Peak Oil Demand Is On The Horizon

For what it's worth, I do not vilify the use of fossil fuels in the past. For a very long time, using coal, oil and natural gas were the only options for improving global standard of living. I believe we need to keep that in context, even as the fossil fuel age ends.

With one recent exception, that might prove to be early, but not wrong. My analysis of oil has been spot on since around 2000 when I first bought Occidental Petroleum (NYSE:OXY) and a while later Petrobras (PBR) just after its IPO. In 2011, on MarketWatch, I predicted the shale boom a few months ahead of research reports from Goldman Sachs (GS) and Citigroup (C). In June of 2014 on MarketWatch, I forecast a large decline in the price of oil, possibly extremely lower. Extremely lower occurred.

Since then, we have seen one substantial rally in the price of oil which I also forecast. We also have seen the most recent drop of oil prices become a far more pronounced crash in oil (and gas) stocks - an occurrence I thought would be a mere correction, but that turned into a collapse.

The short run for oil is going to see more pain for most high debt oil companies that hold second best energy plays. The majors are not only overweight dead assets, but face a unique problem of litigation related to their climate change-related activities.

When the short-term carnage is over, the coming "plateau" could be very profitable for those who can pick the survivors. Most of the survivors have two things in common: Low-cost conventional assets and a major Permian presence.

What Is The Peak Oil Plateau?

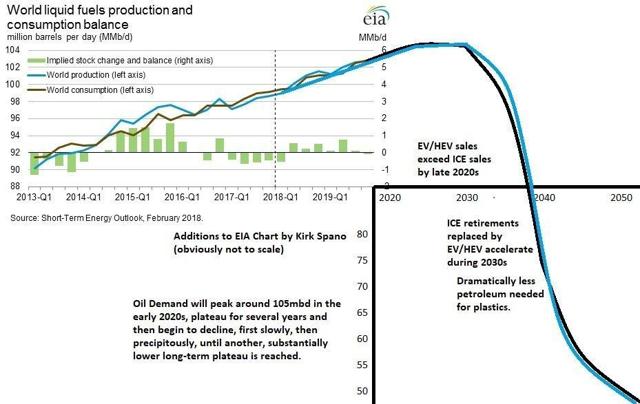

As I define it, the "peak oil plateau" is the period during which oil supply and demand growth flatten and will be roughly in balance. Here's a simple chart I scratched together a couple years ago extending then EIA projections.

As you can see, my projections have peak oil demand a bit over 105 million barrels per day in the next several years. That is fudgable by a few million barrels and a few years, but I believe generally about right based on different sets of extrapolations I have compared.

Demand Destruction For Oil Is Closer Than You Think

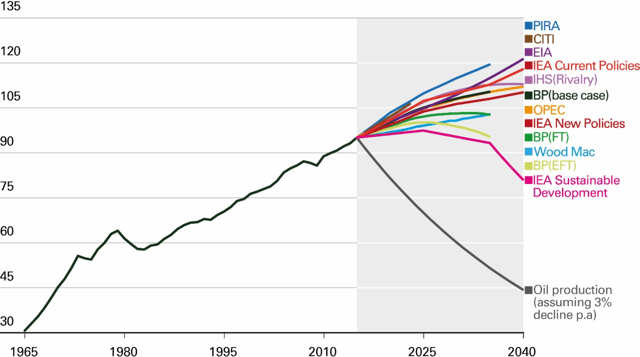

Over the next several years, demand growth for oil will come to a halt. That flies in the face of projections by OPEC, most oil companies and especially amateur oil permabulls. Here's a summary of graphics from BP's (BP) Peak Oil Demand And Long-run Prices report.

Exxon Mobil (XOM) in their 2019 Outlook For Energy state that "demand growth slows beyond 2030." Their projections assume EV and alternative energy adoption near the low-end of projections I've read and 16 million barrels per day of increased oil demand from emerging markets by 2040.

Even with those assumptions, Exxon never sees oil demand exceed about 112 mbd. This is a dramatic shift from just a few years ago when their projections had oil demand increasing handily through 2040 to well over 120mbd. OPEC has seen a similar shift in outlook.

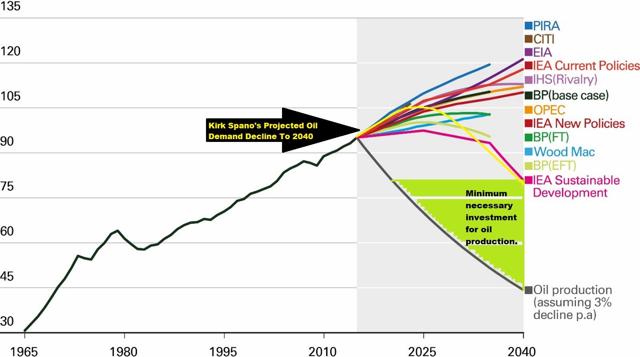

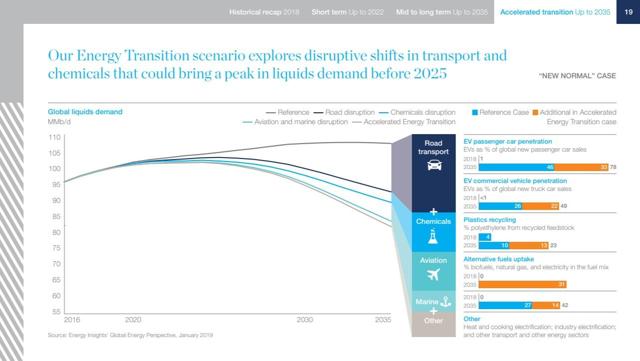

Let's use BP's chart again with some annotations and explanation. Note that the EIA and IEA have similar projections based on current policies. Those policies include energy production policies, such as clean air and clean water requirements as well as climate change policies.

What you see is that I believe that the IEA Sustainable Development will be the true impact on oil demand. I will take that a step further - I believe it's the base case. Why?

My analysis points me to four rapidly moving developments:

- Climate change policy at the government and corporate level is offsetting oil demand growth now. Changes to law and business practices to fight climate change are becoming more pronounced. China and India are in the early stages of massive clean energy pushes. Many emerging markets are skipping right over fossil fuel based electricity grids. As soon as a Democrat becomes president (which I put at over 85% likely in 2021), policy changes will become even more pronounced in the United States.

- Technology improvement in battery technology for EVs (electric vehicles), hybrid vehicles and energy storage is happening quickly. My projections are that in roughly four to six years, passenger EVs will be completely cost competitive with ICE vehicles. Recent improvements and deals by Tesla (TSLA) indicate that at least the high end of the market will get there. However, the unveiling of the new Ford (F) Mustang demonstrates the entire market might be there very soon. GM (GM) plans to launch 20 fully electric vehicles within four years. Toyota (TM) hybrids are already cost competitive with ICE. Volkswagen (OTCPK:VWAGY), Volvo (OTCPK:VOLVY), BWM and others are on the way as well.

- Demand for petrochemicals is wildly overstated. There's already technology to replace much of the petroleum used in plastics. One company at the forefront is Newlight Technologies with their AirCarbon technology. Coca-Cola (KO) and Ikea already have used AirCarbon plastics.

- Solar breakthroughs seem to occur each week. Efficiency is getting so high that solar is being used to power oil fields (that's ironic isn't it) and to replace coal fired power plants. It's even accelerating past wind power now. One use for solar is being developed by a Bill Gates funded startup that just showed the ability to reduce fossil fuels for cement and other industrial uses by up to 60%.

Here's where I think even the International Energy Agency data is light. The IEA projects over 130 million EVs on the road by 2030. I think this projection is extremely low. The U.S. alone could make up close to that number with minor improvements in adoption rates once Ford and GM come to market.

China and Europe remain the leaders in EV adoption. If China should reach the 30% market share for EVs they are seeking, then EV adoption by 2030 would exceed 250 million. It should be clear the pressure exerted by EVs on oil demand.

Ships (driven by IMO 2020 standards) also are becoming more efficient. This is in an age of tariffs that's running into machine learning also moving supply chains. The moving of supply chains means that ocean container travel is likely to be lower for longer, and maybe forever, in addition to using less petroleum per mile.

Airplanes also are becoming more efficient, though delays in deployment are difficult to project. We have seen the Boeing (BA) 737 MAX grounded for months now. Even with growth in air travel, a recession or two in the 2020s, and aging of the global population could cause a flattening in air travel growth. My projections for jet fuel use are more flat than falling over time, but this does offset the general growth bias of most investors.

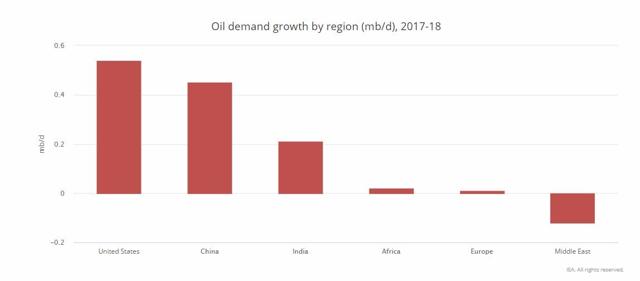

The theory that emerging markets will prop up oil demand also is proving to be a fallacy. Essentially all demand growth for oil is coming from the U.S., China and India. All three are looking to curtail that growth and reverse it by 2030. China and India already have passed legislation and California, which is one-sixth of the U.S. economy, is on the leading edge in America.

McKinsey provides a graphic that essentially labels my "base case" for oil use as their "new normal."

Extending this section into a book would not be difficult. Investors must accept that pressure on oil demand is real and accelerating.

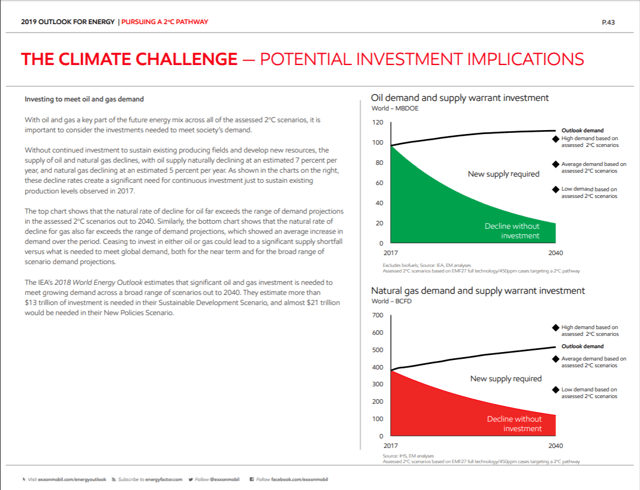

Oil Supply Investment Is About To Crash Again

Capital budgets among U.S. oil producers have been flattening for a year now. Barclays (BCS) has estimated at least a 2% drop in capital spending this year and up to 7%. Cowen & Co has suggested total spending compared to last year to be down 10%-11%.

As it stands, borrowing to increase production is almost non existent for the industry. Refinancing debt that's due has become difficult as well. At the DUG Midcontinent conference this week, as reported by Hart Energy, Guggenheim Partners managing director Subash Chandra said the industry is "in a full-blown liquidity crisis on top of our capital intensity issues."

Projections for next year's capital spending range as extreme as a 30% decrease. I don't think that is likely, not yet. Here's why.

As I said above, I think it's very likely that a Democrat wins the presidency in 2020. All of them are saying they will end new drilling on public lands and offshore. Under this scenario, it would behoove companies to "drill, baby, drill" next year on public lands and offshore with every dime they have.

If by about March we do get a signal that President Trump is floundering, I would expect companies to revise their annual capex as high as they can afford for 2020. They would drill and frack, quite possibly capping where they can.

Interestingly, Russia just stated they would be waiting until March to make an announcement about whether or not to change output. There could be a significant glut of oil next year only to fall off rapidly after the election.

What Can A Democrat President Do To Fracking?

Several Democratic presidential candidates also are saying they will ban fracking. Here's what to know about that. Legally, that's not something that can be done with an executive order - at least not without an immediate legal challenge that would like result a ban being at least temporarily halted.

In addition, the Republican tax cut bill included an underreported section that opened up oil drilling in large portions of the 19 million acre Arctic National Wildlife Refuge. And President Trump has been selling leases on public lands at a record pace with prices as low as $2 per acre. That throws a monkey wrench into undoing the leases.

What the executive branch can do and would do is work through existing air and water regulations to control fracking activity. This is an opinion that Wood Mackenzie also shares.

Gov. Gavin Newsom just imposed a moratorium on drilling and new leases on California due to spills and leaks. As somebody who has been to all the major shale plays except the DJ since 2011, I can tell you, there's leaks and spills everywhere. The flaring of natural gas also is pervasive - take a look at any night time satellite image of America, you can see the oil fields glaring bigger than the megacities.

Environmental regulations strictly enforced would make certain oil projects uneconomical and those would stop for business reasons. In the intermediate term, that would in fact drive oil prices back up - a likelihood that Harold Hamm alluded to this week at DUG.

Democrats of course want to drive the price of oil and gas up at least from the current rock bottom levels. Driving up oil prices would spur the adoption of EVs and alternative energy even faster, which of course is a climate change policy goal.

Killing The Oil Zombies

In the next year, oil prices look likely to look weak and range bound, unless there's a greater conflict in the Middle East, which could certainly happen.

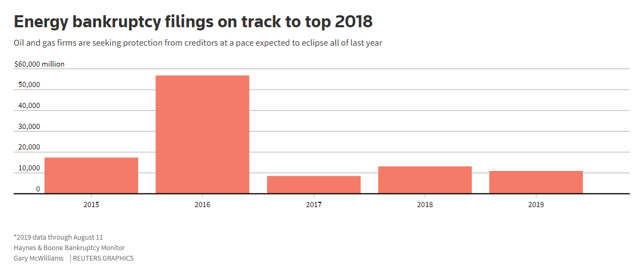

The most recent decline in oil and natural gas prices already has been nothing short of cataclysmic for many exploration and production companies.

I outlined on Seeking Alpha the reasons "why oil stocks are priced for Armageddon." Among the chief causes are an early stage shift away from fossil fuels, poor financial management in the shale patch, a remarkably strong divestment movement for oil and gas stocks, and general disinterest by Millennial investors.

Also, from what I can see, most oil executives and boards of directors did what they could to line their own pockets at the expense of shareholders. Many should face clawbacks as far as I'm concerned, and a few should get criminal charges (I felt the same way about bank executives and bank boards of directors during the "Great Recession").

So far, we have seen the prices of many companies down well over 50% from rebound highs in 2018. Chesapeake Energy (CHK), a company I believed would survive, is on the verge of a reorganization that will likely wipe out or nearly wipe out current shareholders.

Larger, more oil focused companies, such as ConocoPhillips (COP), EOG (EOG) and Occidental Petroleum (OXY) are down 30-45% from 52-week highs. Even majors Exxon Mobil and Chevron (CVX) are down 17% and 5% from 52-week highs.

Clearly, some of this is piling on. Throwing out the babies with the bath water. That said, the bath water is very dirty.

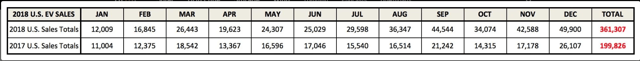

If the price of oil (and gas - which is almost certain) remains low in 2020, then it's almost assured that bankruptcies among companies not operating out of cash flow skyrockets. Bankruptcies already have ticked up in 2019:

In Q1 of this year, I showed members of Margin of Safety a screen I run that showed only about a dozen shale companies were operating out of cash flow. A recent Rystad study of the 40 largest shale producers show that they had turned cash flow positive as a group by $110 million over capex.

What should be understood is that it's the performance of a bit more than a dozen companies that drove that positive cash flow. I covered most the companies that turned cash flow positive earlier this year in an article titled the The Dirty Dozen Oil Stocks For 2019 and another discussing Permian players, ripe for M&A activity.

In the short-term, the next year or two, only a dozen or so companies in the shale patches and maybe Total (NYSE:TOT) in my opinion among majors are sure survivors of the coming zombie apocalypse coming the next year or two. The rest of the batch, be careful of.

The Bullish Intermediate Term For Oil

So, if oil investment declines after 2020 due to regulations, then the intermediate term for survivors looks good.

Consider, fracked wells have fast decline rates, losing at least a third of production sometime in year 2. A dramatic drop in fracking could be interpreted as a supply disruption. I think that disruption would be short lived however, as Saudi Arabia would return to the "drill, baby, drill" mentality and cap oil prices under $100 per barrel.

Companies with lease holds on public lands already are getting to them at a faster rate because they know those are the one most likely to go away. Oil executives with drilling rights on public lands are very likely to drill those in 2020. That is in fact already happening.

If I am an oil exec, I'm also drilling and fracking as many wells as I can afford to, even if I have to cap them short term. I expect that most companies with cash will come in at the very high end of their capital budgets in 2020 or slightly exceed.

That means the price of oil, short of a greater Middle East conflict and disruption, likely does not reach $80 per barrel in 2020 as I had previously thought. There's huge uncertainty of course.

After 2020 though, I think the price oil rises are likely to rise due to changes in policy, financing tightness, decline rates and requirements by investors to operate within cash flow and return money to shareholders. The death of the oil zombies will make the survivors big winners off of bottom fishing prices.

The Bottom Line On The End Of The Oil Age

Regardless of what you want to believe, the end of the oil age has started. We are no longer in batting practice. We are into the game and working our way through the line-up.

No doubt there will still be trading scores to make. And that's how to think about oil now as an investor, if you want to play in the oil patch at all. Oil investing is dead, but long live oil trading.

I continue to believe that the Permian players are the best bets. I don't like companies focused on California, Colorado or Oklahoma. The Bakken will have some legacy winners, but several are on long-term run outs of their businesses and without large dividends are of little interest.

Also, as I said a couple years ago, deep water drillers are doomed, even if oil prices surge. Bankruptcies and the collapse in projects has proven that out and there is no return. Exxon will learn that in Guyana soon (more on that in coming weeks).

Some of the oil companies will move into the next era of low carbon energy, making them highly attractive on share price crashes. Incorporating carbon control technology and alternative energy is the next logical step for long-term focused companies. I will cover these in coming articles.

Disclosure: I am/we are long OXY. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this ...

more

I do share a three-phase process to the decline of oil demand: an initial decline, a plateau and a final decline to a base. That said, the gradient of the first and last phases, as well as the duration of the plateau phase will be determined by factors such as policies, regulations and technology. It may therefore be a little premature to assign well-defined timelines to these.

It is however worthy of note that even OPEC in its recent World Oil Outlook report, projects growth to fall from 1.4 million barrels per day (bpd) in 2018 to about 0.5 million bpd by the end of the next decade.

In a post four days ago, I itemized the challenges facing the US tight (shale) oil industry: and those will be instrumental in shaping the future of oil.

Fascinating.

So, do you see a cyclical bull market within the secular decline? I do, I think it might have just started, though this could be anther false alarm and cyclical bull doesn't start until early 2021.

Well, while that may be inferred, I'm always cautious about "cyclical" processes especially as a basis for investment.

Makes sense.