Oil And Gas Inventories Near Seasonally Historic Lows, Despite SPR Withdrawals

Don’t expect gas prices to moderate significantly anytime soon. Policy matters in the energy arena and when you have an administration banning drilling, then allowing it again, and then not sure what to do, it creates uncertainty. Companies in that environment will do the prudent thing, wait until the dust is settled and policy is clear before wading back in.

This is exactly what you are seeing now.

“Davidson” submits:

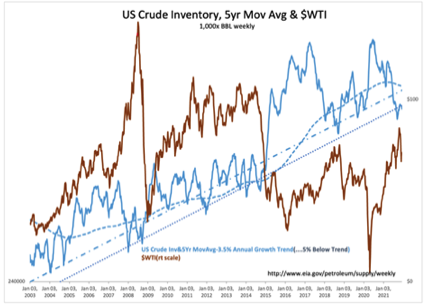

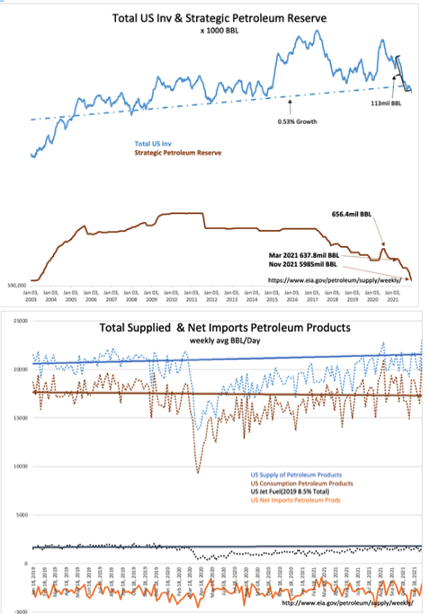

- US Crude Prod holds at 11.7mil BBL/Day, Total Crude Inv fall 6.53mil BBL(working inv -4.58mil and SPR -1.95mil BBL), US Crude Imports fell 1.4mil BBL/Day(9.8mil wk)

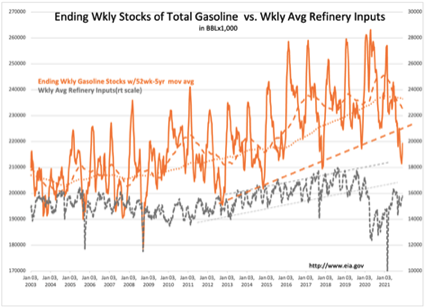

- US Gasoline Inv falls 0.8mil BBL, Refining Input fell 0.1mil BBL/Day, US Exports of Refined Petroleum Prod fell 1.2mil BBL/Day

- US Consumption remains elevated vs 2012 trend, slight rise in Jet fuel consumption rises to 88% of 2012 trend

US continues its net draw down of crude inventories. This week was larger as crude imports fell and did not act as an offset. The build in gasoline inv usually seen at this point of the year is well below expectations. The low refinery inputs implies the typical replenishment may not occur. US Crude and gasoline inventories remain near seasonally historic lows.

The pattern of production and inventory levels suggest that the industry is extracting capital from the system. Inventories represent working capital. As inventories of crude and refined products, using gasoline inventories as a proxy for all refined products, are worked down there is more capital available for other uses. This appears to be a secular shift in my estimation relying more on just-in-time delivery, a ‘lean process’, rather than have capital tied up in inventories to serve as a buffer to unpredictable events.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more

Dangerously low.

$UCO party on…