Silver Caps Off Epic Silver Friday With Surge Above $46

Image Source: Pixabay

One day after silver soared through the $45 level for just the third time in history, today it has taken out the $46 mark.

What we’ve seen in the past week is reminiscent of what I remember from 2011, and just like I experienced back then, these last few days have been stunning in seeing how quickly silver can move when it really starts to make one of its runs.

The futures are now up $5.16 since their low of $41.50 just last Thursday.

Hopefully I’ll get this next comment across in the right light. But given the current volatility in the silver market, it’s not inconceivable that we could actually see a new all-time record high as early as next week.

To be clear, I’m not saying that is definitively what will happen, and we could also see the silver price drop a few dollars next week. But there’s clearly stress in the market, and a lot of speculative money now flying around, and I say this more so just to point out that we’re in that type of fragile environment where big swings can occur.

Given that the price is $46.37, and not $48.37, I would still think that $50 silver in the next week would be somewhat of a long shot. But perhaps more than anything, something just sunk in on a deeper level today as I was watching the price, that reminded me that whatever happens from here, we’re already witnessing an historic event.

As you well know, this is only the third time in history that the silver price has ever been this high, and many silver investors have been waiting for 14 years to see this happen again (yours truly included). And strictly from a market observation standpoint, it’s just been a truly riveting rally to follow, especially in these last few weeks.

I’ve talked plenty this week about the specific factors driving the silver market. But there was another development I wanted to touch on before wrapping up for the week.

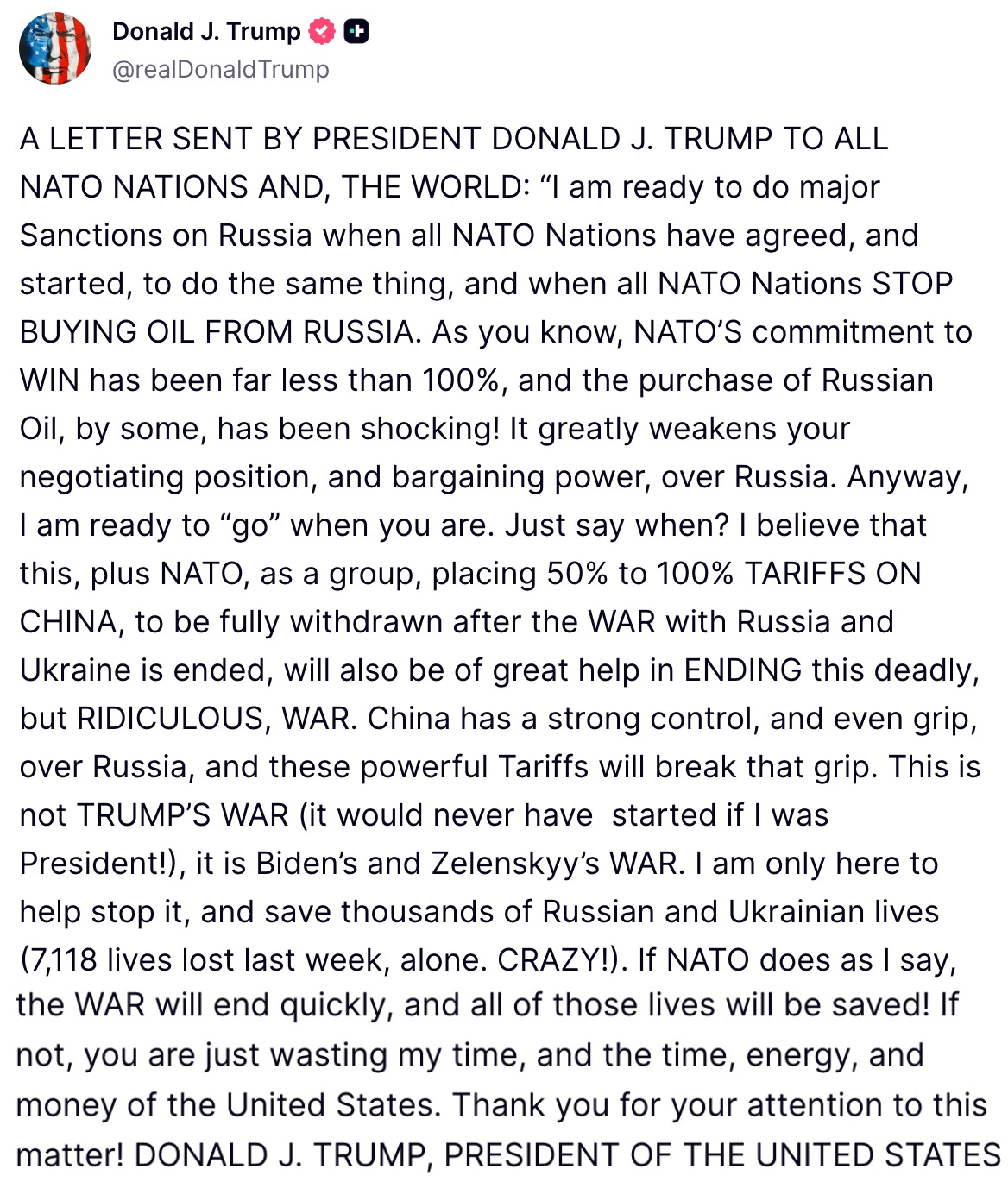

In recent months, we’ve discussed how the status of the Russia/Ukraine/U.S. conflict has seemed like it’s not been heading in a positive direction. And two weeks ago, Donald Trump announced that he is ‘ready to do major sanctions on Russia.’

I won’t go into it again today, but again we’ve talked plenty in this column about how the sanctions on Russia in 2022 coincided right with when the central banks started setting records for the amount of gold they’ve been purchasing. And I can only imagine that if further sanctions are placed on Russia, that effect on the gold market would either be maintained, or possibly even increased.

Then this Thursday, Russian Foreign Minister Sergey Lavrov said that Russia already considers NATO to have declared war on Russia.

“NATO and the European Union want to declare, in fact, have already declared a real war on my country and are directly participating in it,” Lavrov said in comments translated by TASS.

I’m not sure exactly what to make of the reports that the same day Lavrov said that, NORAD was scrambling fighter jets to intercept Russian planes off of Alaska. Maybe it’s just a coincidence, but hopefully it’s not an indication of potential further escalation.

Ultimately, the gold price was up another $18 to $3,789, and while it’s off of yesterday’s highs, it was still another record-setting week for the gold price.

So after another wild week in the precious metals markets, hopefully you’re getting set for a wonderful weekend, with some time for rest and celebration.

And as always, I’ll look forward to checking back in with you next week.

More By This Author:

Silver Surges Over $45 Mark On LBMA Tightness

Daniel Ghali Talks About Silver Supply Fears On Bloomberg

Gold Futures Cross Over $3,800 For First Time Ever