Sanctions On Russia Backfire On US

$4.959 for regular gas at a NJ Wawa on Friday night. Photo via author.

Our Predictions About Sanctions On Russia

Back in March, we pointed out that Western sanctions on Russia were likely to backfire against the West.

Quoting from our March article:

Biden has, in effect, helped launch an economic World War III, imposing unprecedented sanctions on a large and economically important country. Russia isn't an Iran or Libya. It's a continent-spanning country with a population of 145 million, and it is (or was) one of the world's top five exporters of oil, natural gas, nickel, wheat, coal, and other commodities. Let's breakdown why these sanctions are dangerous for us, and close with our investment approach to them.

We'll revisit our investment approach from that article at the end of this post, but before that let's note our follow-up piece in April where we wrote that the West had likely underestimated Russia's economy.

Quoting from that article:

It appears that the laptop class in the West has underestimated the resilience and size of Russia's economy because it's more based on the physical world than ours is.

The Mainstream Media Starts to Catch On

The mainstream media is finally acknowledging what we predicted then. From Tablet Magazine:

The Guardian a couple of days ago:

Revisiting Our Investment Approach

We were right about the impact of Western sanctions on Russia in March and April; were we right about our investment approach in response to it? Let's take a look. In our March 13th post, we wrote:

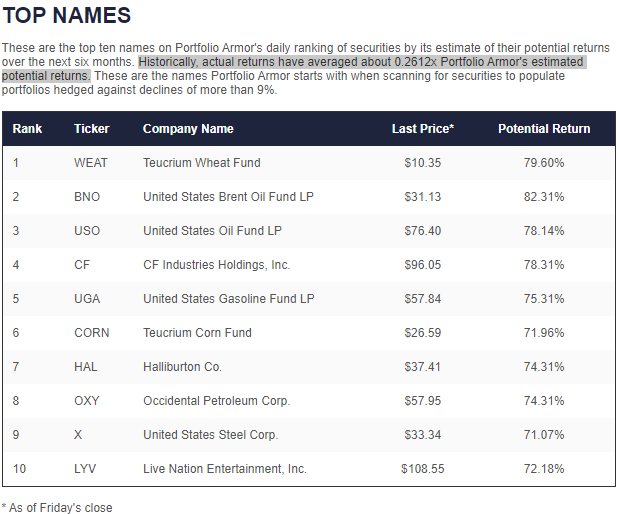

As regular readers know, our system doesn't consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach is painting a clear macro picture when you look at our most recent top ten.

Screen capture via Portfolio Armor on 3/11/2022.

Our number one name on Friday was the Teucrium Wheat Fund (WEAT), and two other agricultural names made the list: the Teucrium Corn Fund (CORN) and nitrogen fertilizer producer CF Industries Holdings, Inc. (CF). Fully half of our top ten were oil and gas names including Haliburton Co. (HAL), Occidental Petroleum Corp. (OXY), and the United States Gasoline Fund LP (UGA). Overall, our nine of our top ten names are bets on food and energy getting more expensive over the next six months.

As always, we suggest readers who decide to buy any of these names consider hedging their downside risk in the event our system ends up being wrong, or the market goes against us. Each of our top ten names can be cost-effectively hedged; you can use our website or our iPhone app to scan for the optimal hedges on them.

Our admonition to consider hedging came in handy for one of our top names from March, United States Steel Corp (X): it's down 25% since. But on average, our top names from March are up 7.29%, versus the SPDR S&P 500 Trust (SPY), which is down 1.97% over the same time frame.

As a reminder, we post an updated top ten names on our website and app every day that the market is open. Three of the names above also appeared in our June 3rd top ten: BNO, CF, and WEAT.