SGX TSI Iron Ore Commodity Elliott Wave Analysis

SGX TSI Iron Ore Elliott Wave Analysis – Trading Lounge

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

The SGX TSI Iron Ore Futures contract is a key derivative on the Singapore Exchange (SGX), tracking iron ore delivered to China with 62% iron content. This contract is globally recognized as a pricing benchmark for the iron ore market.

Market Context and Recent Price Behavior

Since October 2024, the SGX TSI has exhibited choppy price movement. After a strong rebound during that month, the index began correcting the prior rally. The current price action indicates that the market is forming a potential structure that may lead to further swings in both directions in the weeks ahead.

SGX TSI Daily Chart Analysis

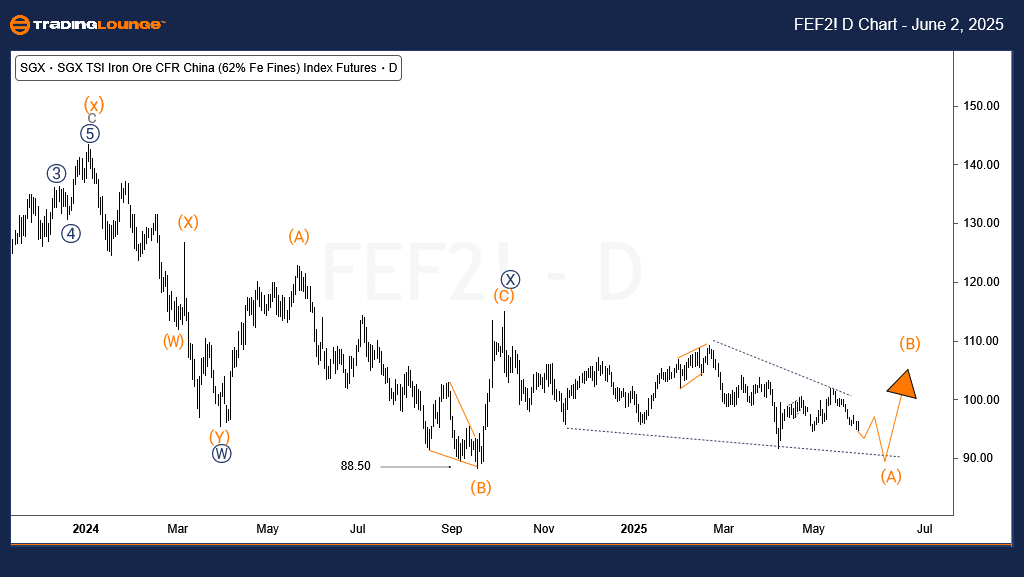

From the long-term perspective, the index is shaping a double zigzag correction from its peak in May 2021, when it hit approximately $234. A sharp decline followed, bringing the price down to around $74 by October 2022. That initial selloff completed a zigzag formation.

The rally that followed formed another zigzag, topping out in January 2024 at $153.5. Since then, the index has resumed a downward move in yet another zigzag pattern. Together, these moves define a large-scale (w)-(x)-(y) corrective structure. The current wave (y) appears incomplete, and projections indicate it may extend toward the $45 level in the coming weeks or months.

SGX TSI 4-Hour (H4) Chart Analysis

On the H4 chart, the decline from October 2024 is taking shape as a leading diagonal, forming wave (A) of ((Y)) of w of (y). Once this diagonal concludes, a corrective rally in wave (B) is anticipated, followed by another decline forming wave (C) of ((Y)). This pattern supports a bearish outlook, particularly while price remains below the key resistance levels of $115 and $143.5.

Traders should expect downward continuation following corrective bounces and monitor price action near these critical resistance levels for confirmation of further declines.

Technical Analyst: Sanmi Adeagbo

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, June 2

Elliott Wave Technical Analysis Walmart Inc.

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Monday, June 2

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more