The Silver Awakening

What a rollercoaster ride! Silver has made a huge leap, especially during the last few trading days, while Gold has continued to consolidate. This development does not come as a complete surprise: in our thoughts on November 12, “Silver, enjoy the ride,” we already anticipated daily movements of around 5%. And the upcoming potential increase was mentioned in the thoughts on Nvidia on November 19.

It came as no surprise that the “first notice day” on the Comex futures exchange in New York on November 28 played a key role. On this day, buyers of December 2025 futures were able to demand physical delivery for the first time.

The fact that Comex was unable to start on time on that day due to overheated servers can be met with either a shake of the head or an incredulous smile. But it was precisely such mishaps that caused the rumor mill to bubble even more vigorously – and in turn contributed to the further price rally. There was even talk of a Chinese delivery request for 400 million ounces of Silver, or that JP Morgan might move its precious metals trading from New York to Singapore. These rumors should be considered unconfirmed for the time being, so that short-term investors do not stumble into loss-making trades. However, if they prove to be true, long-term investors can continue to expect significant opportunities. This makes it clear where the better prospects lie. Short-term traders are likely to have chased the rally – and are now exiting again, leading to temporary selling pressure.

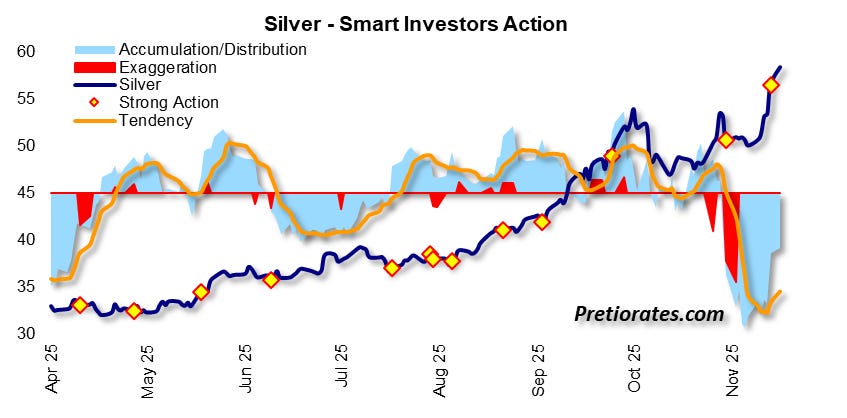

It is interesting to note that Smart Investors Action shows how the Silver price has continued to rise recently despite increasing distribution. This is still so pronounced that additional upward movements can be expected in the coming weeks.

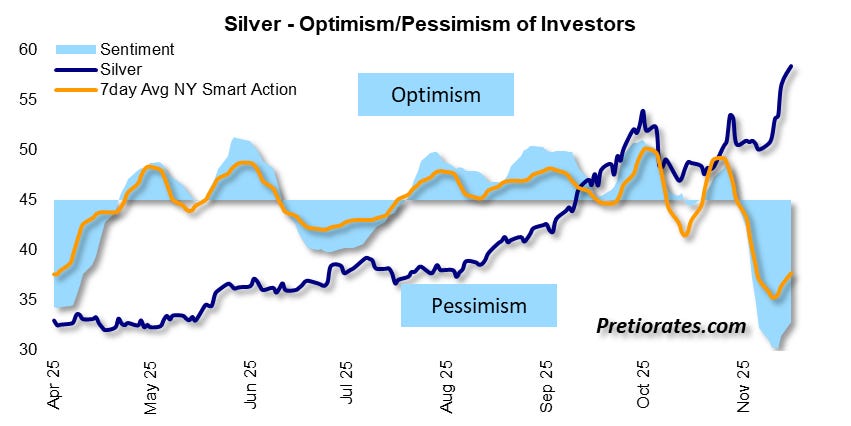

Apart from investors who closely follow the Silver futures market, however, the general sentiment in the broader Silver market remains rather pessimistic.

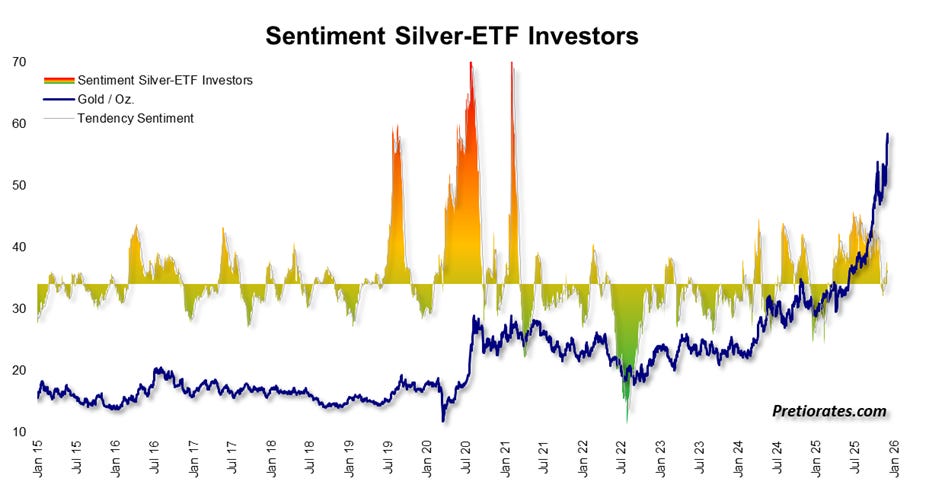

Even in the long-term sentiment picture, sentiment is at most neutral – there is no sign of overheating, despite the impressive advances of recent years. The heated phases we saw five or six years ago have not been reached by a long shot.

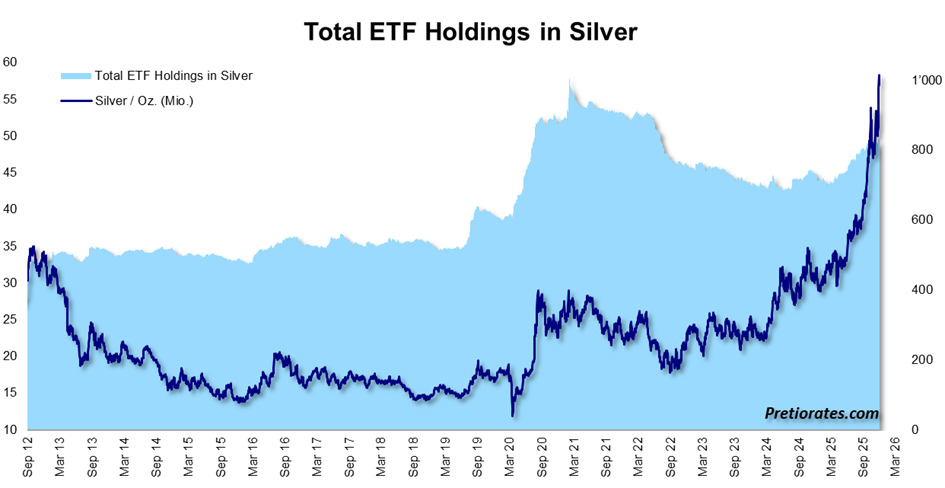

It may come as a surprise that sentiment remains so subdued. But it is precisely this restraint that may explain why outstanding Silver ETFs remain well below their 2021 highs – and have even declined again recently.

Everyone is talking about the rise in the price of Silver, but practically no one is on board – which promises further demand potential. There is nothing worse for an asset manager than not being invested in the winners, especially at the end of the year.

And this is precisely where two important drivers come into play: Silver is likely to continue to rise once Gold has finished consolidating. This could happen sooner than expected if the conflict between the US and Venezuela escalates and Russia and China also become involved. Both countries are close allies of Venezuela. China has invested tens of billions of US dollars in the country to secure access to its vast oil reserves. In addition, the Council on Foreign Relations estimates that China has lent around US$60 billion – funds that would be at risk in the event of US intervention.

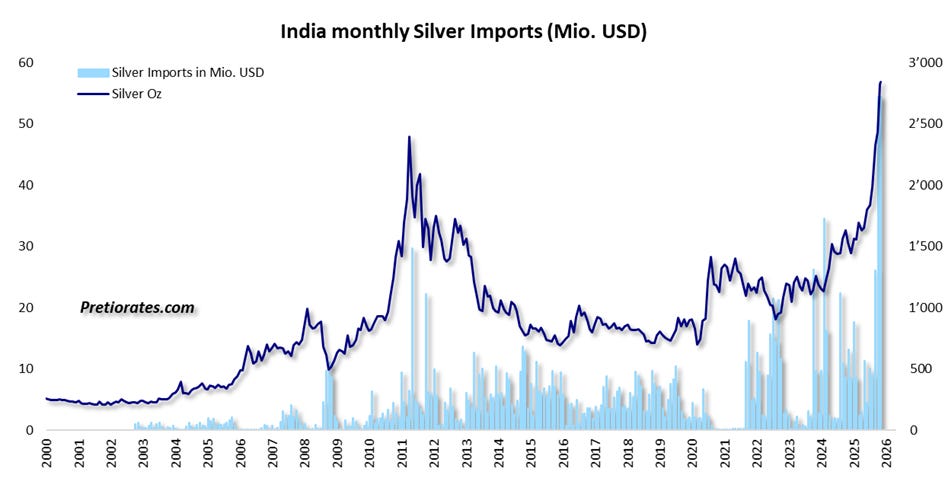

However, Silver is no longer solely dependent on the performance of Gold. Physical scarcity continues to increase. China remains a massive buyer and is focusing on physical Silver for industry. But India also made its largest import in history in October – the volume is beyond comparison with previous months.

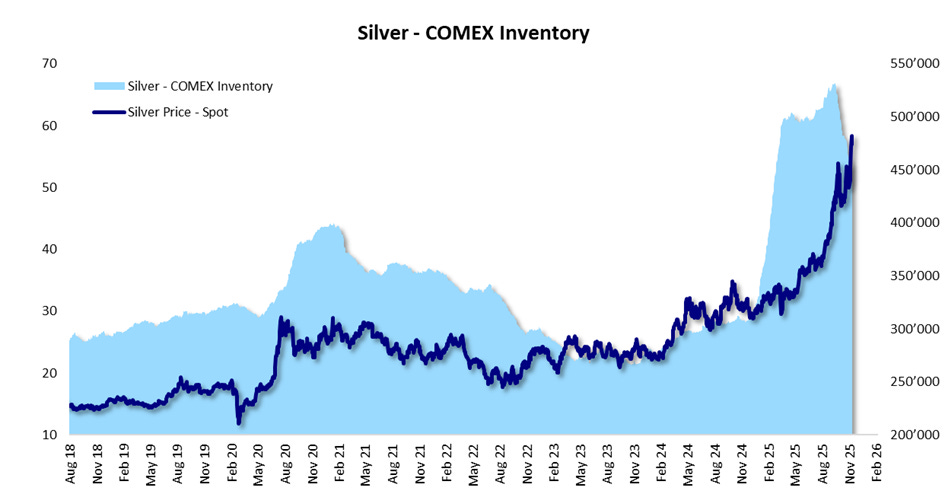

As a result, inventories in Shanghai and at the London LBMA are falling to extremely low levels. Inventories at Comex have also declined recently, but at first glance still appear to be well stocked.

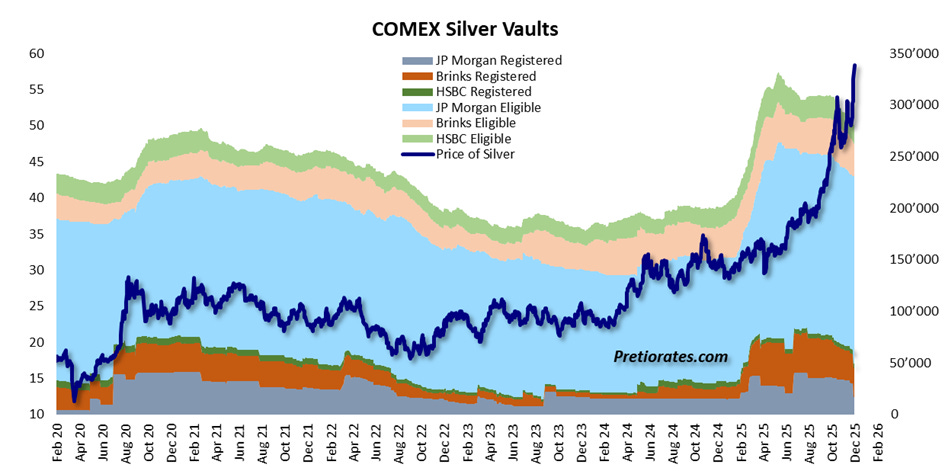

However, this impression is deceptive: futures markets distinguish between available (eligible) Silver and registered stocks. Only registered Silver can be delivered to futures buyers. Eligible stocks meet the conditions for registration, but often never become available because they are allocated to ETF stocks, among other things. A breakdown of the Comex stocks of four major bullion banks shows that more than half of the total eligible stock comes from JP Morgan – the custodian bank of numerous Silver ETFs.

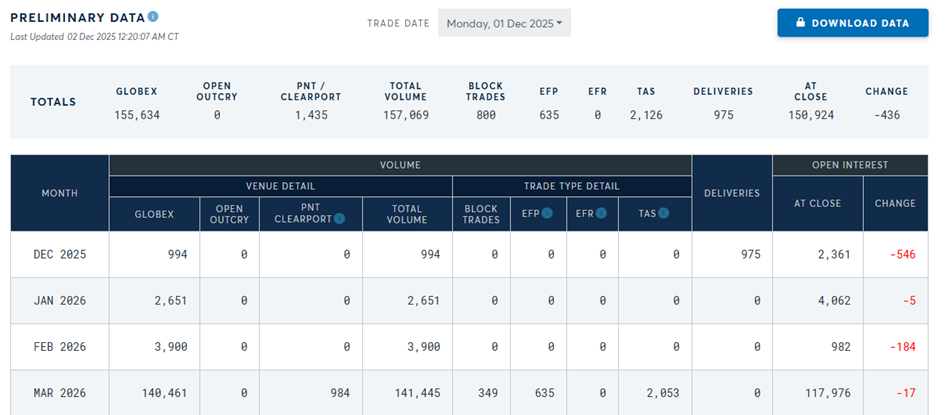

However, the tension surrounding the December futures contract mentioned at the beginning is likely to ease, even though it will continue to be traded until December 29, 2025. Last Friday, 7,330 contracts were registered for delivery, and on Monday, December 1, another 975. With a contract size of 5,000 ounces, this corresponds to 41.525 million ounces of Silver – an extremely high figure and well above the usual average. However, according to current open interest, only 2,361 contracts are still open for the December 2025 expiry that could actually be delivered – a relatively low figure in comparison.

This should put an end to the issue of possible delivery bottlenecks for the December contract – but not the long-term problem of physical Silver availability. The next expiration month for which physical delivery can be requested is March 2026. The current open interest stands at an impressive 118,000 contracts, corresponding to 590 million ounces of Silver – while annual production in 2025 is expected to be 844 million ounces, according to the Silver Institute.

The futures market therefore remains highly exciting. We will attempt to shed more light on the events in this market and the behavior of market participants in the coming weeks. This includes the ongoing rumors of alleged or possible manipulation. A key factor in this regard is the category figures that the exchange usually publishes on open contracts and participants – the Commitment of Traders (COT). However, due to the recent US government shutdown, updated figures will not be available until January 23, 2026.

We wish you successful investments!

More By This Author:

Is The US Treasury Market In The Right Boat?Nvidia Is Just A Gust Of Wind, The Autumn Storm Is Likely Not Over Yet

Silver, Enjoy The Ride

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more