Silver's Signature Trick: Soaring, Although It Means No Good

Silver had one of its highest gains this year, while gold played the second fiddle. Does that make any difference to what awaits precious metals in the medium term?

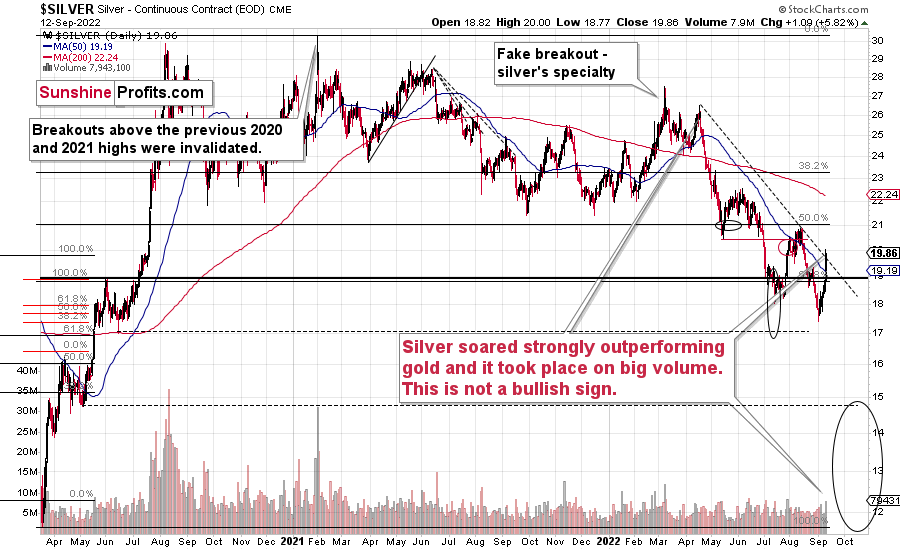

Did you see the huge daily rally in silver? Some (inexperienced) traders will say it’s bullish, but based on over a decade of experience with the precious metals sector, I know that it’s rarely bullish when silver soars while gold doesn’t. That’s exactly what we saw yesterday.

(Click on image to enlarge)

Silver prices jumped by almost 6% during a single session. The volume was one of the biggest that we’ve seen this year and the biggest that we’ve seen since the beginning of August. Silver stopped at its declining, medium-term resistance line, but even if it moved slightly above it, it wouldn’t really matter, as the white metal is known for fake breakouts (“fakeouts”) right before bigger declines.

Since – based on the analogy to what we saw in 2013 – the precious metals market is likely right before a huge slide, the recent price action in silver is even less bullish. In fact, it perfectly fits this extremely bearish medium-term narrative.

Now, huge daily run-ups in silver are suspicious on their own, but it’s particularly so when they are taking place along with a lack of analogous action in gold.

(Click on image to enlarge)

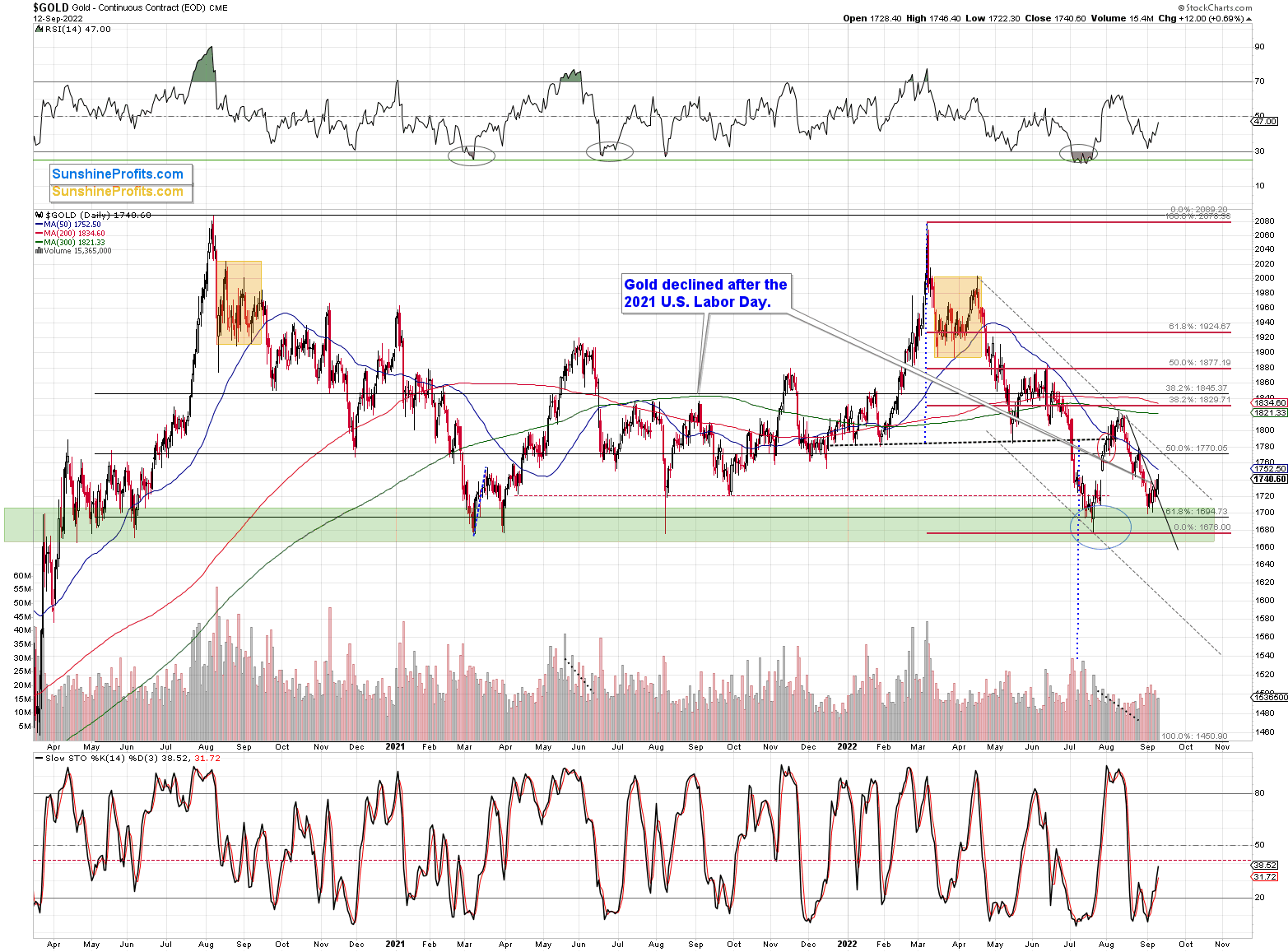

Gold was up by less than 1% yesterday, so it’s clearly the case that silver is outperforming gold on a very short-term basis.

In the case of the flagship precious metal, nothing really changed yesterday. It moved higher by $12 yesterday, but compared to what the USD Index did, it was “small potatoes.”

(Click on image to enlarge)

In yesterday’s analysis, I wrote the following about the USD Index’s short-term performance:

From the short-term point of view, the USD Index declined substantially today (likely the safe-haven demand decline based on the counter-offensive in Ukraine, which suggests that the war might be close to its end, and Russia could be on the losing side thereof), and it’s about to reach its rising support line.

This line kept the declines in check for months, so it’s quite likely that it will stop the declining prices also this time.

While the USD Index declined substantially in today’s pre-market trading (about 1.2%), did gold’s price rally substantially?

No. It’s up by just 0.38% so far today. (And silver’s price is up by over 1.6%, which means that it’s outperforming gold on an immediate-term basis – something that we often see right before bigger declines.)

So, we have a situation where gold doesn’t really want to rally based on the USD’s decline, and that’s bearish for gold, especially since the support for the USD Index appears to be just around the corner.

Also, regardless of the immediate-term effects on forex prices, please consider the following. If the situation in Ukraine stabilizes and things get back to the way they were before, at least in terms of borders (or Ukraine claims Crimea back), it means undoing a lot of what happened based on those changes in the past, right? And gold rallied in response to both events – the invasion of Crimea and the invasion of the rest of Ukraine. So, it could decline as things stabilize – mainly because the safe-haven demand wanes.

While gold prices moved higher after I wrote the above, they didn’t move substantially higher, but silver did. Overall, based on the relative valuations, the indications got more bearish during the session.

What about junior mining stocks?

(Click on image to enlarge)

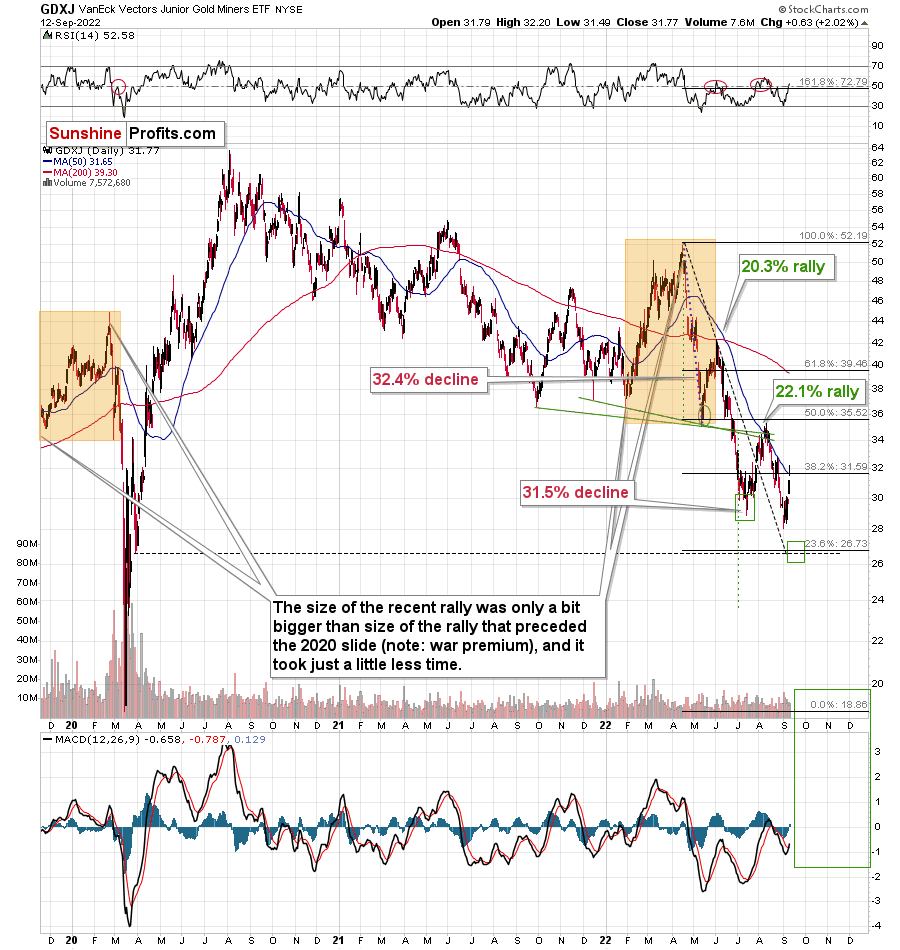

They moved higher as they were practically forced to by rallying gold, but please note that they ended the day only 2% higher, which is very little compared to silver’s almost 6% rally.

Plus, please note that junior miners reversed some of their earlier gains before the end of the session.

Interestingly, the GDXJ just approached its 50-day moving average, which means the end of previous counter-trend rallies ever since the April 2022 top.

This ~$4 rally fits the final counter-trend rally that we saw in 2013.

(Click on image to enlarge)

The GDXJ rallied by about 14.7% from its recent low.

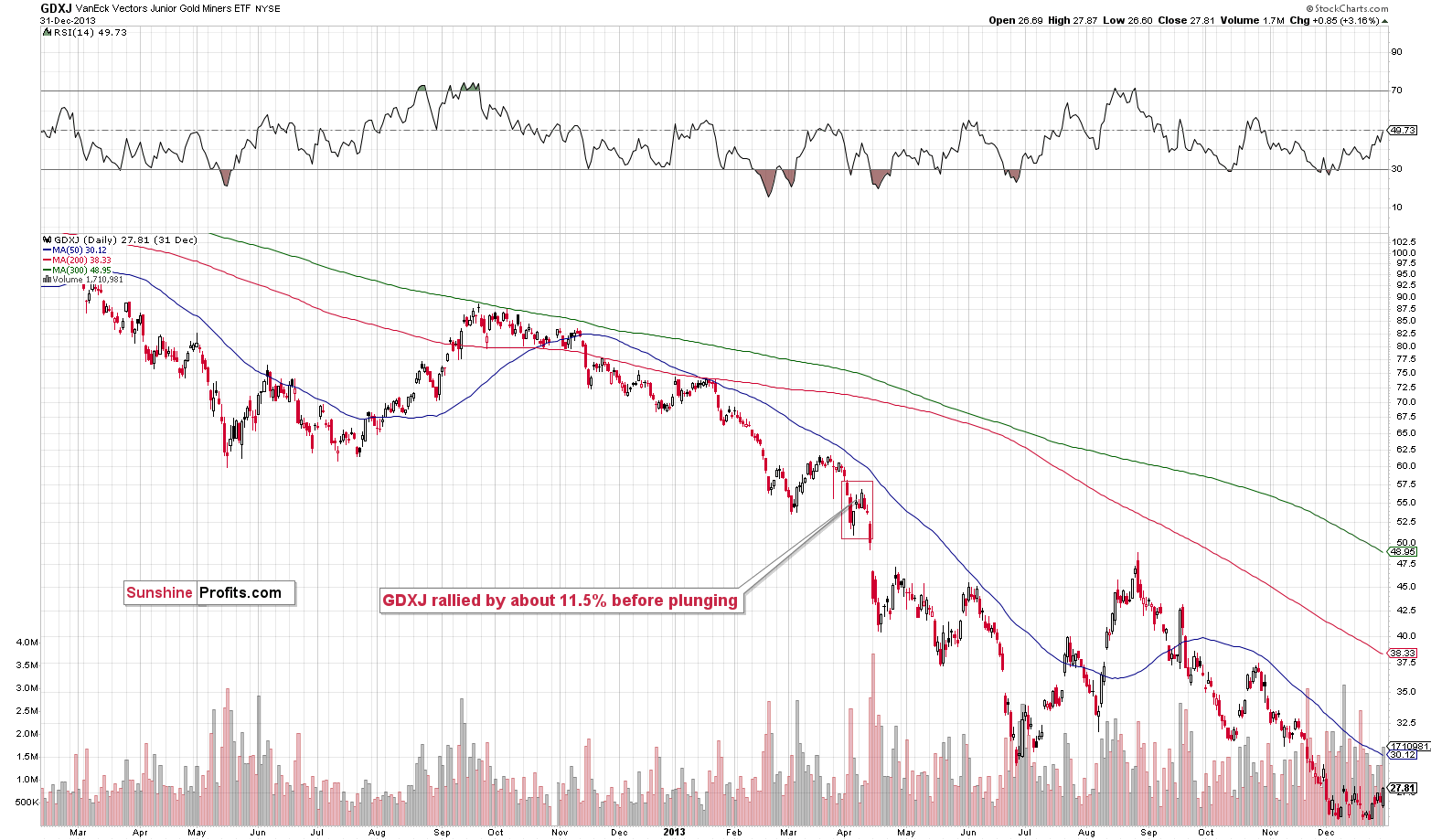

Back in 2013, the GDXJ rallied by about 11.5% before plunging.

This time, the corrective rally is bigger, but please note that the decline that we saw beforehand was sharper than what we saw in 2013. Consequently, a bigger bounce is normal.

It’s even more interesting to compare the rally to the previous price movement. In both bases, the GDXJ corrected about half of the preceding short-term rally, and it moved above the most recent short-term low. This is exactly what we saw recently.

This is yet another indication that what we’re seeing right now is a part of a bigger pattern that’s very bearish.

One might focus on the last few days on a stand-alone basis and claim that “the rally is bullish”, but in my opinion, this narrow focus might be very costly.

More By This Author:

The USD Fell On Ukraine’s Success News; How Did Gold React?

Reversals In Gold And Silver Are More Bearish Than Declines

Is Gold Going To Drop Every Year After US Labor Day?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more