S&P GSCI Mid-Year Recap And Lithium Added To S&P GSCI Electric Vehicle Metals Index

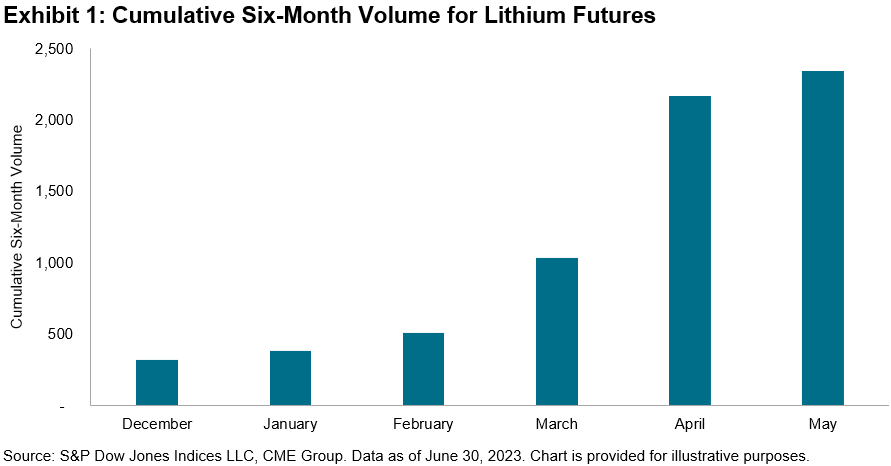

Surging futures activity on CME Group’s lithium contract allowed for entry into the S&P GSCI Electric Vehicle (EV) Metals Index. This milestone reflects the changing nature of indices to maintain a representative share of the global commodities market. The largest and most recognizable benchmark for commodities, the S&P GSCI, reviews contract eligibility for existing and potentially new contracts. This review allows for the index to add new commodities, like lithium, to commodity giants like wheat, cattle and crude oil. Spoiler alert: lithium has a long way to go in terms of production and trade volumes to qualify for the flagship S&P GSCI. But this raises the question of how indices evolve and what other commodities could enter new and existing indices. In this blog, we attempt to answer that for lithium as well as for the broader commodities market.

The S&P GSCI EV Metals Index seeks to reflect the performance of the tradeable metals used in the production of an electric vehicle. The expertise of S&P Global Commodity Insights is utilized to determine the index constituents and production weights to ensure the index broadly reflects the relative metal usage in a representative EV. To meet liquidity requirements for the financial products that track the index, minimum volume thresholds ensure investability.

Oil futures made their debut on the NY Mercantile Exchange over 40 years ago. A production-weighted index with liquidity filters, the S&P GSCI added light sweet crude oil in 1987, when it took on about one-third of the broad commodities benchmark. With the addition of Brent crude oil to the West Texas Intermediate, the oil component started to dominate the commodities market, peaking at 56% in 2008, which coincided with the fracking boom that transformed the economy and led the U.S. out of the Great Financial Crisis. Energy continues to dominate the global markets and oil remains king. However, peak oil, as measured by the total production and value of commodities traded globally, appears to be waning.

Like early millennials who were born in the 1980s, oil futures are now 40 years old and face a new generation entering adulthood. This new generation of futures contracts are iron ore, cobalt and lithium, which, combined with industrial metals, have come to create a new “sector” of commodities and power the energy transition economy. While these contracts make up the S&P GSCI EV Metals Index, they currently do not qualify for the S&P GSCI. Iron ore is the longest-tenured contract and meets liquidity requirements, but other rules currently prevent it from entering. Exchange location, liquidity and volumes on a particular venue come into play. For example, copper traded on the LME is an S&P GSCI constituent, while copper traded on the COMEX is not.

Quarterly Recap of the Market

Lean hogs and natural gas rebounded in June but remained among the worst-performing commodities in the S&P GSCI YTD. The Dallas Fed Energy Survey showed businesses were no longer expanding for the first time since 2020. On the other side of the pond, Ukraine’s energy minister believes Russia could shut off Russian gas to Europe by the end of 2024 when Ukraine’s supply contract with Gazprom expires. Last year, estimated global nickel mine production increased by about 20%, with the increased production attributed to Indonesia. Forecasts by the International Nickel Study Group maintained that supply growth is forecasted to continue in 2023, though monthly performance appears to have stabilized during June trading. Half-year leaders in commodities were cocoa, sugar, and cattle, which have all dealt with weather-related supply shocks: El Niño conditions in West Africa, 2022’s drought conditions leading to supply shortages across sugar-producing regions in Asia and the thinning of North American cattle herds. Cattle futures are currently at an all-time high. Considering downstream impacts, the outlook calls for swapping out beef for pork on your summer barbecues and laying off the venti mocha swirls.

(Click on image to enlarge)

More By This Author:

S&P 500 Low Volatility Index May 2023 Rebalance

Active Or Agnostic?

Hedging Debt Ceiling Drama With The S&P GSCI SOFR And S&P GSCI Gold

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.