Stocks Bounce After Brutal Week Despite Apple Unveiling A Dud

Image Source: Unsplash

After the worst week for the S&P since the March 2023 bank crisis...

... which sent the Nasdaq to one of the most oversold levels since the covid crash...

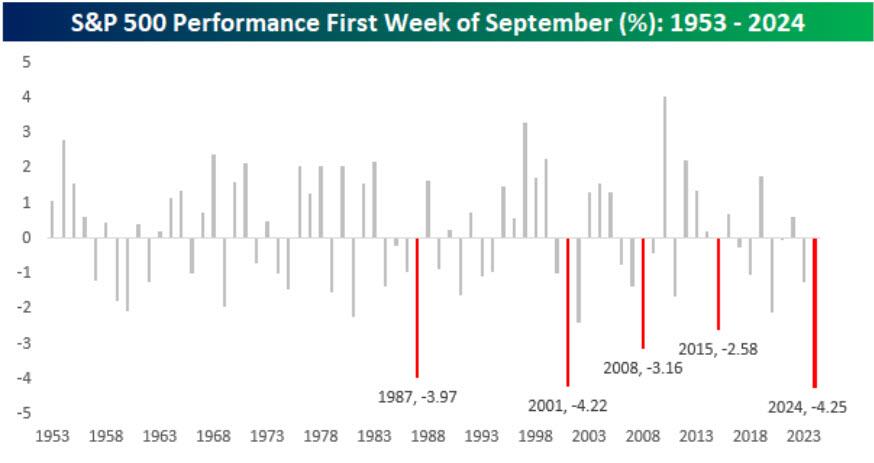

... and with the market starting off September in typical "whimper" style: deep in the red as the following chart from Bespoke shows...

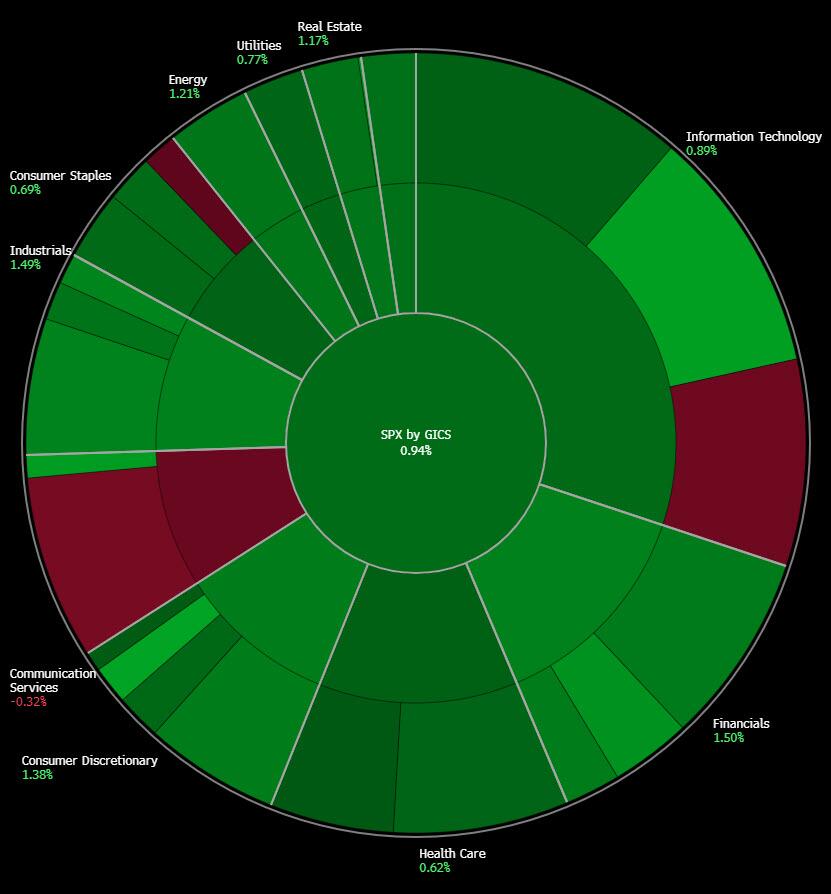

... today's bounce back was basically a formality, and bounce back we did after the brutal start to September...

... as all sectors were deep in the green (well, almost all)...

... yet while some tech names enjoyed today's session, chief among them Palantir (PLTR) and DELL, which learned they would be added to the S&P500 index, pushing the latter to its best one-day gain since February...

... and even Nvidia (NVDA) managing a rebound from the critical $100 level...

... others were less lucky, Google (GOOGL) parent Alphabet most notably as the tech giant dropped another 3%, down on 4 of the past 5 days, 7 of the past 9, and decisively breaching below its 200DMA...

... and AAPL failing to capialize on today's iPhone 16 reveals, which was largely viewed as a dud, sending the stock to session lows before recovering...

... and down 5 of the past 6 sessions.

And so, as the Mag 7 generals that have led the market for the past 2 days are starting to wobble, the critical support below the Mag 7 index is in jeopardy. If the key support line gives way, then it is the 100DMA, then 200DMA... and then things get very ugly...

... although as Goldman TMT specialist Peter Callahn notes, positioning is not yet a major problem:

- Goldman Prime Broker data shows overall long/short net and gross exposures are moderate, based on a 3-year look-back.

- Hedge funds and mutual funds cut exposure to Info Tech, holding their lowest tilts to the sector in the past decade.

- In TMT subsector positioning: Internet > Semis > Software > Hardware > Payments > CME; positioning is no longer a bearish factor for the sector.

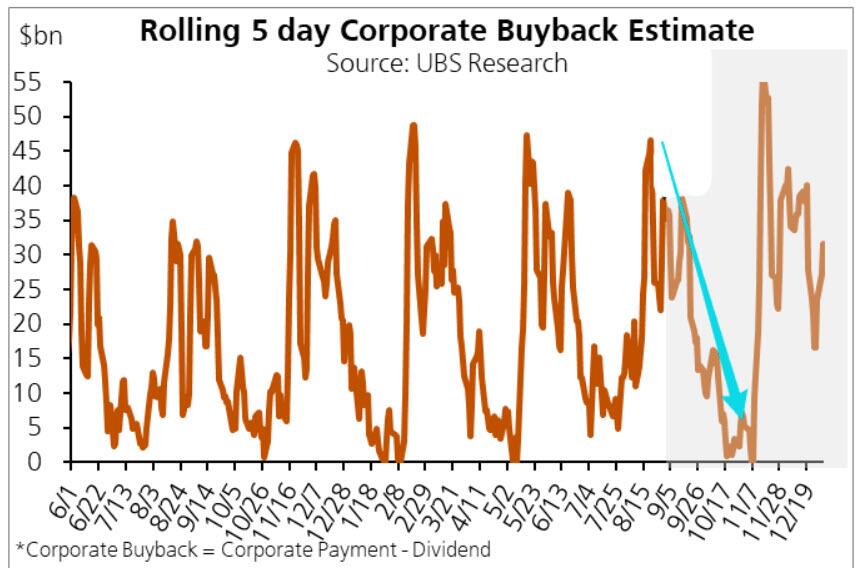

That's the good news. The bad news as Goldman's Tony Pasquariello noted over the weekend, is that systematic buying is now reversing, and the massive buyback bid which kickstarted the August rebound, enters its blackout period next Friday, among the notable factors that are about to become a headwind for stocks, to wit:

- Demand from the systematic trading community has diminished.

- Corporate buybacks are tapering, reducing a key support for the market.

- Follow-ons and block trades are increasing, but may not fully offset the fading buybacks.

- As the derivatives expiry on the 20th approaches, key drivers of the August market bounce (systematic demand and buybacks) will likely fade.

- Household investment activity, another key market support, is also slowing down, raising concerns for continued upward momentum.

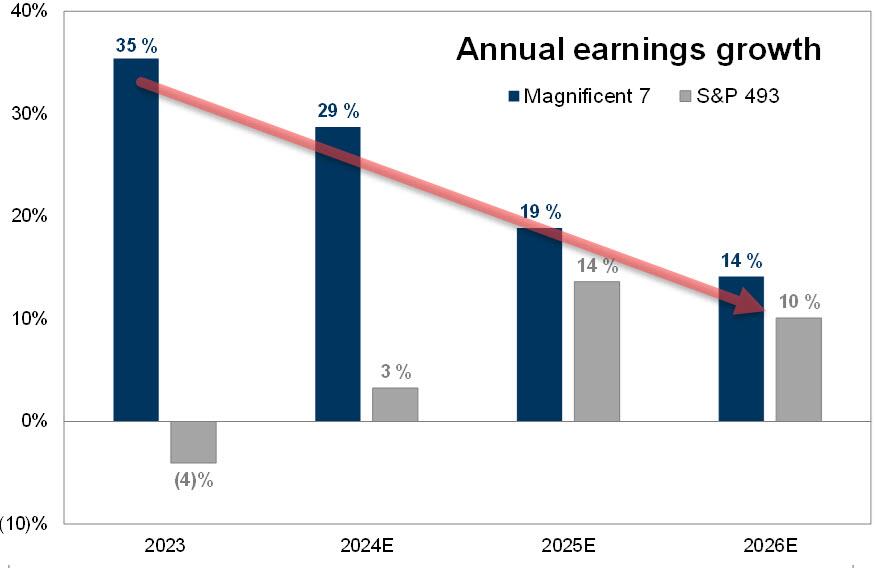

But wait, there's more headwinds for the all-important generals, with the annual earnings growth for the Mag 7, still at impressive levels, set for a long, painful convergence with the rest of the S&P500.

It makes you wonder if the Nasdaq jaws of death (Advance/Decline line vs the Nasdaq itself) are starting to finally close?

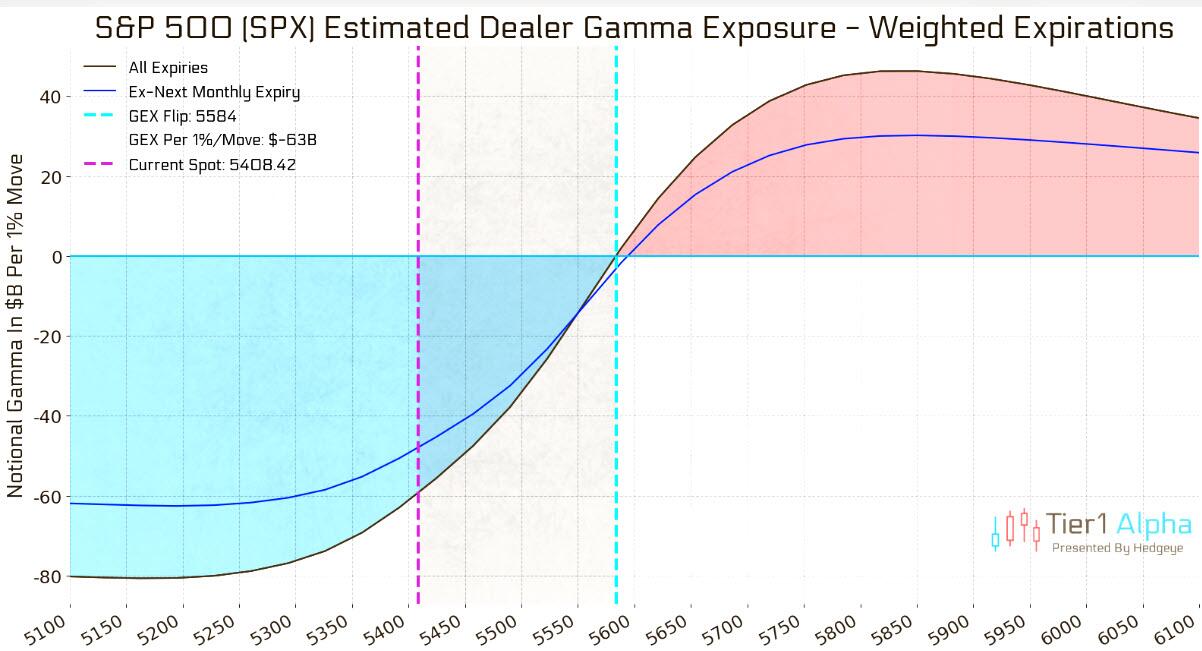

Meanwhile, while the bulls enjoyed today's rally, that can and will quickly reverse with dealers still deep in negative gamma territory, and all that would take for another trapdoor lower is a sudden drawdown in stocks which forces dealers to chase risk to the downside, as the dreaded positive feedback loop of negative gamma positioning kicks in.

While stocks staged a comeback, the rest of the market was quiet, with bond yields failing to rebound, and after rising in the early morning, yields gradually faded all day only to closer down on the day...

... which in turns hammered the all important carry trade, as the USDJPY first ramped higher after the European open, only to slink back ahead of the cash open and stay there...

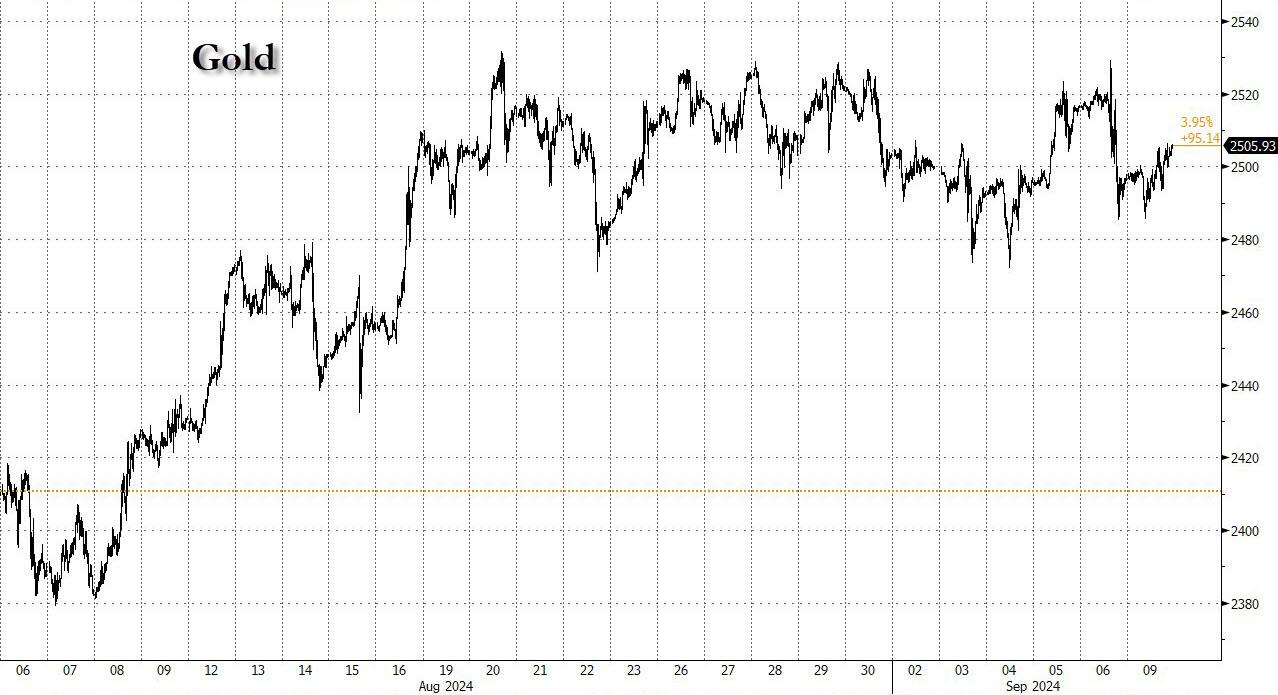

... and finally, no matter what happens across the rest of the market universe, one place where the bid refuses to fade is gold: after getting hammered on Friday in the aftermath of Waller's comments which were interpreted by Timiraos as hawkish, gold once again rebounded and has managed to recover most of its losses as it trades just shy of its all time highs.

More By This Author:

Boeing Shares Rise On "Historic Contract Offer" With Union, Potentially Averting A Crippling Strike

When Car Shopping, Baby Boomers Prefer To Buy American; Here's Their Favorite Brands By State

IRS Plans Changes To Boost Retirement Savings With $1,000 Saver's Match Program

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more