Silver's Historic Rally Continues As Futures Break Above $48 Level

Image Source: Pixabay

Some of you are too young to remember the last time the silver futures were above $48. And some of you remember it too well. But this morning, the futures broke the $48 level again for just the third time in history, and are currently trading at $48.27.

(Click on image to enlarge)

Even more stunning is that this is happening just a day after a selloff where the futures dropped more than two dollars from peak to trough, from a high of $47.99 to a low of $45.71, before then shooting back higher again in the latest leg of today’s rally that began late Thursday night.

(Click on image to enlarge)

Today’s move now leaves the silver price $2.64 higher than yesterday’s low.

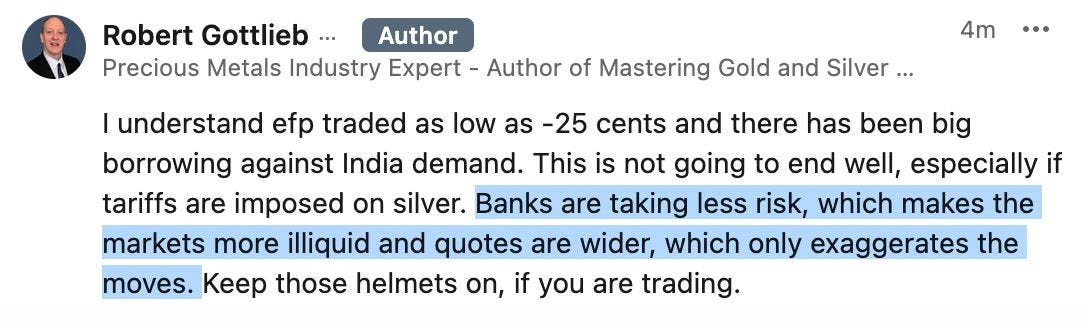

As we’ve discussed quite frequently in the past few months, this is the kind of volatility you can expect when you have conditions like what former JP Morgan precious metals managing director Robert Gottlieb mentioned on Wednesday.

Until that tightness is resolved, there’s a good chance we’re going to have more of the volatility we’ve been experiencing.

We talked about the surge in Indian gold and silver imports earlier this week, as well as how the SLV borrow rates have risen, and also how the silver lease rates have spiked. However, what changed since Robert wrote that on Wednesday, is that now the London spot price is trading above the Comex front-month futures contract.

In terms of what that means when the London spot price is trading over Comex, I was actually just finishing some edits for the upcoming second edition of our book The Big Silver Short, which includes a new bonus chapter with Vince Lanci of Goldfix, where he actually talked about exactly that:

It’s also interesting to see this happening at this particular time. Because after large amounts of gold and silver came from London to New York earlier this year, now the LBMA’s free float inventory is getting into dangerously low territory, and people are beginning to wonder if some of the metal could return back to London. And if the London spot price were to rise enough to overcome shipping and potential tariff risk, this is at least one of the first steps that would have to be in place for something like that to happen.

In one of Robert’s other recent comments he also mentioned how the banks are taking less risk, which is just making the market even more illiquid.

This last comment is somewhat reminiscent of the LBMA’s 2021 silver report, where they talked about what happened during the EFP crisis of 2020 following the onset of COVID.

Just in case anyone has ever wanted confirmation that the amount of contracts the banks write influences the price, the LBMA just laid it out about as clearly as one possibly could right there. ‘The banks’ risk departments continued to limit the ability of their trading desks to issue contracts,’ which ‘kept futures prices higher for longer.’

So there’s tightness in the metals, and then add on that the U.S. apparently just gave Ukraine intelligence on long-range energy targets in Russia, and is weighing whether to send the missiles that could be used to attack them.

So between the mix of the conditions in the underlying metals markets, the Fed cutting interest rates, the world realizing that we’re getting closer to Trump naming a new Fed chairman who’s going to cut rates even faster, and the current geopolitical conditions of the world, the gold and silver prices are ringing the alarm bell.

In some ways, the current silver run-up is somewhat eerily reminiscent of the spike to $49 back in 2011 following Ben Bernanke’s QE2 programs.

(Click on image to enlarge)

Silver had just crossed over the $48 level (and then $49) late in the last week of April, and you’re probably already well aware by now that when the markets opened back up that Sunday night, the same night that the government reported that Osama Bin Laden had been killed, the silver price fell $7, and was back in the $30s within a week.

Hopefully for silver investors, this time we’ll have a different outcome. And I think that’s likely, especially because of the London silver tightness, which is the key element that wasn’t there in 2011.

You could also say that we already did get a 2011-like move down back in April when the silver futures went from just over $35 at the time the reciprocal tariff announcement was made, to under $29 just a few days later.

(Click on image to enlarge)

Ultimately, it’s going to be truly stunning to watch how this unfolds, as we’re seeing history in the making. And it will also be fascinating to see if the London spot price does eventually rise high enough to start bringing metal back from the Comex, and whether that Comex metal is actually available, and at what price.

Lastly, in case you’re wondering how it all could have gotten to this point, why the issues in the silver market go beyond just what we talked about here today, and perhaps most importantly, the possible outcomes from here, we did just publish our silver report, which many of our readers have already been enjoying.

It addresses the events that have led to this spike, why the ongoing deficits are now starting to become a problem, and several of the key questions in the silver market that rarely get addressed, but are more important to understand than ever.

The report’s free, and if you’re still reading this article now, there’s a good chance you would not only find it helpful and enjoyable, but that especially in time, you’ll have been glad that you read it when you did.

So hopefully now you can go enjoy your weekend, without spending too much time wondering ‘how much longer until the Comex opens on Sunday.’ And I’ll look forward to checking back in with you next week.

More By This Author:

Mainstream Money Starting To Pour Into Gold & SilverSilver Breaks $47 As Signs Of Short-Squeeze Continue To Emerge...

Why Silver’s Surging Towards Its $50 Its Time High