LBMA/COMEX Silver Spread Remains In Danger Territory As Supply Disruptions Pop Up In India

.webp)

Photo by Zlaťáky.cz on Unsplash

Just in case yesterday’s volatility in the precious metals markets wasn’t enough for you yet, you’re getting an extra serving today, as the silver spread that blew out yesterday remains wide in alarm bell-ringing territory, while the gold futures surged again this morning, and are back over the $4,000 level.

First, is the spot market silver spot/future spread, which remains inverted, with the XAG/USD spot price currently trading $1.76 over the December silver futures.

As a reminder to those who are new to this concept, normally the futures trade over the spot price, so the current level is really even more than $1.76 out of line (if the futures price would have under normal conditions been 20 cents over the spot price, then the current level would be $1.96 lower than normal).

The silver spot price was back over $50 this morning, and here you can see the volatility from the last 40 hours.

(Click on image to enlarge)

In the next chart, you can see how the futures look over the same time period.

(Click on image to enlarge)

The high point for this spread yesterday was $2.50 around noon. It came back in a bit over the afternoon, yet by late Thursday night, it had widened back out to over $2 again.

A few thoughts.

First, is that this is not a spread that normally goes into negative territory at all, let alone this far into negative territory. So it will be fascinating to find out more details in the coming days and weeks about exactly what’s happening right now, and fortunately I’ve recently developed some new contacts that have insight into some of these inner dynamics.

But while there’s less than full information currently available, the evidence suggests that the London market is getting squeezed, and that someone is having a hard time sourcing metal. Essentially, exactly what we have been talking about regarding Daniel Ghali’s reports about how the LBMA silver inventory was getting into dangerously low territory.

I mentioned yesterday that four billion ounces of silver have left the Comex vaults this week, and with the prices elevated in London, we’ll soon find out if they are able to sufficiently replenish their inventory.

I did have a conversation with my colleague Vince Lanci of Goldfix yesterday, and he believes that the silver that came over from London to New York earlier this year was most likely on behalf of the U.S. government, based on them knowing back then that silver was a strategic critical mineral, and that they would be adding it to their draft list a few months later in August. Vince also thinks that we will not see large amounts of silver leave the COMEX and head back to London. Although, keep in mind that we’re still somewhat in the dark here, and I don’t think anyone knows definitively how this is going to play out just yet. However, what’s clear is that the alarm bells are going off, and you can see the smoke coming out of the building.

There was a report yesterday that Indian silver ETFs were halted due to a ‘shortage.’

(Click on image to enlarge)

The article used the word ‘shortage,’ although the author also said that the administrators of the ETFs were expecting their silver to arrive in the next shipment.

In India, the world’s biggest silver consumer, silver premiums over official domestic prices jumped as much as 10% on Thursday because of strong investment demand ahead of a key festival and limited supplies, bullion dealers said.

It added that the suspension is temporary in nature and will continue only until further notice in this regard.

A large number of silver imports are expected to arrive next week, which will increase supply and bring premiums down to more normal levels, said a bullion dealer with a private bank in Mumbai.

I just always try to be extremely careful with words like “shortage,” as I understand the weight that carries, especially in the silver world. And I think, at least based on what was presented in the article, it might be premature to call this evidence of ‘a silver shortage.’

Now if we’re sitting here two weeks from now and they still haven’t been able to obtain the silver, it’s not on the next truck, and you have building pent up investor demand, then that might be a different story. So this is not to say that what they are reporting might not turn out to be evidence that a shortage has developed. But just that based on that article, I would be careful about using that term just yet. However, certainly an interesting development.

This development also falls in line with a recent Metals Focus report, that talks about the strength of the Indian demand for silver right now, particularly on the investment side.

Local premiums rose to $1–1.5/oz in early October, as imports picked up dramatically from September onwards. In the first eight months of 2025, imports totalled 3,288t. With an estimated 800t arriving in September, year-to-date imports have surpassed 4,000t, nearly 10% higher than the five-year average for the same period.

These strong imports have exacerbated tightness in the global silver market in recent weeks. Prior to that, US tariff-driven shipments and sustained inflows into silver ETPs have already contributed to a sharp drop in liquidity in the London OTC market.

Underscoring the urgency of demand, these shipments have increasingly arrived by air over the past month, in contrast to the usual sea route used for silver. Bullion dealers are struggling to get material into India before the festival of Diwali, which starts on 18th October. Much of this demand has been driven by investment buying, as the jewelry and silverware segments have struggled for much of this year (though both have improved recently).

Then the report talks about a significant shift in sentiment, especially in the historically price-sensitive Indian market.

This robust silver investment can be attributed to several reasons. First, investor confidence remains high, reinforced by the sharp price rally. This optimism is rooted in historical trends, where silver has shown a tendency to rise swiftly during bullish phases. As a result, the current rally is encouraging more buyers to participate. Second, record high gold prices have made silver appear a more accessible alternative for retail investors.

Our discussions with local bullion dealers indicate that current retail investor sentiment mirrors that of 2011, when silver saw euphoric buying.

Silver ETPs have also attracted strong inflows, significantly contributing to this year’s import surge. (For all Indian listed physically backed silver ETPs, the metal must be stored in-country.) As of end-August, total ETP holdings exceeded an estimated 2,000t, up more than 60% this year-to-date.

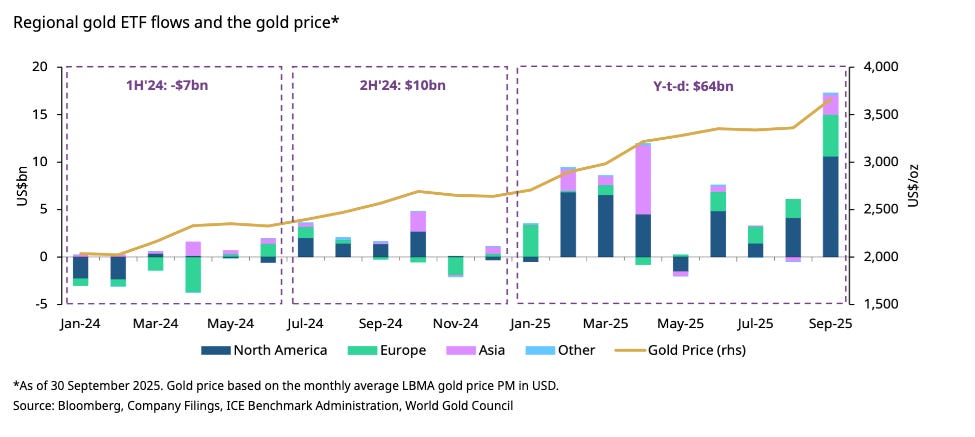

The September ETF data is out, and you can see below that the gold ETFs just set a new record for monthly inflows, which has been a large driver of this last leg of the rally.

Inflows of gold into ETFs set a record in the third quarter, driven by the largest September increase on record.

This reflects Western investors finally getting off the sidelines and joining the gold bull market.

Based on assets under management (AUM), flows of metal into gold-backed funds set another record in September at $472 billion. AUM rose by 23 percent quarter-on-quarter in Q3.

However, even with the surge of gold into ETFs, global holdings remain below the all-time high in tonnage terms set during the pandemic.

You can see that demand being reflected again today in the gold price, which has been volatile this morning, but just spiked higher, and the futures are now back up to $4,024.

(Click on image to enlarge)

Earlier this week, my colleague Vince Lanci mentioned how Goldman Sachs upgraded their gold forecast to $4,900 by the end of 2026.

Although, if they previously put out a forecast earlier this year saying they could see the gold price going to $4,500 in an ‘extreme tail scenario,’ does this mean that Goldman is now conceding that we’re already in that extreme tail scenario?

Our last note of the week is the following comment from U.S. Treasury Secretary Scott Bessent, which seems to indicate that the U.S. has now decided to essentially backstop Argentinian debt.

It seems a bit odd given the U.S.’s own balance sheet concerns. Although at least it was fun to see Bessent talk about ‘the speculators’ in the first sentence of that last paragraph, which reminds me of how Nixon temporarily suspended the gold window to protect us from those pesky speculators all the way back in 1971.

But at least 54 years later, you’re getting to witness history. And here’s another fun one to mull over for the weekend, especially for those of you who are somewhat newer to the silver world.

Keep in mind that there are people who have been waiting 45 years for the silver price to break the $50 level. Put slightly differently, some people have spent more time waiting for what happened yesterday than some of our other readers have been alive on the planet.

But hopefully you enjoyed an exciting week, and only a few more hours until the Sunday night open in the far east!

More By This Author:

Silver Breaks $50, As Evidence Mounts That Something Has Broken In London

Silver Nears $50, And Money Is Pouring Into The Miners

Silver's Historic Rally Continues As Futures Break Above $48 Level