Pre-October USDA Crop Production And Supply/Demand Report

Market Analysis

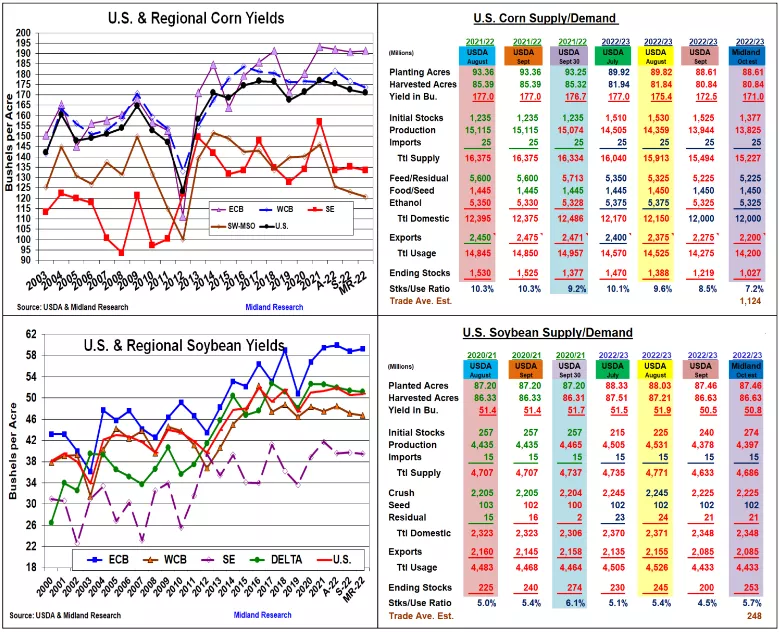

The USDA’s September ending stocks had surprises again this year. Corm’s big 148 million bu lower stocks because of last summer’s hefty feed/residual increase, soybeans stocks rose by 34 million bu & wheat’s 1st quarterly stocks were unchanged vs 2021 were surprises. Changes in crop sizes were a significant part of soybeans and wheat’s unexpected stocks. Last summer’s wheat & corn prices and their availability prompted some big swings in US cattle feedlot usage, too. The latest US corn & soybean carryovers have impacted 2022/23’s bushels, but October’s crop reports will establish overall supplies. Last week’s 41 million bu. drop in 2021’s corn crop and minor ethanol (-2 million) & export (-4 million) shortfalls in August demands were factors in corn’s smaller stocks. However, wheat’s significant drop in 1st quarter feed usage despite US feedlot numbers holding steady vs 2021 suggests higher summer corn demand. Overall, 2021/22’s feed demand projects to be 113 million bu higher because of September 1’s 1.377 billion bu carryover. Last spring’s late plantings have the US behind 2021 & 5-year average harvest paces. Below normal rainfall in WCB & Delta/SW the past 6 weeks has us lowering yields by 2.9 & 2.3 bu. Rains in IL, OH, & WI may boosts ECB by 0.7 bu. Overall, US output could drop by 119 million bu to 13.825 billion & 171 US yield. With smaller supplies, US exports maybe cut 75 million to keep ending stocks at 1.027 bilion bu. Soybeans’ 30 million larger 2021 US output was needed when Sept 1 stocks rose to 274 million bu. An August export surge appears to have dropped seed & residual demands to 102 million minimum. Dryness in the WCB (-0.4 bu), Delta rains (-0.2) & Hurricane Ian damage in the SE have slipped these regional yields, but late-season ECB moisture (+0.5 bu) could boost the US output by 19 million & up US yield to 50.8 bu. If new crop US demand is left unchanged, 2022/23’s stocks could rise to 253 million bu. Wheat’s 130 million lower US supplies means higher imports & lower exports to keep 2023 stocks at 522 million bu.

What’s Ahead

Despite tightening US corn & wheat supplies, the managed money’s focus is on increasing interest rates, a high US dollar, lower Chinese business activity/demand & a world recession. The collapse of the Black Sea food corridor, Argentina dryness expanding into Brazil & US Plains drought curtailing wheat seedings are also real possibilities. Looking to add 20% sales $6.90-$7 & $14.25-45 ranges. Hold wheat sales.

(Click on image to enlarge)

More By This Author:

Lower US Wheat Output And Smaller Corn Stocks

US Wheat Crop/Stocks Update

Pre-Sept 30 Corn & Bean Stocks: Be Alert For Stronger Corn Feeding & A Smaller US Bean Crop

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more