Silver Breaks $50, As Evidence Mounts That Something Has Broken In London

Image Source: Pixabay

Congratulations on just living through one of the most historic days in silver market history!

Back on March 27, 1980, the Hunts brothers were issued a margin call, in what came to be known as Silver Thursday. Yet perhaps a couple of years or decades from now, we’ll look back at what happened today, maybe with an even greater significance.

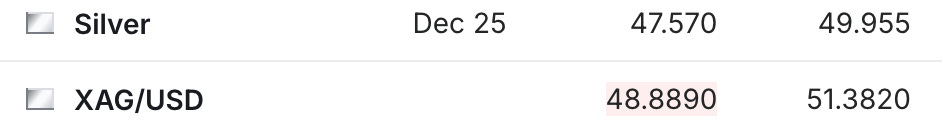

Because as exciting as it is that silver broke $50 today, with the spot price reaching as high as $51.38, while the silver futures peaked at $49.95, the evidence is increasingly suggesting that something has broken in the physical silver spot market.

Here’s the chart of the silver spot price, and you can see how it surged twice over the $51 level within a couple of hours before selling off sharply.

(Click on image to enlarge)

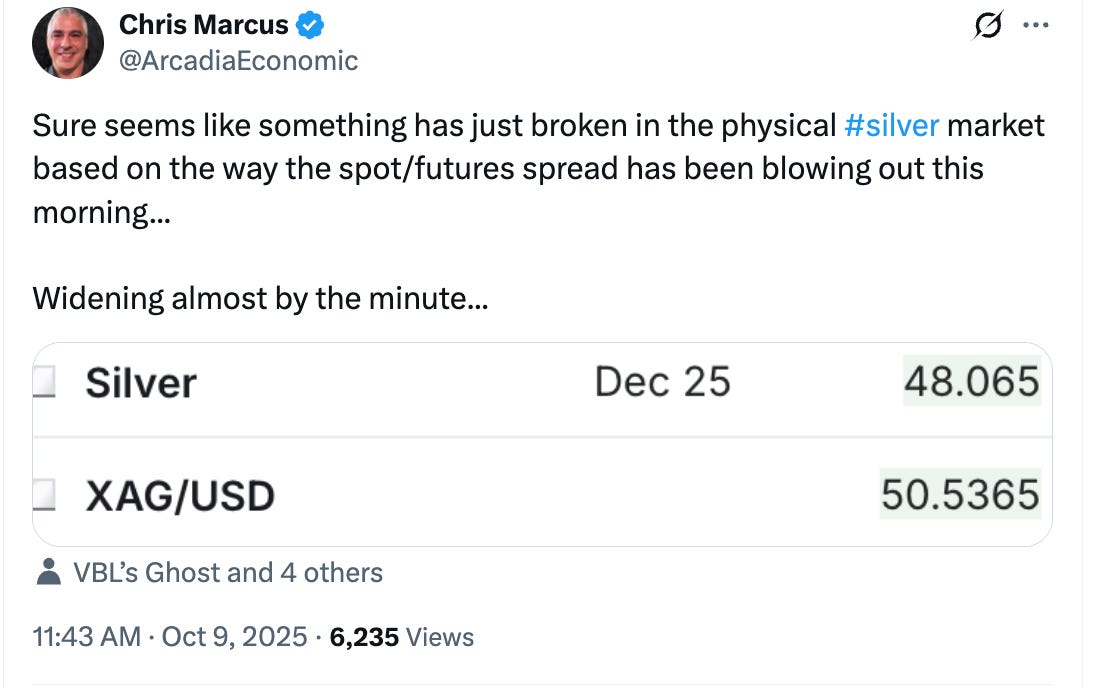

But what was really shocking was how the spread between the spot price and the Comex futures blew out today, at one point widening as far as $2.50, with the London spot price trading over the futures.

This is highly unusual, a huge move for this type of spread, and very likely the widest the spread has ever been. Keep in mind that under normal conditions, the futures trade above the spot price, so the distortion was actually even greater than $2.50 away from normal.

That was at 11:43 AM, and you can see below how far it had widened from just a few hours earlier this morning.

Also, keep in mind that this spread was at just 50 cents yesterday, and 20 cents two days ago. And this is not the type of relationship that is normally supposed to blow out to anywhere near this extent.

It’s come in a bit since then in the past few hours, but is still at an elevated $1.32 right now.

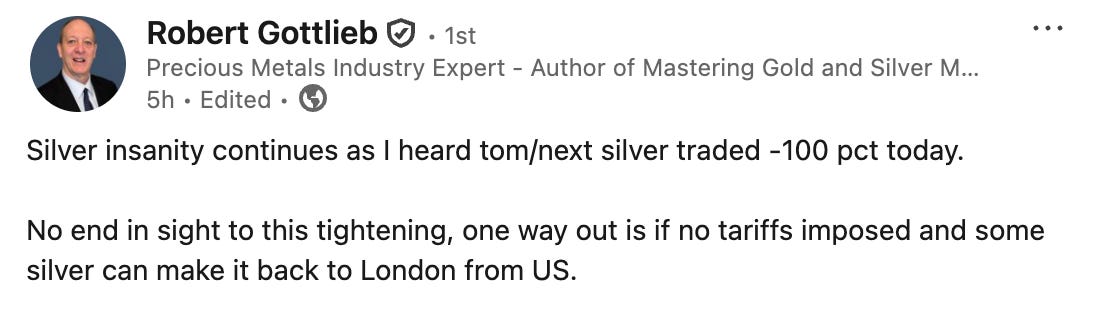

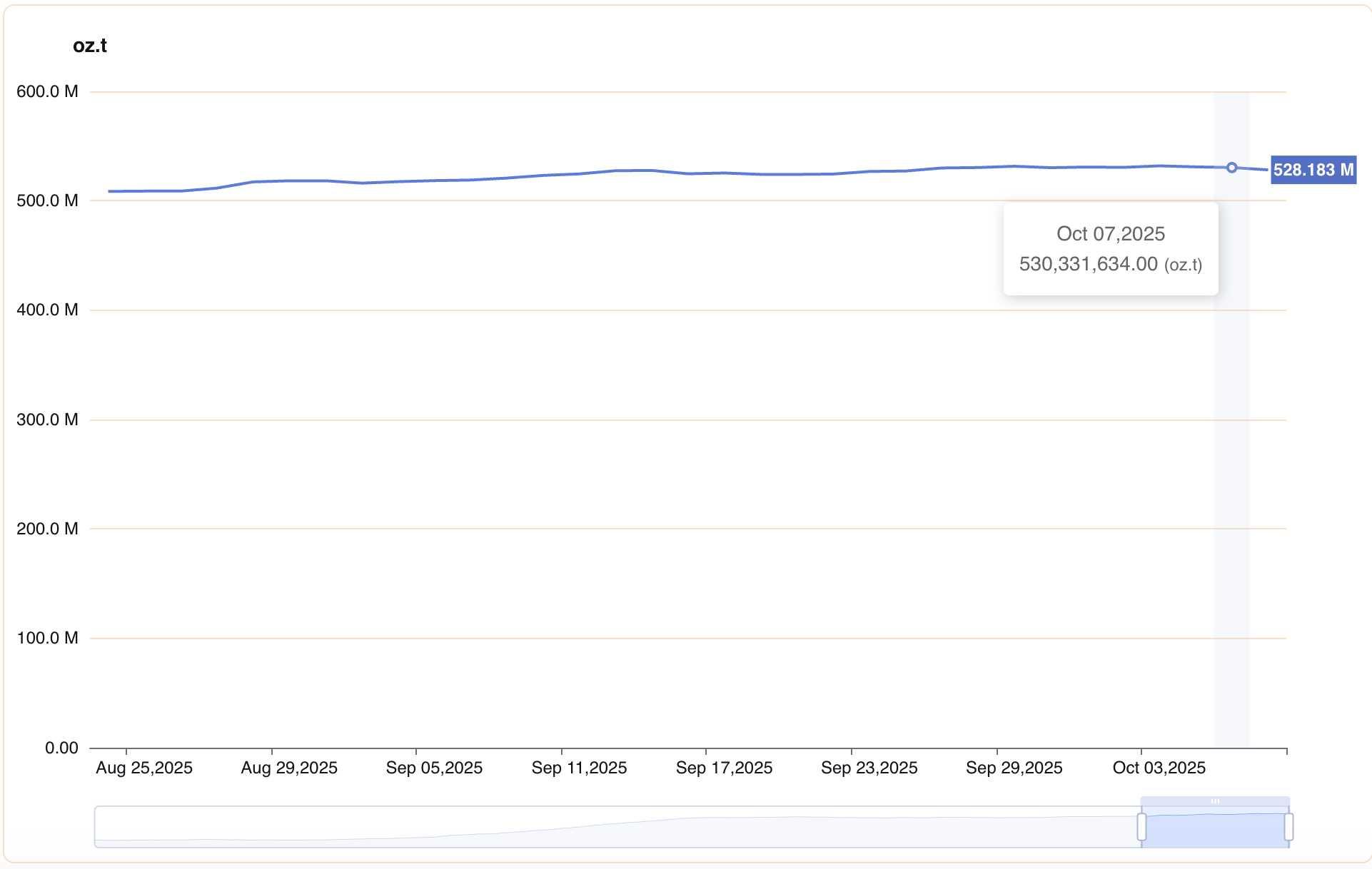

In terms of what’s actually happening, in short, today we finally just saw the big explosion of what we’ve been reporting on for the past few months, in terms of how the LBMA available silver inventory had gotten to dangerously low levels.

Now the London spot price is being pushed up, and while we’ll learn more in the coming days and weeks just exactly what was happening beneath the surface today, it sure feels like someone was trying to get silver in London, but it wasn’t free to be delivered.

We’ll see if this facilitates silver going from the Comex back to London, although 4 million ounces have left the Comex since Tuesday.

Meanwhile, the gold price is back under $4,000 per ounce today, although based on some of the coverage coming out of Bloomberg lately, it seems like the money may be just starting to pour in.

(Click on image to enlarge)

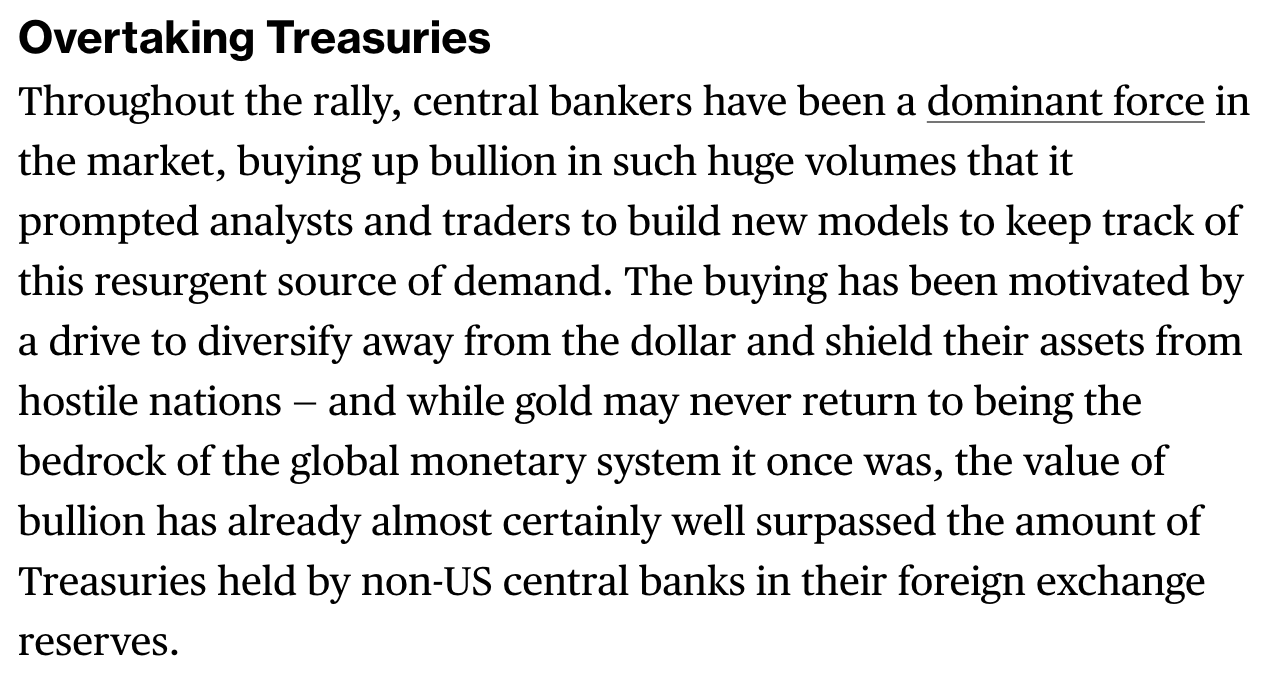

Wall Street has even come up with the new title the ‘debasement trade’ to describe why money is flowing into alternative assets. And it’s interesting to see that now even silver is being included with gold and Bitcoin in these explanations.

Bloomberg was also writing about how central banks are shifting away from U.S. Treasuries, and how the value of bullion held by non-U.S. central banks has already surpassed the amount of Treasuries they’re holding.

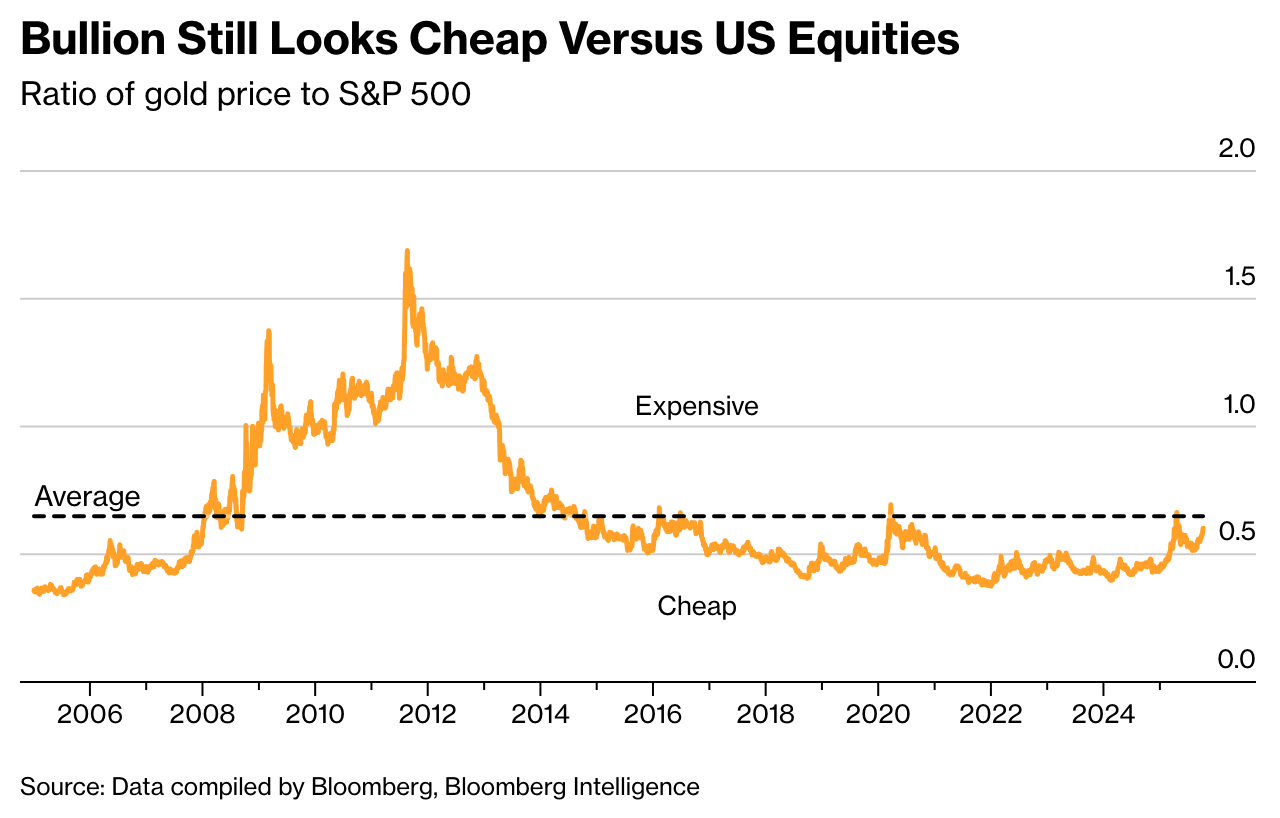

Bloomberg also noted how gold still looks cheap relative to U.S. equities.

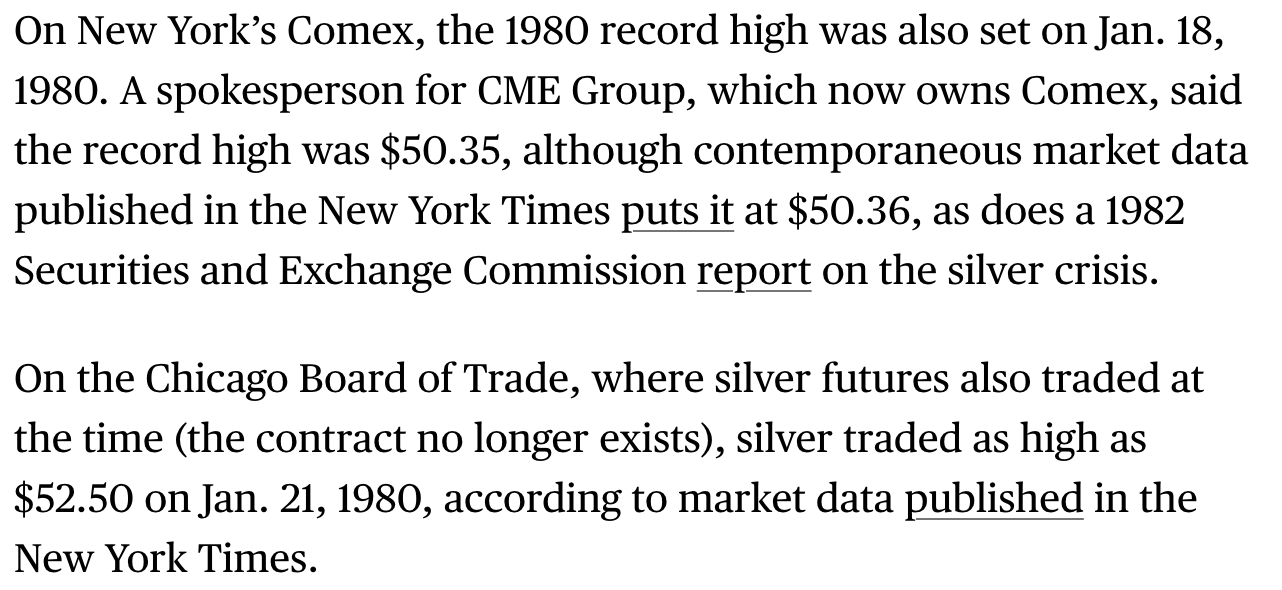

And they also had an interesting note on silver and its all-time high.

In terms of Bloomberg’s coverage of today’s events, here’s what they published at 8:19 AM eastern this morning:

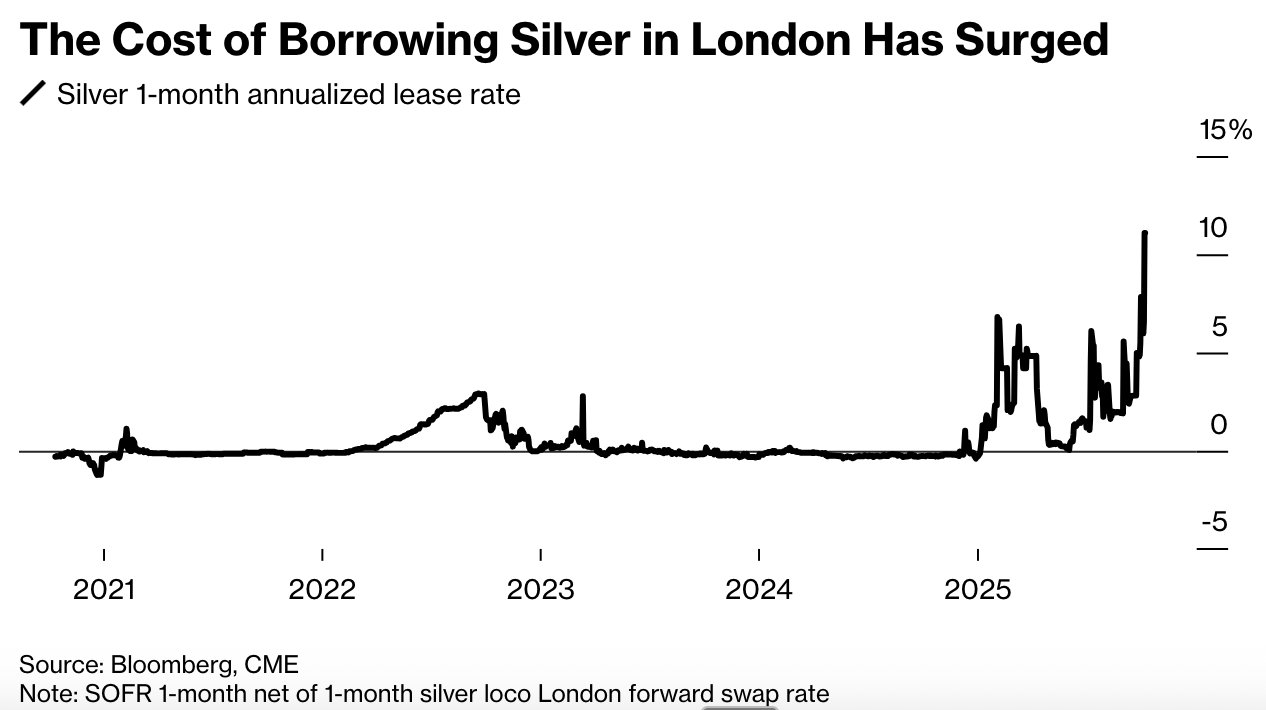

Meanwhile, a shortage of freely available silver in the key London market has supported prices, while also pushing up the cost of borrowing the metal sharply.

The metal has been boosted by the so-called “debasement trade,” with investors flocking to the perceived safety of Bitcoin, gold and silver while pulling away from major currencies. Concerns that the value of financial securities will be eroded by inflation and unsustainable fiscal deficits have led those assets to set new milestones.

The silver market in London has tightened to an almost unprecedented degree, with sky-high borrowing costs for the metal. This year, fears that the US could levy tariffs on silver have spurred a dash to ship the metal to the US, drawing down inventories in London and reducing the amount of material available to borrow.

Lastly, I think it’s important to keep in mind that as all of this is happening, there was a really big development that took place last week.

I mentioned on Friday how the U.S. had reportedly given Ukraine intelligence on long-range energy targets in Russia, and that it was also weighing ‘whether to send Kyiv missiles that could be used in such strikes.’

I was thinking more about that this week, and in particular, how Putin might react to the U.S. sending missiles to be used against targets that U.S. intelligence has identified, especially when Russian officials have stated that in their eyes, they believe NATO is already at war with Russia.

We continue to hear reports of Europe wanting to send troops to Ukraine, and also confiscate the frozen Russian assets. And if this latest report about Ukraine using U.S. missiles to strike Russian energy targets is true, it seems like we’ve reached an incredibly dangerous moment in time.

I’m sure we’ll be hearing more about that as it develops, but I just thought it was worth pointing out again. As if something like that should take place, that would be quite an event in addition to everything that’s already going on in the metals markets.

But hopefully you’ve been able to still enjoy this historic day, and I’m already looking forward to seeing how the gold and silver markets close out the week tomorrow.

More By This Author:

Silver Nears $50, And Money Is Pouring Into The Miners

Silver's Historic Rally Continues As Futures Break Above $48 Level

Mainstream Money Starting To Pour Into Gold & Silver