South America’s Crop Updates Are The Market’s Focus

Image Source: Pexels

Market Analysis

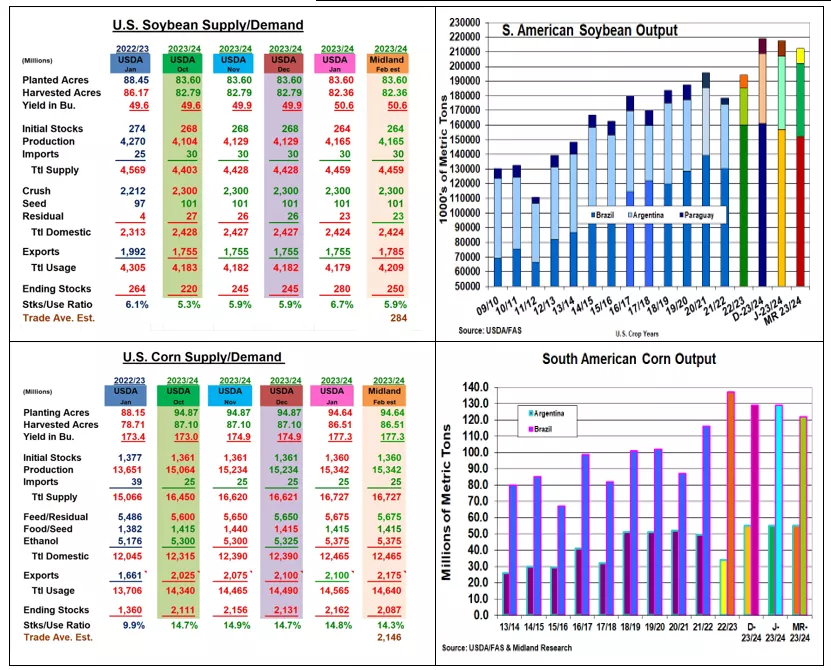

The USDA will be updating its US/World Supply/Demand & S American crop estimates on February 8. The World Board normally doesn't make many February US balance sheet changes. In the past, they have taken a wait-and-see approach. However, for the 3rd year in a row, S Am weather has impacted their crop prospects. Brazil’s crop season was divided between north & south. Dryness & heat delayed Mato Grasso & other northern states’ seedings while excessive rains impacted Parana & Rio Grande’s plantings. This prompted ideas of 2.9 million hectares of replanted soybeans across Brazil this year. Argentina’s crop season has generally been normal up to this point. However, extreme triple-digit heat is forecast for the next 1-2 weeks potentially reducing Argentina’s corn & soybeans outputs.

Brazil’s excessive spring heat & dryness prompted the USDA to drop their January bean crop by 4 mmt to 157 mmt from their initial 163 mmt forecast. Because of domestic conditions, most S American firms have already dropped Brazil’s crop to 150 mmt or lower. We anticipate a 5 mmt USDA decline to a 152 mmt level. Interestingly, talk of a larger Argentine bean crop has been circulating but, the current heat wave may leave the USDA Feb outlook at 50 mmt. These smaller supplies could up US bean exports by 30 million bu while a record December US crush of 204 million bu doesn’t suggest a cut in our domestic demand. Overall, Feb’s US stocks could dip to 250 million & their World stocks by 2 mmt.

Delayed planting & replanting of soybeans have already hurt Brazil’s 2024 corn output. After the USDA’s initial 129 mmt forecast, they shaved 2 mmt last month. With most S Am analysts in the 117-120 mmt, the USDA could trim 5 mmt to 122 mmt. Like beans, the USDA may leave Argentina’s corn crop unchanged at 55 mmt. but it’s vulnerable if heat is extensive. Brazil’s smaller crop could up US export by 75 million bu. Despite 4 record months of usage, Jan’s cold snap may leave US ethanol corn demand unchanged. Overall, a 2.087 billion bu US corn stock is expected.

What’s Ahead:

With Brazil’s 1st crop corn & soybean harvest beginning & excessive heat hitting Argentina, S Am updates remain highly important to world prices. The impact on Brazil’s safrina corn & Argentina’s recently seedings to world supplies is very important. Still upping old-crop beans & corn to 65% & 50% at $12.90-$13.10 & $4.75-85. Have 15% of new crop done at $4.95 & $12.40. Move KC wht to 65% & $6.70.

More By This Author:

Weekly U.S. Ethanol Production Plunge Last Week

Low Fall Prices And Dryness May Lower US WW Plantings Further

U.S. Fall Corn Demand Is Up, But 2023’s Hefty Crop Jumps Stocks

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more