spend a lot of time in airports, making this one of my favorite Frank Talks to write. Surprising no one, Hartsfield-Jackson Atlanta International Airport was America’s busiest airport, serving a whopping 38 million people this past summer alone.

Throughout 2025, passenger volumes have continued to climb, and just last week, the Transportation Security Administration (TSA) announced it’s preparing for record-breaking holiday travel. A massive 44.3 million passengers are expected to be screened at U.S. airports between December 19 through January 4.

Meanwhile, airports continue to invest billions in terminals, gates and security, reflecting anticipation for growing demand.

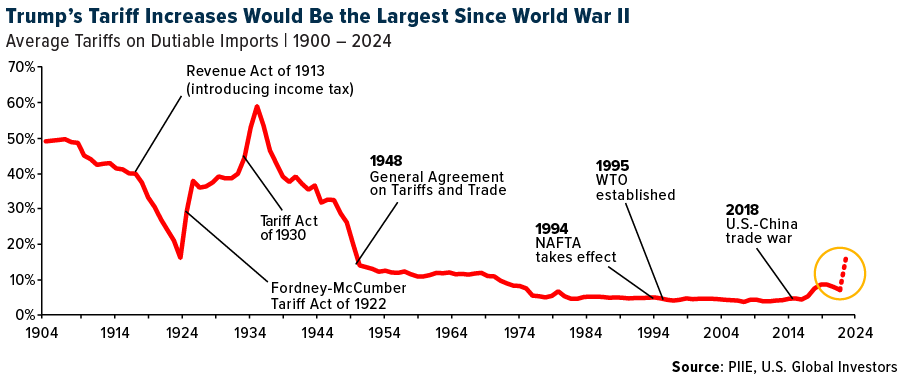

1. The Surprising History of Tariffs and Their Role in U.S. Economic Policy

February 10

The most-read Frank Talk of 2025 looked backward to understand the present and, perhaps, the future.

I traced tariffs from their historical role as a primary source of U.S. government revenue to Trump’s current use of them as a policy and negotiating tool. At the time of this Frank Talk’s writing, the administration’s tariff increases were on track to be the largest since World War II.

(Click on image to enlarge)

As the year has progressed, these taxes on imports have become even more consequential, whether looked at from an economic, political or legal point of view. Businesses and consumers have absorbed the higher costs, while court challenges have raised questions about their legality. Earlier this month, CBS News reported that the U.S. government could owe businesses as much as $168 billion if the Supreme Court rules against the administration.

The popularity of this Frank Talk tells me that investors want to understand how trade policy fits into a broader economic framework, and what that means for inflation, supply chains and, ultimately, markets.

As always, my goal with Frank Talk is to help make sense of what’s happening in markets around the world. I’m grateful you continue to read and think alongside me.

Here’s to a thoughtful and prosperous year ahead!

More By This Author:

The Diesel Shock No One Is Talking About

Copper Rally Is Accelerating As AI Data Centers Push Global Supply Toward Crisis Levels

Americans Spent A Record $11.8 Billion On Black Friday Despite Economic Worries