OpenAI: Fueling Massive AI Stock Gains

As we led in yesterday’s Commentary, AMD rose 25% on the news that OpenAI would purchase 10% of AMD. In exchange, OpenAI will become a significant customer of AMD. This symbiotic relationship is just one of many that OpenAI is forming with companies at the forefront of the AI revolution. The bullet points and graphic (courtesy of @darioCPX) below provide context for some of the most important relationships. It also emphasizes the circular relationships OpenAI is forming with its customers and suppliers.

- Microsoft: OpenAI’s primary strategic partner and largest investor has committed over $13 billion since 2019. OpenAI’s models power Microsoft products, including Bing, Copilot, and Microsoft 365. The partnership includes ongoing revenue sharing and IP access through 2030.

- Nvidia: In September 2025, OpenAI and Nvidia announced a $100 billion partnership for deploying at least 10 gigawatts of NVIDIA systems in data centers, as well as participation in OpenAI’s funding rounds. Under this arrangement, Nvidia will fund OpenAI, which in turn will buy Nvidia chips and other equipment.

- Oracle: In September 2025, Oracle and OpenAI signed a $300 billion, five-year deal for computing power, contributing to over 4.5 gigawatts of capacity. OpenAI is funding Oracle, which will, in turn, will pay OpenAI for its services.

- AMD: In October 2025, the two companies signed a multi-billion-dollar deal for 6 gigawatts of AMD GPUs. OpenAI will fund AMD, which in turn will sell chips to OpenAI.

- CoreWeave: In March 2025, OpenAI invested $350 million in CoreWeave shares and committed $11.9 billion over five years for access to AI computing.

The symbiotic relationships being formed between OpenAI and the companies highlighted above, as well as many others, may prove beneficial to all involved. However, we must ask what would happen if OpenAI fails financially or its products prove not to be industry-leading.

What To Watch Today

Earnings

- No notable earnings reports today

Economy

(Click on image to enlarge)

Market Trading Update

Yesterday, we discussed how we are reaching the “enthusiasm” stage of the market cycle. That enthusiasm translates into momentum and can last for a while before the eventual reversion. What causes that reversion is always unknown, but it can happen swiftly.

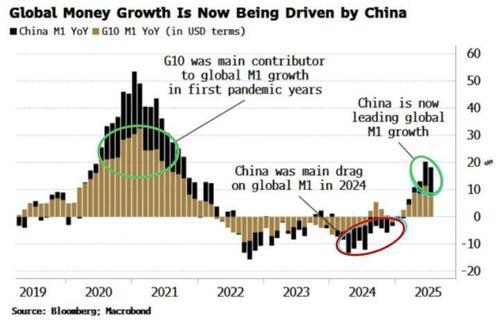

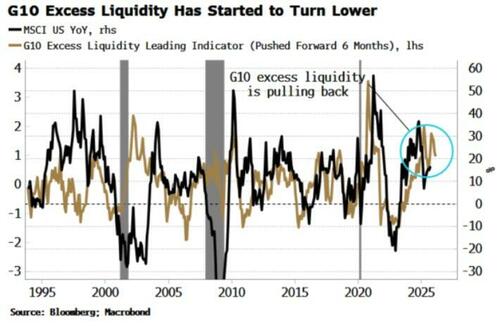

However, the market remains underpinned by a massive flood of liquidity. As noted by Simon White via Bloomberg yesterday:

“Just as bubble risks elevate, valuations hit new all-time highs, and G10 excess liquidity falls, a rising flow of liquidity from China is set to offer support. It may not be enough to avert a correction that punctures some of the more extreme signs of feverish speculation, but it is likely sufficient to limit losses in the face of historic valuations. Money in China is now steering global money growth. After several false starts, stimulus there is finally breaking through more broadly, leading to a sharp and sustained rise in M1, driven by an increase in corporate demand deposits.”

That liquidity support is critical to keeping markets elevated. While China has gone from being a net drag on global liquidity to its main supplier, which is consequential for equities, that support is somewhat limited.

As Simon goes on to note:

“Without China, US stocks were destined to have an increasingly hard time. Excess liquidity – real money growth less economic growth for the G10 and the best medium-term guide to stock performance – has been faltering.”

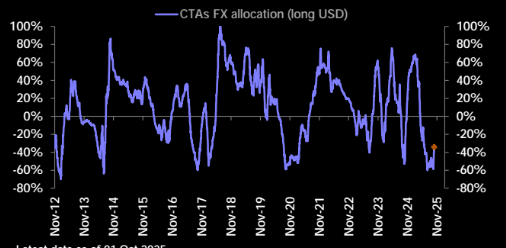

The risk, of course, is a reversal in the U.S. dollar, which would potentially create havoc through dollar-denominated assets. As we noted previously, the setup for a dollar rally is building with the dollar attempting to move above the longer-term negative trend line. Note, we are trading above the 100-day as of writing, something not seen since the bear started. A close above the 99 area and things risk getting dynamic to the upside.

Furthermore, CTA’s are running a very large short position against the dollar which could fuel any advance.

The bottom line is that with liquidity in China buoyant and the global channels it flows through still clear and unobstructed, the bulls have support for now. However, a rally in the dollar, impairing profit margins for US stocks, could start a bigger unwind than expected. Remain focused on risk management.

Gold Heads To 4k

Gold futures traded above $4,000 an ounce for the first time on Monday night. Leading the momentum is the federal shutdown in America, as well as concerns that Japan’s new Prime Minister and France’s political turmoil may be inviting more fiscal spending, rather than conservatism. While fiscal irresponsibility is undoubtedly a reason to consider buying gold, we must still ask if it’s the right time.

Gold has risen 50% this year and over 150% since the start of 2020. These increases indicate that gold investors are certainly pricing in global fiscal malfeasance. But are investors over their proverbial skis? To help answer the question, we share the graph below. The blue line indicates that the price of gold is now 3.01 standard deviations (Z-score) above its 200-day moving average (DMA). A correction to the 200 DMA, which would be technically healthy and not necessarily negate the bullish trend, would entail a 25% decline.

The last three times the Z-score has been above three, excluding the most recent earlier this year, have been accompanied by significant declines in gold prices. The instances in 2011 and 2020 saw gold prices correct by 50% and 25%, respectively. This time may be different. However, if it’s not, bear in mind that gold is technically grossly overbought, and a significant correction would not be abnormal, even if the fundamental drivers of gold remain strong or even strengthen.

The Tweet of the Day below offers another cautionary technical indicator. As you can see from the graph, gold is approaching a long-term level of technical resistance.

Tweet of the Day

More By This Author:

AMD Surges: Nvidia Competition Heats UpCorporate Prices Lead Consumer Prices

Bear Market Losses – A Dangerous Illusion

Disclaimer: Click here to read the full disclaimer.