Oil UOA Explodes, Is It Just The Beginning?

In Monday’s video, I laid out the bullish case building for oil stocks. That thesis was based on the data that was about to come out on production and supplies but also based on significant option activity. As the price of oil advances toward the pivotal $75 price level, the bullish option activity continues to generate momentum. Let’s take a look at the fundamentals or oil and today’s option activity.

Oil Production & Supply

People always want to focus on oil demand, but in the COVID age, you can’t take production for granted. The supply-side economic argument is starting to come to the fore as consumers are unable to buy goods, like cars.

COVID policies had a dramatic impact on oil supplies as oil prices collapsed and costs were running high. Since that event, oil producers have been reluctant to increase production and following Ida, production has once again taken a turn for the worse. The graphic below shows the current oil supply in the U.S. compared to its 5-year range.

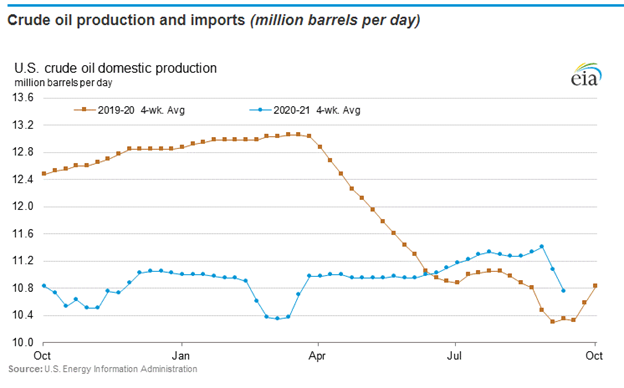

As you can see, the supply of oil is approaching the 5-year low and the 6.4M barrel draw in oil inventories last week is troubling. Looking at the impact of production by Hurricane Ida is also unsettling. In the image below you’ll see the sharp drop-off in production over the past two weeks.

As you compare the decline over the past two weeks compared to 2020, you’ll see how dramatic it is. Also, production is substantially below what was being produced at the same time in 2019. To gain further perspective, looking at gasoline and many distillate supplies sitting below their respective 5-year range shows even greater potential demand downstream.

With all these fundamental reasons for oil to go higher, why is the price still wading below $75? This is the tenuous position we find ourselves as COVID policies place oil demand in flux. Maybe traders just don’t believe the production and supply situation in light of rising COVID cases in the U.S.

Oil Option Activity

Right off the bat this morning, the bullish oil stock option interest started to roll in. While many of the trades were gargantuan, the breadth of the option activity was unusual. Here’s a breakdown of today’s activity:

- SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA: XOP)

- 5,000 15 COT 21 $100 calls BOT in 1 print @ $0.95

- 8,000 15 OCT 21 $89 calls BOT in 1 print @ $4.18; 8,000 15 OCT 21 $94 calls sold in 1 print @ $2.18

- 55,000 17 DEC 21 $70 puts BOT in 1 print @ $1.70; 55,000 17 DEC 21 $60 puts sold in 1 print @ $0.67

- Comstock Resources Inc (NYSE: CRK)

- 2,900 15 OCT 21 $10 calls mostly BOT quickly @ $0.45 to $0.55

- Royal Dutch Shell plc ADR Class A (NYSE: RDS-A)

- 7,500 15 OCT 21 $45 calls mostly BOT @ $0.25 to $0.35

- Southwestern Energy Company (NYSE: SWN)

- 5,700 18 MAR 22 $7 calls mostly BOT @ $0.49 to $0.54

- BP plc (NYSE: BP)

- 3,600 24 SEP 21 $27 calls mostly BOT @ $0.06 to $0.15

- Cabot Oil & Gas Corporation (NYSE: COG)

- 3,750 21 JAN 22 $19 puts mostly BOT @ $1.65 to $1.80

- Transocean LTD (NYSE: RIG)

- 4,870 22 OCT 21 $4 calls mostly BOT @ $0.26

- Energy Transfer LP Unit (NYSE: ET)

- 3,100 29 OCT 21 $10 calls mostly BOT @ $0.27 to $0.30

The information above doesn’t represent all the oil and gas activity but is a reasonably comprehensive listing. One thing you may notice is that there were some bearish trades on COG and XOP. The trade on XOP was sizable at 55,000 contracts but was for a longer expiration in December.

Conclusion

The big takeaway is that there is significant potential for near-term strength and possible weakness as we enter winter. With colder weather in the winter forecast and low inventories, the only thing that could hold oil prices and stocks down is a surge in COVID cases and an increase in restrictive policies.

Wondering when to hedge? See how unlocking the Vomma Zone can help you better understand when volatility is about to rise.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more