Low Fall Prices And Dryness May Lower US WW Plantings Further

Image Source: Pexels

Market Analysis

Late-season weather in both the Central US & Canadian Prairies helped 2023’s N American wheat output to modestly improve. This year’s El Nino hurt Australia’s output by 37% and the Black Sea War continued, but Russia’s wheat crop was 90 mmt for the 2nd year in a row. Because of this output, Russia was an aggressive marketer the final 6 months of 2023. Their need for revenues to continue its fight with Ukraine added pressure to world wheat prices. A record US corn harvest also added to wheat’s general price malaise as the US feed grain supplies rose. US hard red wheat prices retreated 25% in the final five months of the year to 2021’s harvest level. Even a Chinese soft red US buying spree to cover wheat damaged by rain during their summer harvest couldn’t spark a meaningful price recovery.

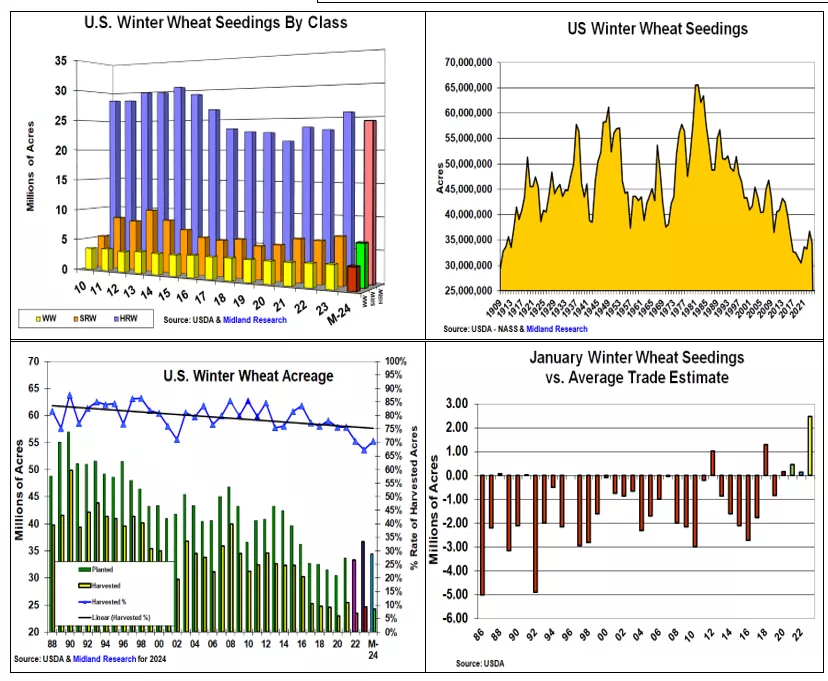

After last year’s 11% increase in US winter wheat seeding because of Russia’s invasion of Ukraine, a reduction in US plantings is anticipated. Low prices and fall dryness in Kansas, the eastern Midwest & the Southeast US should have prompted lower wheat seedings. After 2023’s 3.7 million jump in US WW plantings to 36.95 million acres (the highest level in 8 years), the wirehouse surveys are only down 900,000 to 1 million acres for Friday’s USDA update. Other trading firms and I are sensing that last fall’s Plains seedings may be 1.35 million lower, soft red’s plantings could be 785,000 smaller & the PNW’s white wheat may decline 114,000 acres from 2023. These changes could mean a 2.25 million smaller WW area of 34.45 million acres vs the trade’s 35.79 million average, off 915,000.

Last fall’s low US WW crop conditions may have curtailed US planted area, but next spring’s US rainfall will determine the US wheat size. If 2024’s harvesting percent would return to 2022’s 70.5% level, the coming year’s harvested area would only be 383,000 acres smaller. After 4 years of higher January WW seedings vs expectations culminating with 2023’s 2.47 million surprise trade shortfall, the upcoming seeding report could revert to its long-term tendency of over-estimating the US WW plantings.

What’s Ahead:

With the trade focusing on the upcoming US/World soybean & corn crop data & balance sheets, the US 2024 winter wheat seedings & wheat data hasn’t garnered much attention. With the world’s wheat either harvested or dormant, the upcoming US WW seedings could have a big impact if plantings are lower than expected. Hold old-crop KC wheat. Look to up sales at 65% in the $6.70-6.90 range.

More By This Author:

U.S. Fall Corn Demand Is Up, But 2023’s Hefty Crop Jumps Stocks

US Fall Exports Dip, But December Stocks May Slip On Lower 2023 Crop

US/World Limited Stocks Changes Keep South American Output Important

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more