Silver Surges Over $45 Mark On LBMA Tightness

Image Source: Pixabay

In another stunning day in the precious metals markets, the silver price surged above the $45 level for only the third time in history.

The futures were up $1.25 to $45.44.

(Click on image to enlarge)

Here you can see that even the spot price is now above $45 at $45.19.

(Click on image to enlarge)

After today’s move, the futures have rallied from $36.28 on July 30 to $45.22, a move of $8.94 in just under 2 months.

(Click on image to enlarge)

The current rally isn’t entirely off the pace of some of the final stages of what we saw in 2011.

(Click on image to enlarge)

There were two big moves in the final run-up. The first one took the price from $26.60 on January 25, 2011 to $36.02 on March 9th, a gain of $9.42 in about six weeks. And the second one took the price from $33.56 on March 16th to $49.56 on April 28th, a gain of $16 in 6 weeks.

Back in 2011, the rally was fueled by Ben Bernanke’s QE2 program, with one of the more direct drivers being the silver that was added to the ETFs in response. This time, an easy money policy out of the Fed has once again driven metal into the ETFs, at a rate that has brought the LBMA’s underpinning inventory into question. And perhaps that’s the big difference this time.

It’s hard to overstate the impact of Daniel Ghali’s recent report stating that at the current pace of ETF additions, the LBMA is 7 months away from a supply crisis, and at the historic rate of additions during a cutting cycle, that could be as low as 4 months. This week he was out discussing that on Bloomberg, which means this is also what the institutional investing audience is seeing and hearing now.

You also have a rather well-known former J.P. Morgan precious metals managing director in Robert Gottlieb, going as far as to say that he ‘was thinking we would see $50 silver by year-end, however, the way this market is reacting, we may see it sooner.’

But what is it that they’re so concerned about?

Fortunately, while the broader investing world is just starting to notice that the silver price has risen to a level it’s only reached twice before in history, much like with The Big Short, the signs that a problem was building have been there for anyone who took the time to look.

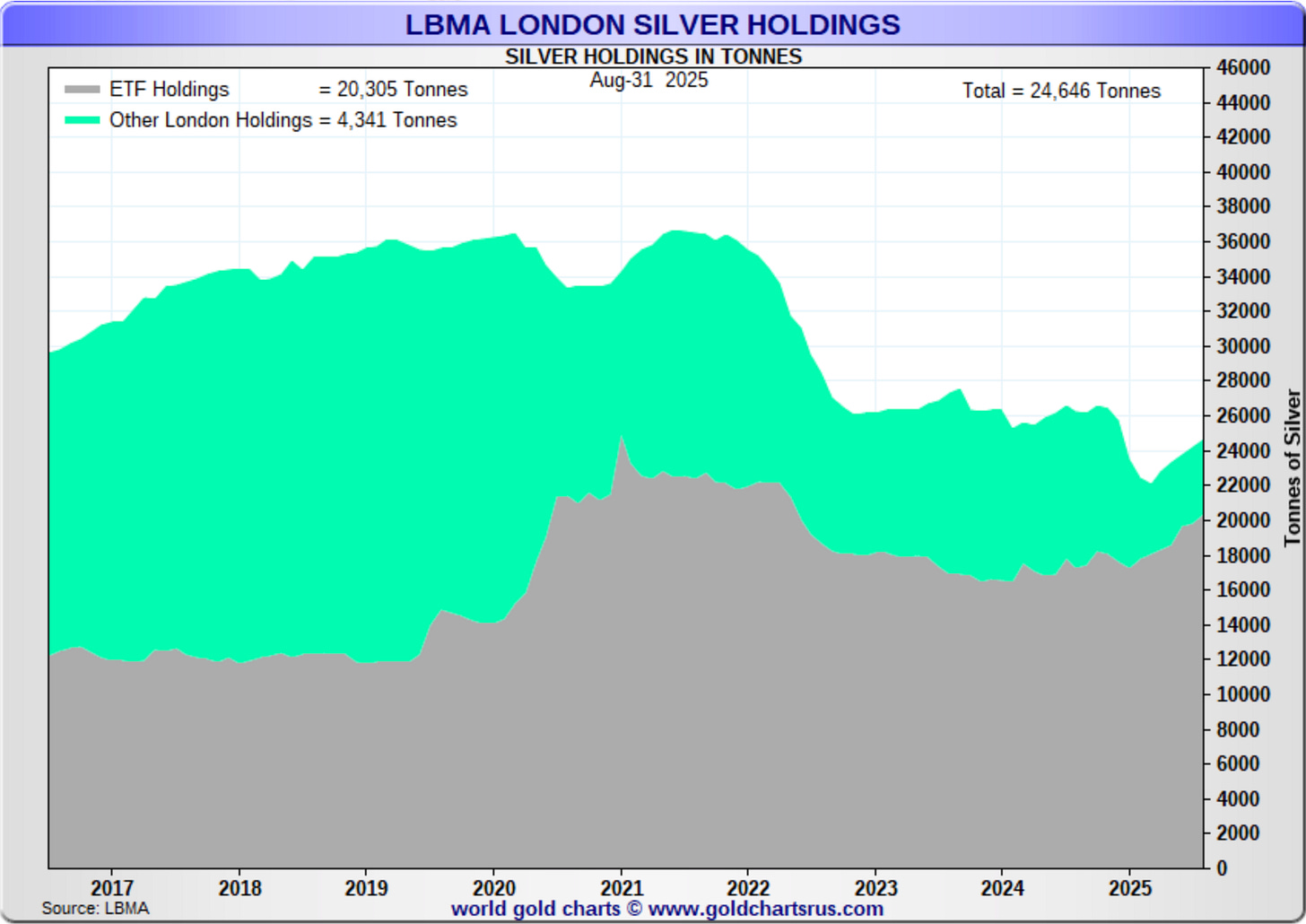

At the heart of it is that the LBMA supply of silver has gotten to what appears to be a dangerously low level. In Ghali’s comments about the silver supply, he was referring to the LBMA’s free float, which is the total vault holdings, minus the silver that is accounted for by the ETFs. This is currently down to 153 million ounces (the green portion of the chart below).

(Click on image to enlarge)

In one of Ghali’s reports from January where he talked about how the silver market was ‘walking into a short squeeze,’ he mentioned that the daily turnover underpinning the LBMA was generally around 250 million ounces.

(Click on image to enlarge)

When he wrote that report in January, the LBMA free float was 305 million ounces, and his main concern was what happens when it drops below the 250 million ounce level.

Now we’re finding out.

(Click on image to enlarge)

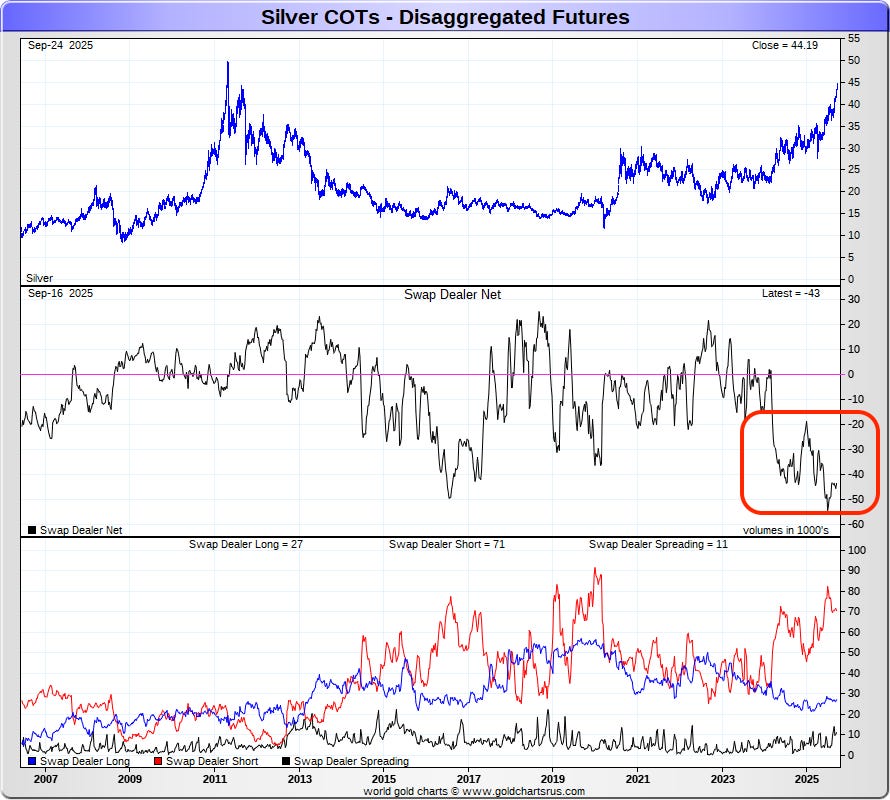

Of course, the short position collectively held by the banks remains on the high end of their range. The bullion banks often say that they aren’t really net short, because these are the hedges offsetting their London holdings. Although to whatever degree that’s the case, that would mean that the true free float is even lower than the 153 million ounces shown on the latest report.

(Click on image to enlarge)

There is the possibility that some of the silver that went to the COMEX eventually heads back to London. But we haven’t seen that so far, and the overall COMEX inventory has actually continued to rise even in recent months.

(Click on image to enlarge)

We don’t know exactly who holds that silver, for what purpose, or at what price they would be willing to send it back to London, but it hasn’t happened yet. And now with the Fed forecasting more rate cuts than previously expected, while we’re getting closer to Trump picking an even more dovish Fed chairman, if the ETF inflows continue, and some of that COMEX silver doesn’t go back to London, that’s why even the bullion bankers are getting a bit concerned.

More By This Author:

Daniel Ghali Talks About Silver Supply Fears On Bloomberg

Gold Futures Cross Over $3,800 For First Time Ever

Silver Breaks $44 As Turmoil Continues