Silver Breaks $52 Per Ounce As Historic Short Squeeze In London Intensifies

Image Source: Pixabay

Congratulations on being here for what has to be one of, or arguably even the most significant day in the history of precious metals pricing since the Comex was created.

In case you thought last week was pretty wild, today the doors were blown off for even the most once-disgruntled gold and silver investors, as both gold and silver are absolutely soaring to start the week.

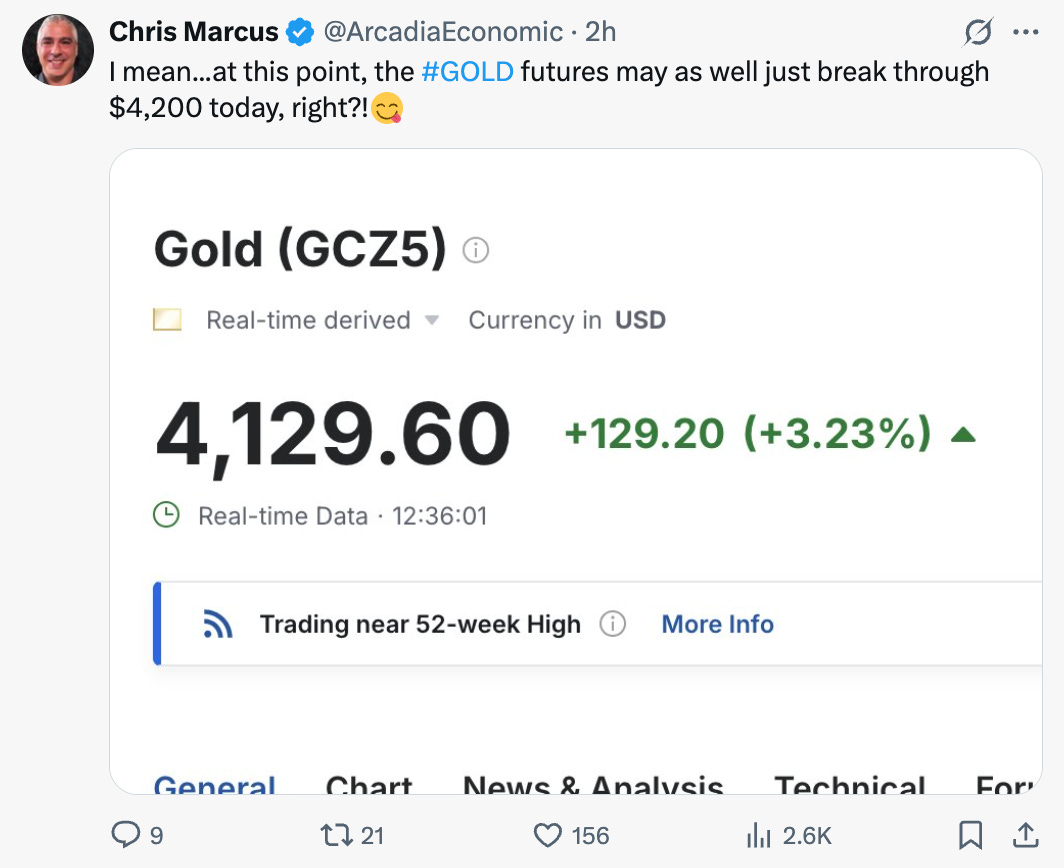

The gold futures are currently up $125 to $4,126, and at the moment have left the $4,000 mark in their dust.

(Click on image to enlarge)

Obviously this is another new all-time record high.

Yet if it’s actually possible for the gold futures to be up $120, AFTER having just broken through the $4,000 level, but that’s conceivably not even the biggest news of the day, today was the day. As the silver squeeze continued, with both the spot and futures prices soaring.

The Comex futures remain in extreme backwardation to the spot price in London, and today the futures finally broke through the $50 level for the first time since 1980, while the London spot price is now over $52 per ounce.

Here’s the chart of the silver futures, which are currently up $3.31 to $50.56.

(Click on image to enlarge)

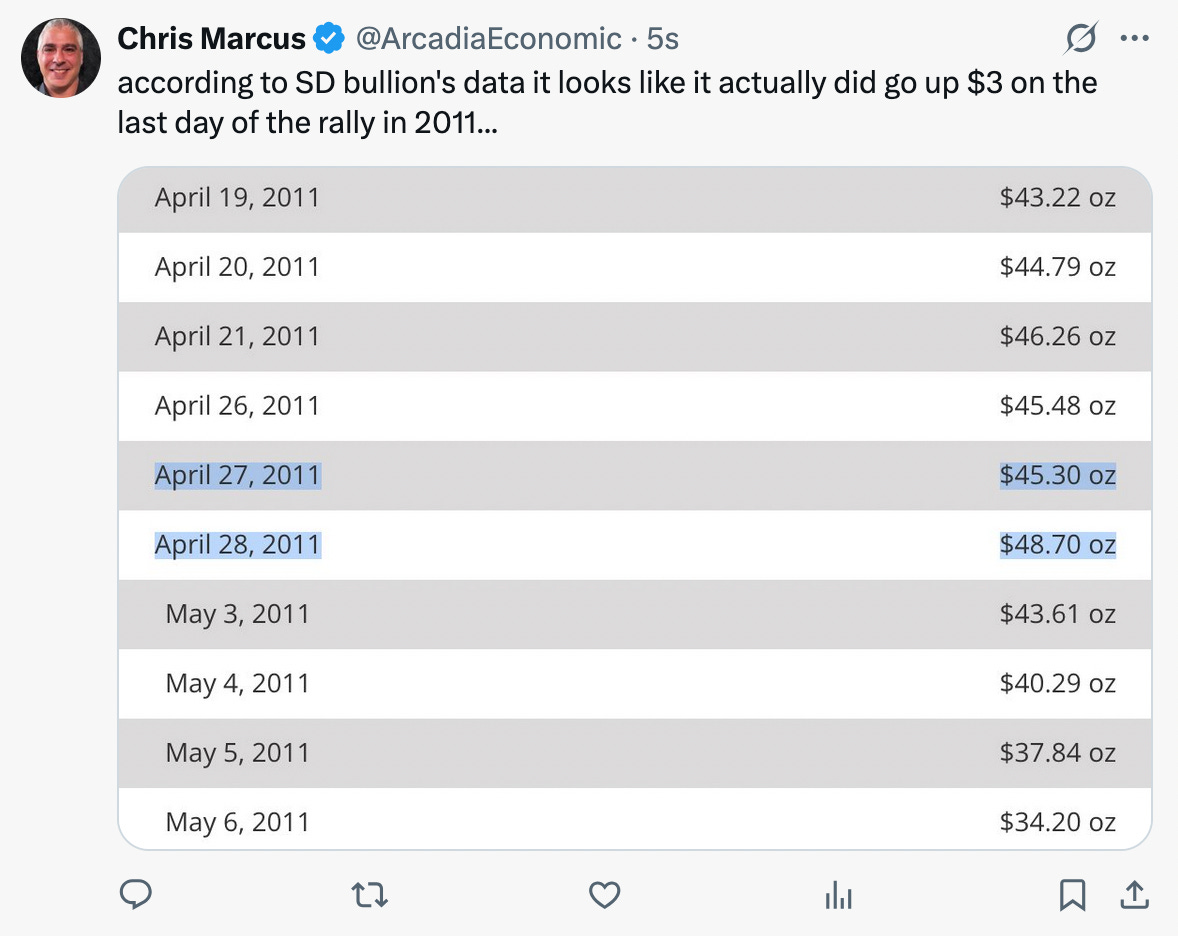

I’ve been trying to figure out the last time the silver price was up more than $3 in a session, as I didn’t remember it being up that much in a day in 2011, and thought it might be back in 1980. But at least according to data from SD Bullion, it looks like silver was up $3.40 on April 28th, the last session before it then fell over $6 when it opened the following Sunday night.

Next, here’s the chart of the spot price.

(Click on image to enlarge)

Along with the surge in the price, the silver lease rates have really surged, and were over 35% earlier today.

‘Silver lease rates — which represent the annualized cost of borrowing metal in the London market — surged to more than 30% on a one-month basis on Friday, creating eye-watering costs for those looking to roll over short positions.’

(Click on image to enlarge)

In terms of what’s driving this chaos in the silver market at this particular time, let me connect a few different events that have just happened here.

On Friday, I mentioned how Indian silver ETFs halted new purchases because there is currently a shortage of silver in India. To be clear, this is different than saying there’s an overall silver shortage, and in the report it was mentioned that they are expecting to receive a new shipment in the next week or two. So we’ll see if that gets resolved. But the surge in India’s silver imports in September placed additional pressure on the London silver market at a time when the available inventory was already low. And now you’re seeing the impact.

We’ve already seen silver leave the Comex, and reported on how it’s being quickly flown back to London, where some of it will presumably be redirected to India to alleviate the shortage there. Although now the key question is how much silver will go to London, and will it be enough.

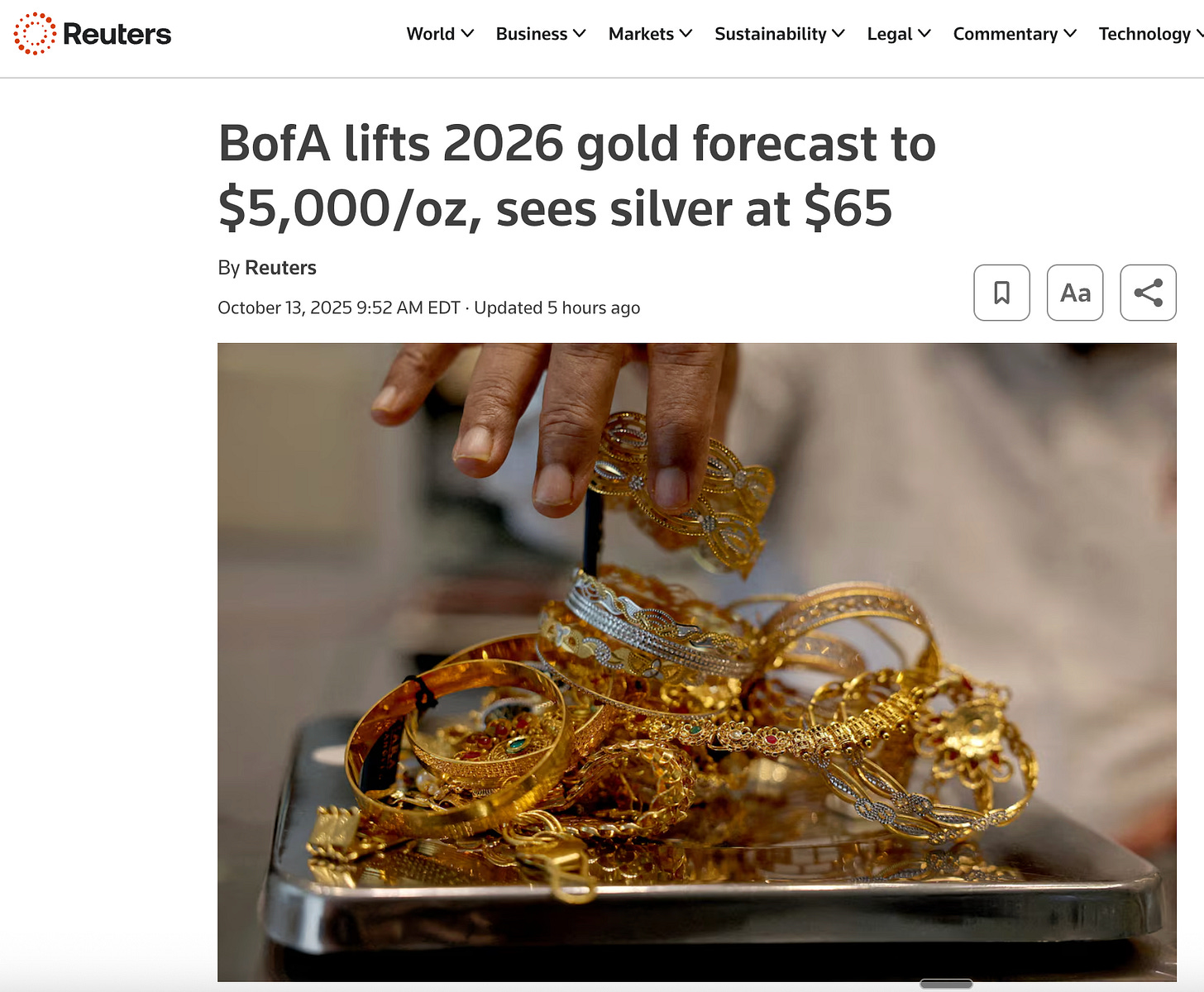

But at least as of now, based on the pricing and the extreme backwardation in the New York/London spread, the situation remains unresolved. And I would suggest that despite how there will likely be wild swings in both directions in our near future, I don’t know that there’s an easy resolution to be found. And it also probably doesn’t help that Bank of America just put a $65 price target on silver.

(Click on image to enlarge)

Or that there are reports of disruptions in the Chinese silver market.

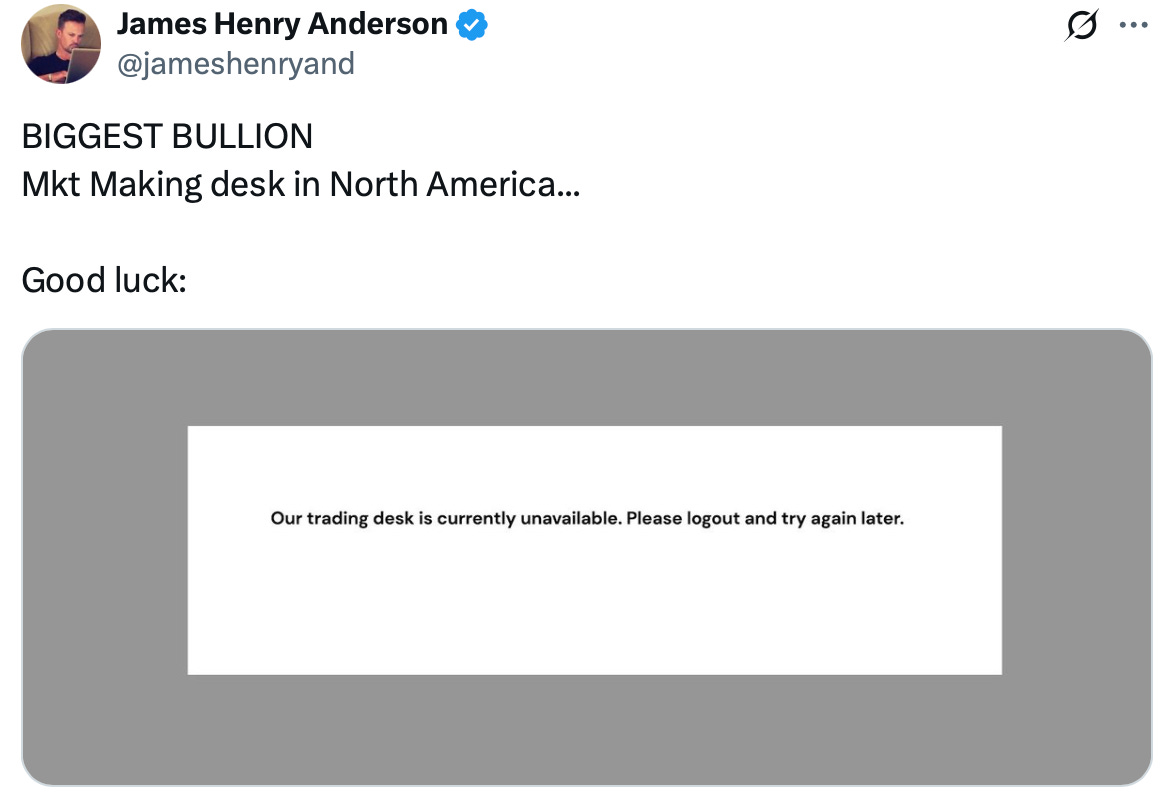

All of this has also left the retail and wholesale silver industry in a state of chaos, as spreads are wide, and hedging is becoming more difficult, while some dealers and wholesalers have temporarily halted sales.

I just finished up a live YouTube call with a bullion dealer in South Florida who explained in more detail what’s going on regarding the retail dealers, and I think you would enjoy this one.

Lastly, I know I’ve said something to this effect several times in recent weeks, but I really do hope you’re stopping to take a moment to appreciate that we’re witnessing some truly historic events right now. Events that people will be writing and talking about for decades, much like how so many of us have researched, studied, and thought about what happened in 1980 and 2011.

So hopefully you’re having fun, and I’m already excited to check back in with you tomorrow when we see what happens next!

More By This Author:

LBMA/COMEX Silver Spread Remains In Danger Territory As Supply Disruptions Pop Up In India

Silver Breaks $50, As Evidence Mounts That Something Has Broken In London

Silver Nears $50, And Money Is Pouring Into The Miners