Not All Markets Share The S&P 500’s Enthusiasm

While the S&P 500 reached new monthly highs, gold, silver, and mining stocks took the opposite direction. Is it just a temporary situation?

While the S&P 500 continued its squeeze higher on Oct. 28, the short covering has morphed into another bout of FOMO. However, while stock investors assume that a dovish pivot is on the horizon, operating in a vacuum should prove painful for the bulls.

For example, gold, silver, and mining stocks declined on Oct. 28, as the PMs did not share the S&P 500’s enthusiasm. Furthermore, the USD Index rose slightly, and the U.S. 10-Year Treasury yield closed back above 4%. Likewise, the futures market has priced in a peak U.S. federal funds rate (FFR) of 4.90% in May 2023.

As a result, the bond, FX, commodity, and futures markets are not buying the S&P 500’s pivot prediction.

Please see below:

To explain, the red line above tracks the one-hour movement of the S&P 500, while the green line above tracks the inverted (down means up) one-hour movement of the U.S. 10-Year Treasury yield. As you can see, higher interest rates have weighed on the S&P 500 in 2022.

Moreover, the box with the arrow shows how a sharp decline in the U.S. 10-Year Treasury yield (green line rising) helped underwrite the S&P 500’s June to August rally. However, if you analyze the right side of the chart, you can see that the U.S. 10-Year Treasury yield’s recent pullback was relatively small.

Also, with the Treasury benchmark rising on Oct. 28, bond investors are not positioning for a pivot.

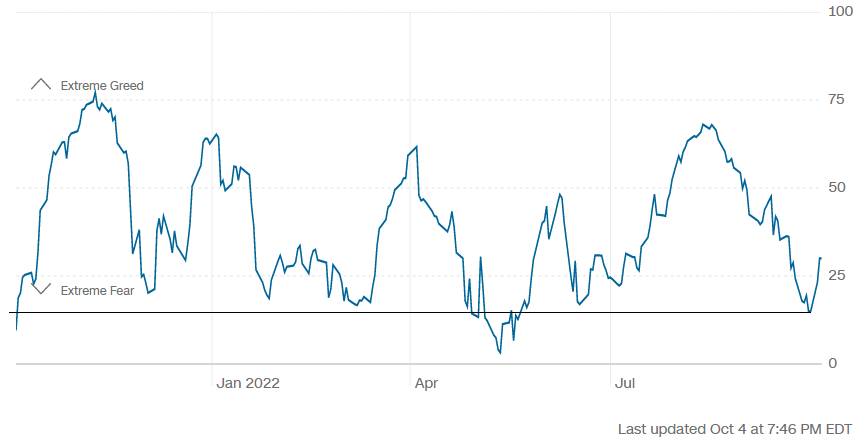

In addition, sentiment is an important component; and when CNN’s Fear & Greed Index highlighted investors’ anxiety, I warned on Oct. 5 that depressed sentiment supported a bear market rally. I wrote:

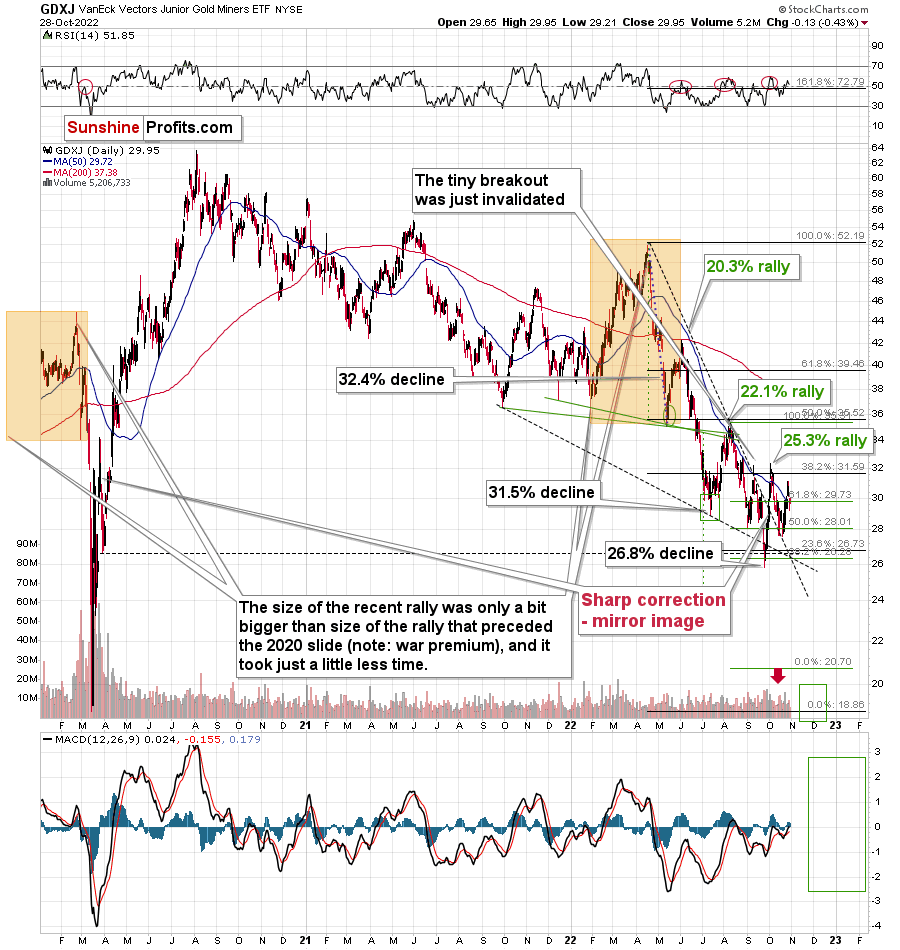

Because asset prices don’t move in a straight line, countertrend moves are an unfortunate byproduct of medium-term investing. So while the GDXJ ETF’s recent uprising is far from fun, bear market rallies are commonplace along the journey to a final low (…).

CNN’s Fear & Greed Index hit abnormally low levels, which signaled extreme fear in the financial markets.

Please see below:

Source: CNN

To explain, the blue line above tracks CNN’s Fear & Greed Index. If you analyze the horizontal black line, you can see that the index ended September at its lowest level since May. Thus, over-positioning helped fuel the S&P 500’s squeeze higher.

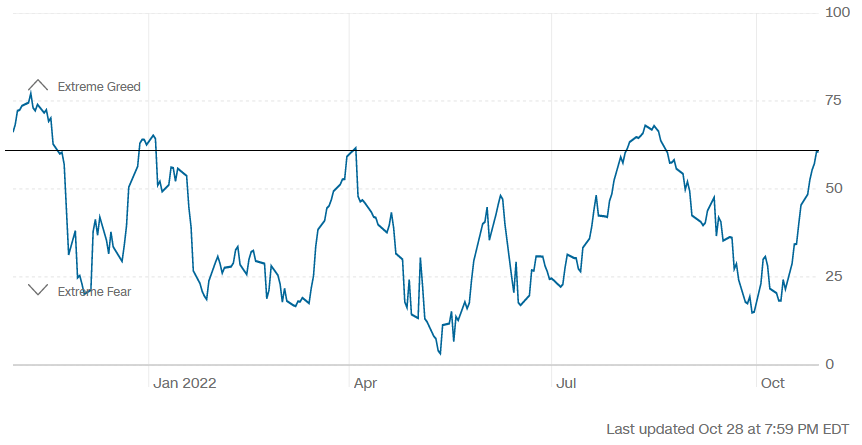

However, with the metric now at one of its highest levels in 2022, fear has turned into greed, and sentiment has flipped from bullish to bearish.

Please see below:

To explain, the horizontal black line above shows that CNN’s Fear & Greed Index is only one and seven points away from its April and August 2022 peaks. Moreover, these were the highest readings since the 2022 bear market took shape.

As a result, while the S&P 500 may not turn on a dime, the bear market rally is long in the tooth and a medium-term reversal should weigh heavily on gold, silver and mining stocks.

Data-Driven Decisions

While narratives are entertaining, the data determines the direction of the fundamentals; and with more hawkish economic releases hitting the wire in recent days, the results are bullish for the FFR, real yields, and the USD Index.

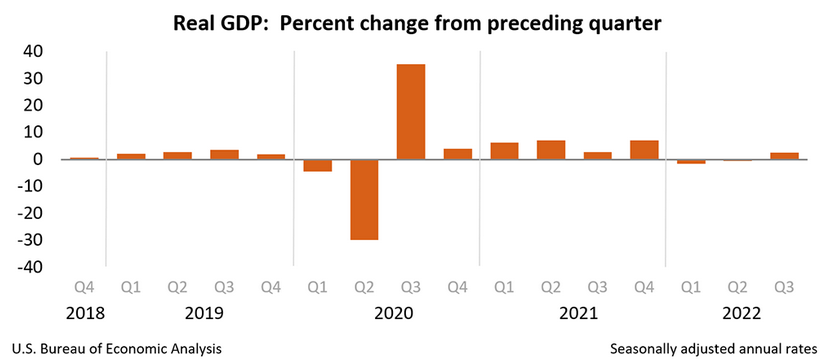

For example, the U.S. Bureau of Economic Analysis (BEA) released its advanced estimate of Q3 real GDP growth on Oct. 27. The report revealed:

Real GDP “increased at an annual rate of 2.6 percent in the third quarter of 2022,” which “reflected increases in exports, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending, that were partly offset by decreases in residential fixed investment and private inventory investment.”

As such, while the recession crowd has grown confident in recent months, unanchored inflation and resilient growth should keep the Fed’s foot on the hawkish accelerator.

Please see below:

Likewise, with Americans’ spending behavior continuing to outperform, we haven’t reached the demand destruction required to warrant a dovish pivot.

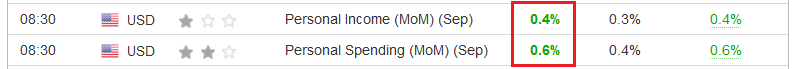

Please see below:

Source: Investing.com

To explain, the BEA revealed on Oct. 28 that personal income increased by 0.4% month-over-month (MoM) in September, which exceeded the consensus estimate. More importantly, personal spending increased by 0.6% MoM, which highlights Americans' ability and willingness to splurge. Thus, I've warned repeatedly that the Fed's inflation fight will be one of attrition.

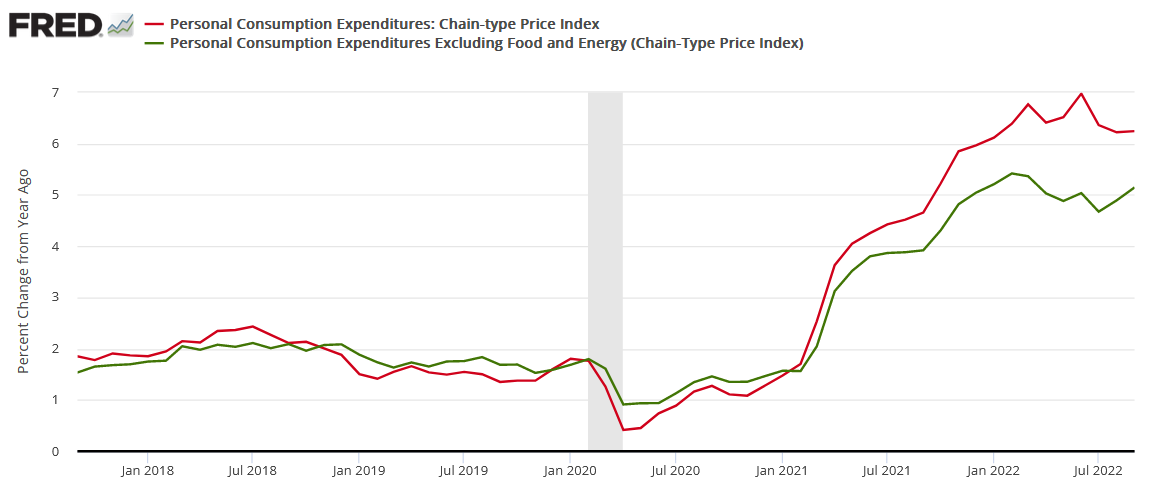

To that point, the BEA also revealed on Oct. 28 that the headline PCE Index increased from 6.22% year-over-year (YoY) in August to 6.24% YoY in September, while the core PCE Index increased from 4.89% YoY in August to 5.15% YoY in September.

Please see below:

To explain, the red and green lines above track the YoY percentage changes in the headline and core PCE Indexes. For context, the latter excludes the inflationary impacts of food and energy, but it’s a better indicator of consumer inflation, and the metric has increased YoY for the last two months.

Therefore, the crowd doesn’t realize that bullish corporate earnings (outside of Big Tech) are also bullish for the FFR. In a nutshell: when corporate prints are resilient, demand allows companies to pass on higher input costs, which stokes inflation. As such, what’s perceived as constructive is actually destructive. To explain, I wrote on Oct. 18:

Narratives don't create recessions, and the important point is that the longer consumer spending remains elevated, the higher the FFR will need to rise; and while investor sentiment was boosted by short-covering and resilient corporate earnings, the latter's strength is bearish because it means the Fed has much more work to do.

So, while the crowd may celebrate that earnings have 'held up,' the reality is that the longer they remain durable, the longer inflation will persist.

In addition, while the Consumer Price Index (CPI) garners all of investors' attention, please remember that the PCE Index is the Fed's preferred inflation gauge; and with the headline and core metrics increasing YoY in September, nothing in the data supports a pivot.

Please see below:

Source: U.S. Fed

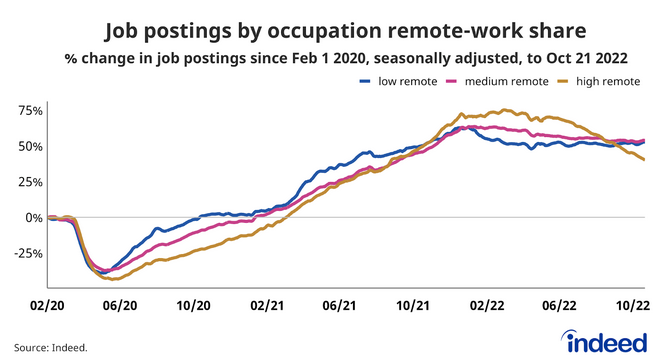

Finally, Indeed released its latest U.S. labor market update on Oct. 27. The report revealed:

“The U.S, labor market remains hot. As the U.S. economy bounces back from the initial COVID-19 shock, demand for labor has grown much more quickly than supply. Employment has rebounded, wages are growing quickly, and joblessness is approaching pre-pandemic levels. The labor market is, however, showing some signs of normalizing, particularly as demand for workers cools….

“As of October 21, 2022, job postings on Indeed were 48.8% above their pre-pandemic baseline. New job postings, defined as those on Indeed for seven days or less, are also well above their pre-pandemic baseline, up 55%. While job posting growth has slowed, the leveling out has been relatively moderate.”

Please see below:

To explain, the blue, pink, and brown lines above track the percentage change in job postings for low, medium, and highly remote positions. If you analyze the movement of the brown line, you can see that highly remote opportunities have fallen somewhat materially. However, these are predominantly work-from-home listings in sectors that benefited from the pandemic.

In contrast, the blue and pink lines have barely budged, which highlights how employment opportunities for in-person roles remain resilient despite the Fed’s 12 25 basis point rate hikes in 2022. As a result, demand has not normalized, and the FFR needs to go much higher to curb inflation.

Source: Indeed

Source: Indeed

Technically Speaking

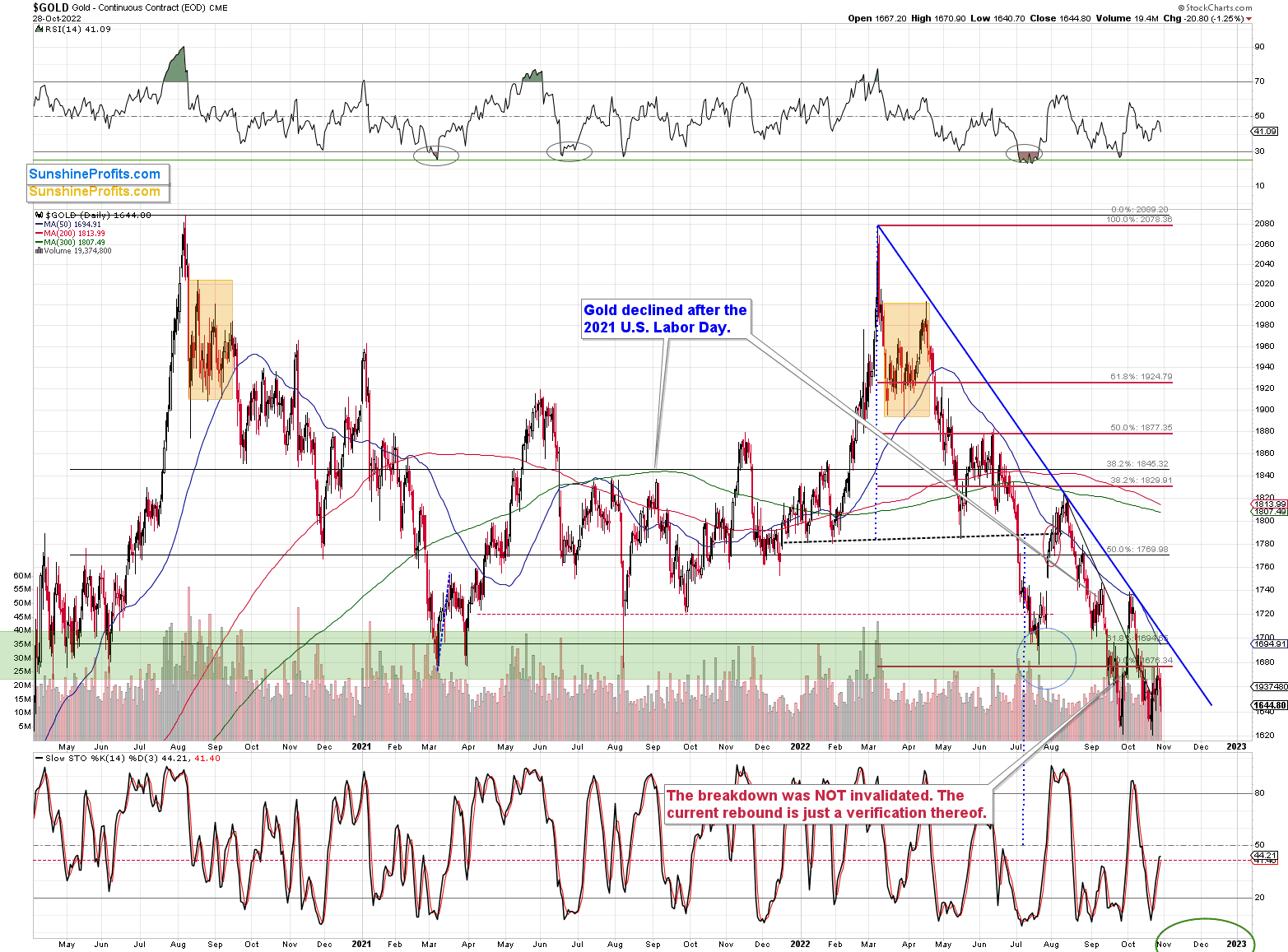

Gold declined visibly on Friday, but the decline in silver and mining stocks was less visible. Why is that so? It’s quite obvious if you focus on what happened in the main stock indices.

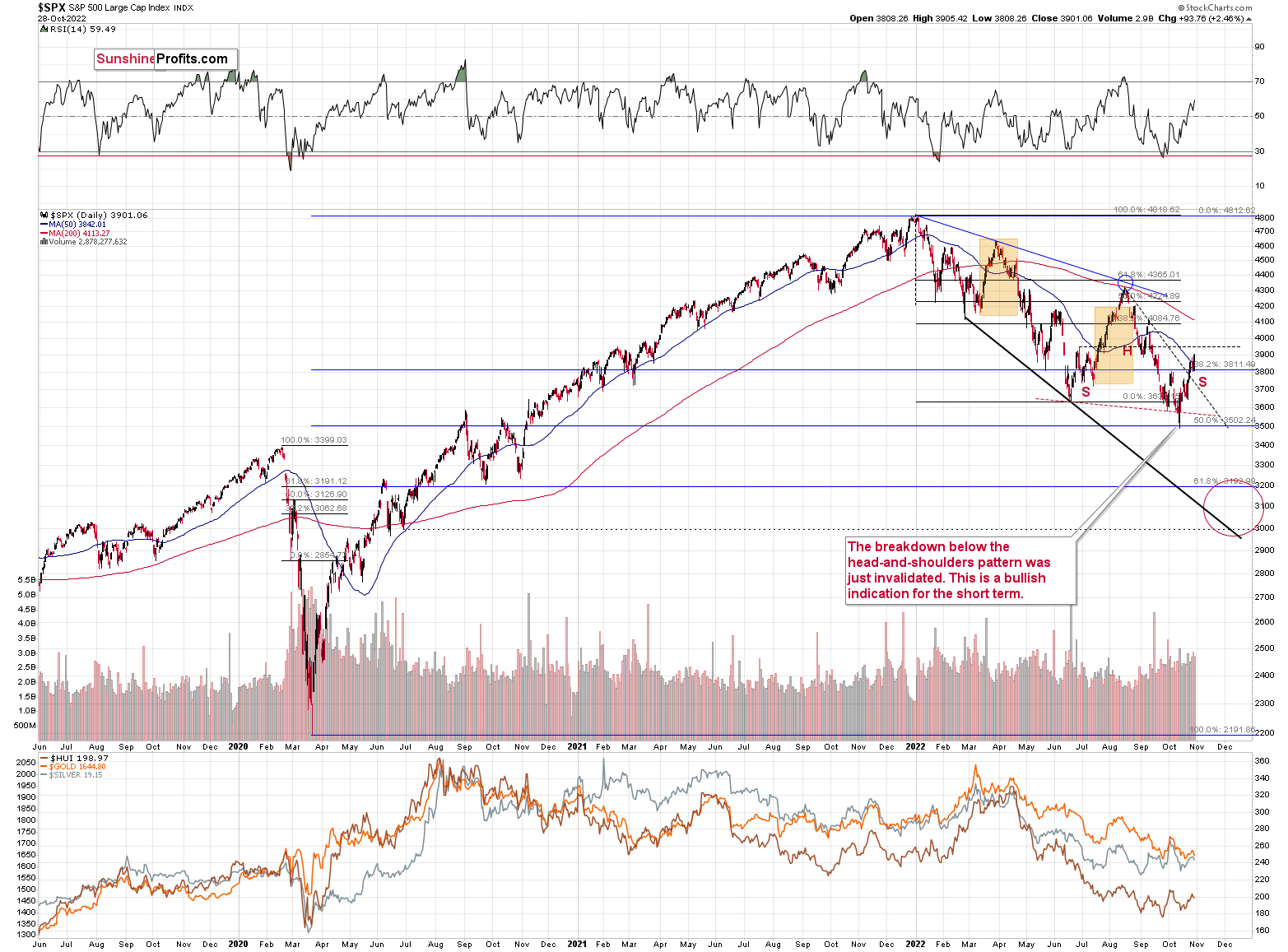

The S&P 500 rallied to new monthly highs, which caught investors’ eyes. However, as the index didn’t move above its June 2022 high, the head and shoulders formation could still be completed.

Consequently, nothing really changed based on Friday’s session, and what I wrote in Friday’s extensive analysis remains up-to-date.

Gold is now relatively close to its 2022 lows, while junior miners are not, and it’s most likely due to the stock market’s recent strength.

Can this positive impact from stocks remain intact? It can, but it’s highly unlikely. The increasing real rates are simply strongly bearish, and for the above to happen, two things need to take place at the same time:

- Stocks would have to continue to rally in the following weeks / months.

- The relatively strong impact that stocks recently had on the junior miners’ performance would have to persist for longer.

Both are unlikely.

Starting with the latter, gold is ultimately a much more important price driver for junior miners than stocks are. After all, gold is the only current or expected source of revenue (thus profits) in the future.

As for the former, the rally is likely to be reversed, as I explained many times. For example, that’s what the world stock ($MSWORLD) index very strongly implies (you will find its analysis in Friday’s Gold & Silver Trading Alert).

The Bottom Line

While the stock market heads in one direction, the bond, FX, commodity, and futures markets have headed in another. Moreover, with employment still resilient and inflation highly problematic, the prospect of a pivot is more semblance than substance. Therefore, while the Fed could pull a Bank of Canada (BoC) and surprise with 50 basis points on Nov. 2 (though, unlikely), the FFR’s peak is much more important than what happens at any single meeting. Thus, the stock bulls should learn this lesson the hard way over the medium term.

In conclusion, the PMs declined on Oct. 28, as the S&P 500’s bullish price action contrasted the moves in other markets. So, while the USD Index and the U.S. 10-Year real yield have largely been in consolidation mode, it’s normal for a cooling-off period to occur after such strong rallies. However, we expect the pair to hit higher highs in the months ahead, and a realization should culminate with lower lows for gold, silver, mining stocks and the S&P 500.

More By This Author:

Relatively Dovish Bank Of Canada Depressed The Dollar

Will Gold Stocks Manage To Ignore The S&P 500’s Volatility?

Gold Didn’t Need Any Special Boost To Reach The New Low

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more