Silver Breaks $44 As Turmoil Continues

Image Source: Pixabay

The gold and silver futures had another big day to start the week on Monday, as gold hit another all-time record high, while silver entered new territory for this now almost two-year-old precious metals rally.

The gold futures were up $60 to $3,782, with $3,783.22 being the new official all-time record high.

Silver finished another 80 cents higher from the Sunday night open, and is a dime off of today's $43.40 high, which is also the high of the current silver rally.

I don't know that there was a specific data point or a piece of news driving today's rally. But if I had to sum it up in one sentence, I would say it has a lot to do with the fact that the interest rate cuts have started, they're going to continue, and the Fed has seemingly given up on its fight to ever bring down what they once said would be ‘transitory’ inflation.

“I would expect gold to reach new record highs this week with Fed officials likely to indicate further rate cuts, but also being data dependent on the pace and magnitude of cuts,” said UBS analyst Giovanni Staunovo.

It was last year towards the end of the summer when the gold and silver inflows into the ETFs started to pick up as the market realized that the Fed was finally getting ready to start cutting, much later in the year than the market had been anticipating heading into 2024. Similarly, the ETF inflows have continued this year, and it's possible that we could even see an acceleration as we get more rate cuts. And that's even before Trump's Fed nominee takes over next year!

From some of my conversations with those closer to the banking side of the industry than I am, I am starting to get the feeling that even within banking circles, there is legitimate concern growing about what's happening with the silver supply. We're now through two-thirds of the way through a year of back-and-forth tariffs that somehow still have market participants uncertain of silver's ultimate tariff status, and have left the LBMA silver inventories at such low levels that TD Securities says that at the current pace of ETF inflows, we could be only 7 months away from the LBMA’s inventories being depleted.

I'm guessing that's not entirely disconnected from how there were zero SLV shares available to borrow at one point last week. It's like we're finally seeing the impact of all of the stresses in the silver market that we've been describing for the past few years finally manifest.

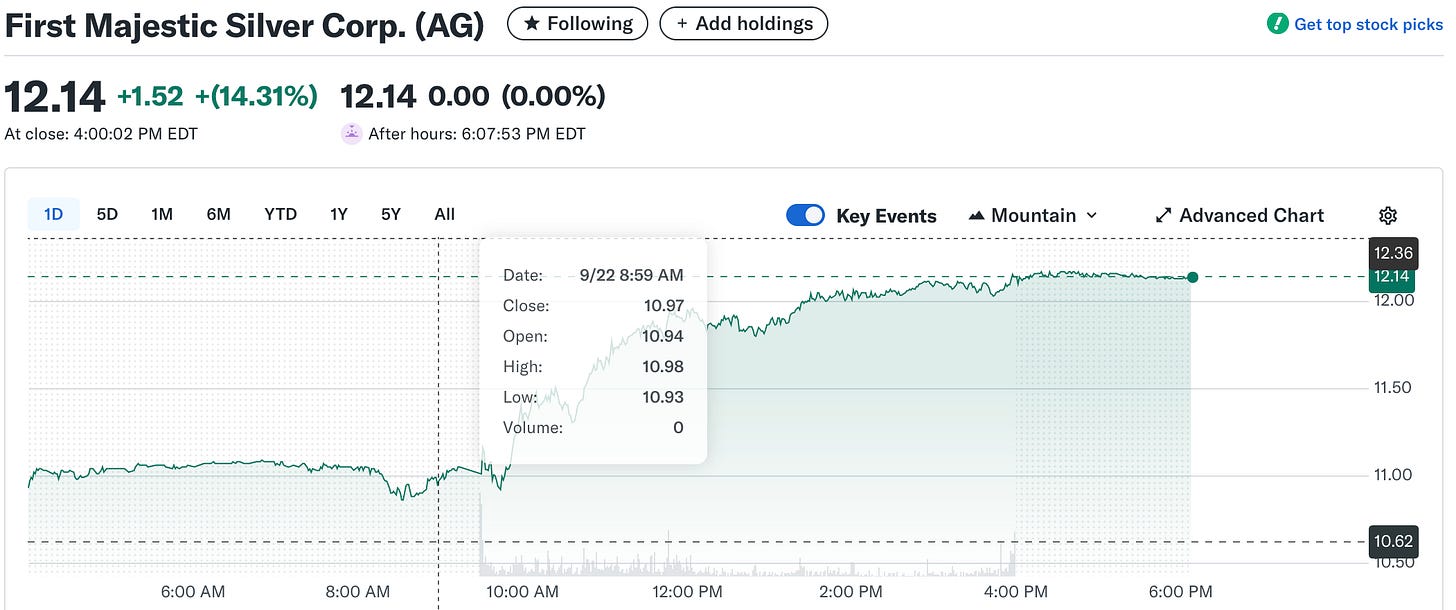

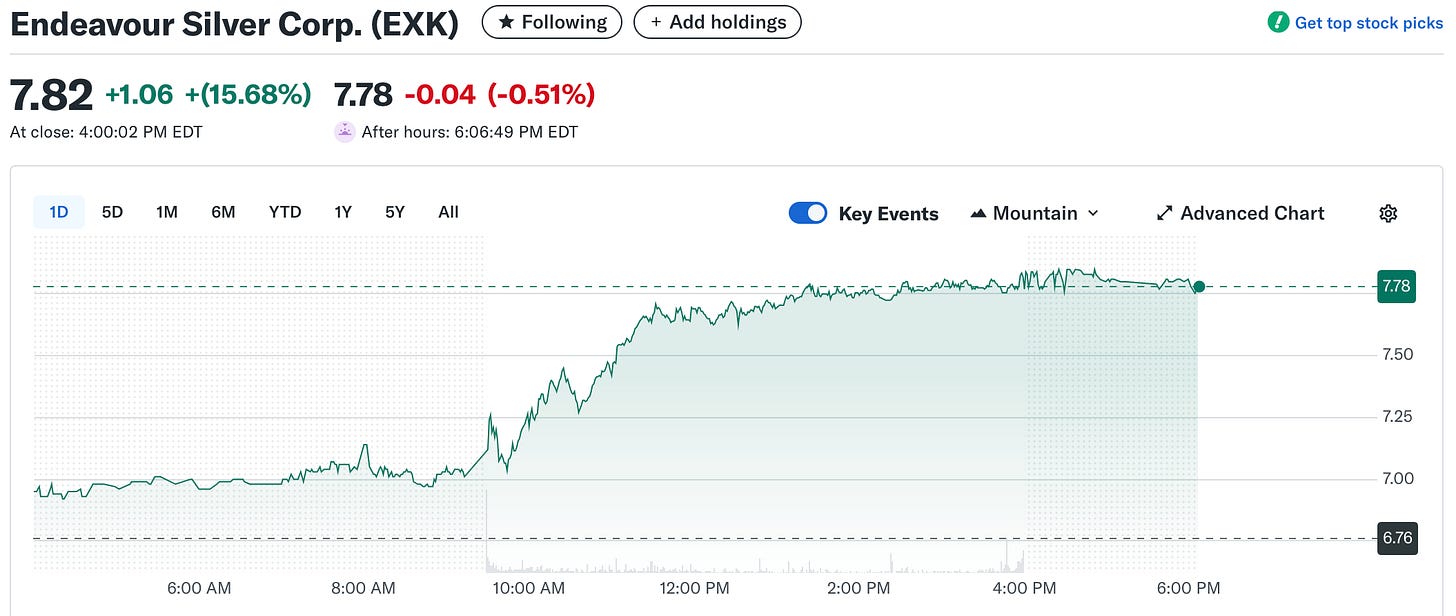

So if you're a long-time gold and silver investor, hopefully you enjoyed the price action today. It was also a big day for a lot of the silver miners in particular.

Here you can see First Majestic Silver was up over 14% today.

While Endeavor Silver was up over 15%.

So if you're a longtime gold and silver investor, hopefully you had fun. These are the kinds of days and weeks that precious metals investors have dreamed about for decades, and I think an important part of making it through the ups and downs of any market is remembering to appreciate the good days, just as much as we sometimes feel the sting on the not-so-good days. So hopefully you can take a moment tonight to think back on the long and winding journey that got you to today's success.

More By This Author:

Gold & Silver Soar Again To Finish Out The Week As Political Turmoil Continues...

Gold & Silver Spike And Then Plummet Following Latest Fed Rate Cut

Silver Futures Briefly Break Over $43, As Geopolitical Tension Escalates Further