US Fall Exports Dip, But December Stocks May Slip On Lower 2023 Crop

Image Source: Unsplash

Market Analysis

A second year of drought in Argentina, tight US feedgrain supplies boosting US corn plantings to their highest level since 2013 & the central US experiencing dryness in May & June which returned in August & September combined to tighten US protein supplies in 2023/24. This year’s smaller output & Brazil’s erratic 2023 planting & growing season conditions elevated the soy complex’s values despite having a choppy price pattern. Brazil’s dryness in its northern major regions prompted China to return late season to source US soybeans boosting sales back to seasonal levels. Expanding veg oil demand to meet the West Coast’s renewable diesel needs remains a positive factor for the US processing industry.

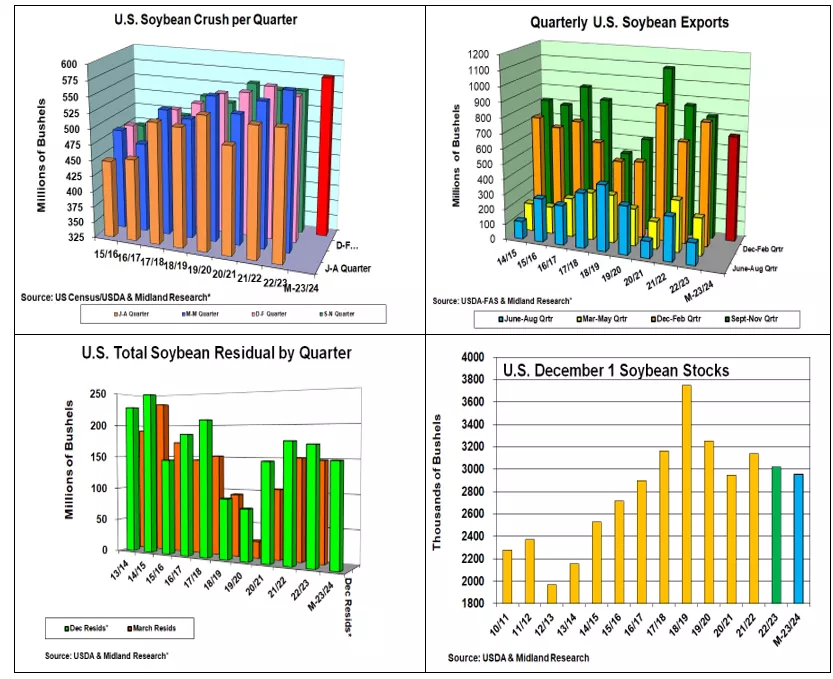

Despite one less processing day, November’s US crush was 200.1 million bu, just 1.3 million lower than October. Overall, this past fall quarter’s soybean processing utilization was 22 million higher than 2022 at 576 million bu. Given the current strong crushing pace, the USDA isn’t likely to change their current record 2.3 billion bu yearly outlook that is 88 million bu higher than last year.

Brazil’s strong marketing of its record 160 mmt crop limited foreign interest in US bean purchases late summer & fall. Late season dryness in the central US for the 2nd fall in a row also curtailed the US Mississippi River shipping system. This prompted 15-25% lower loading of barges reducing this year’s 1st quarter US overseas shipments to a likely 688 million bu pace. This is 114 million lower pace than last year’s 802 million bu level. After China recent purchases, current sales are 44 million ahead of its seasonal pace to reach the USDA’s current yearly forecast. This suggests no change in the USDA’s 1.755 billion export outlook.

Given last fall’s curtailed barge shipments because of low river levels, a lower quarterly seed & transit residual to 150 million vs 2022’s 171 million level is expected. Utilizing our 31 million smaller final US bean crop, Dec 1 US stocks are projected at 2.955 billion bu; 66 million bu lower than last year because of a 238 million smaller beginning supplies.

What’s Ahead:

Despite last fall’s 92 million in reduced US demand, the USDA’s quarterly stocks are expected to lower than in 2022 because of the sharply lower US crop. This means South America’s weather & China’s market actions remain price factors heading into 2024. Hold 2023/24 crop sales at 50%, but be prepared to advance sales to 65% in $13.70-85 March range & begin 2024 marketings at $12.70-80 for 15%.

More By This Author:

US/World Limited Stocks Changes Keep South American Output ImportantAfter The Recent Export Surge, US Ending Stocks Aren’t Expected To Change

Slightly Larger US Soybean And Corn Crops Prompts Small Stocks Changes

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more