Mainstream Money Tiptoes Into Gold Miners

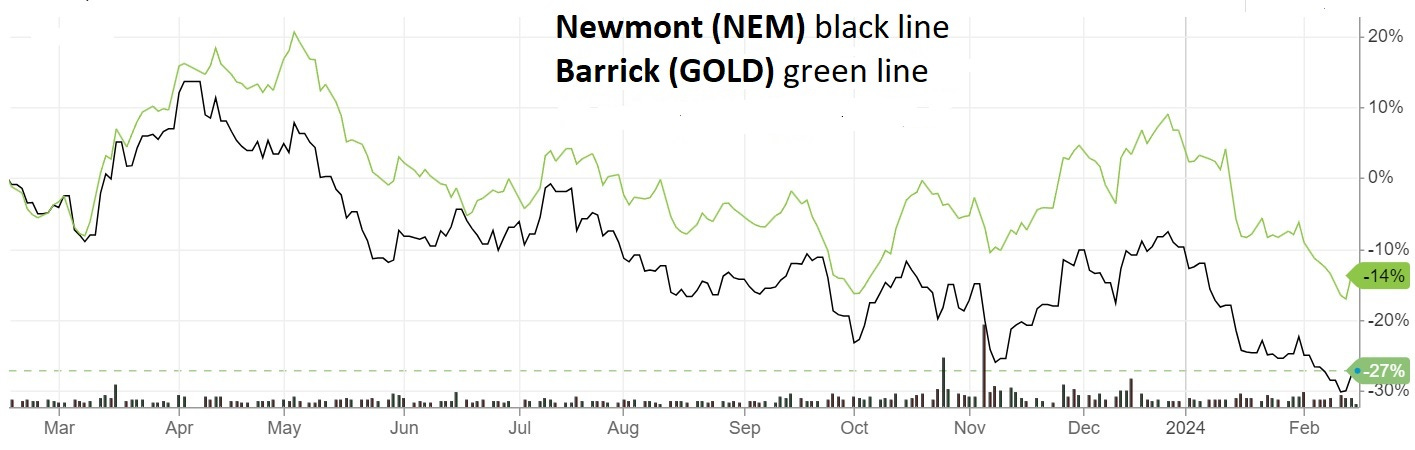

The appeal of mining stocks is that they’re “leveraged bets on the underlying commodity”. So you’d think that with gold not far from an all-time high, the big gold miners like Newmont (NEM) and Barrick (GOLD) would be crushing it. But the opposite has been true lately, as these stocks have become almost ridiculously unloved.

(Click on image to enlarge)

Two possible conclusions can be drawn from this: Either the relationship between gold and its miners is fundamentally broken, or this divergence is signaling an opportunity. One way to decide is to look at the miners’ earnings. If they’re making lots of money from $2000 gold, then the operational side of the story is intact, and share prices should follow. If not, not.

Newmont’s Q4 earnings are due out next week, but Barrick’s were just released:

Barrick Gold Posts Q4 Earnings Of $479 Mln; Declares Dividend, Plans Up To $1 Bln Share Buyback

(RTTNews) - Barrick Gold Corp. (GOLD, ABX.TO) reported Wednesday that its fourth-quarter net earnings attributable to equity holders of the Company were $479 million or $0.27 per share.

Sequentially, net earnings grew 30 percent from $368 million or $0.21 per share in the preceding third quarter.

Adjusted net earnings were $466 million or $0.27 per share, compared to $418 million or $0.24 per share in the previous quarter.

Revenues were $3.06 billion, up 7 percent sequentially.

Further, Barrick announced the declaration of a dividend of $0.10 per share for the fourth quarter of 2023. The dividend will be paid on March 15, to shareholders of record at the close of business on February 29.

Barrick also announced that its Board of Directors has authorized a new program for the repurchase of up to $1.0 billion of the Company's shares over the next 12 months.

At least for Barrick, a rising gold price still translates into higher earnings, increased dividends, and continued share buybacks. So far, so good.

Generalist Investors See The Opportunity

Now comes the tricky part, where non-gold-bug investors notice the combination of positive financial trends and underperforming stocks and conclude that the miners are value players. That too is starting to happen:

Druckenmiller bets on the world’s two largest gold producers

(Kitco News) - The gold market and mining equities have struggled as investors have avoided the sector like the plague; however, at least one billionaire investor sees value in the industry.

According to updated F-13 regulatory filings, Stanley Druckenmiller’s Duquesne Family Office dumped its holdings in Google’s Alphabet (Nasdaq: GOOGL), Alibaba Group (NYSE: BABA) and Amazon (Nasdaq: AMZN) in the fourth quarter of 2023.

As Druckenmiller has pared back his exposure to the tech and e-commerce sectors, he has placed new, albeit smaller, bets in the mining sector. The filings show the investment office bought 1.76 million shares of Barrick Gold (NYSE: GOLD) and 474,000 shares of Newmont Mining (NYSE: NEM). At the same time, they increased their exposure to Teck Resources (NYSE: TECK), which represents the fifth biggest investment in the portfolio.

Druckenmiller’s renewed focus on the world’s two largest gold producers brings new attention to a mining sector that has struggled since the start of the year. The VanEck Gold Miners ETF (NYSE: GDX) is down nearly 14% so far this year, even as it bounced off its four-week lows earlier this week. GDX last traded at $26.70 an ounce.

Newmont has attracted specific attention as its share price has fallen nearly 20% since Jan. 2. Shares of the world’s largest mining company last traded at $33.12.

Barrick is also down nearly 20% year-to-date, with shares in the second-largest gold miner last trading at $14.41.

Major Earnings Season

A big name like Druckenmiller buying gold miners gives other generalist investors permission to do the same thing, so it’s easy to envision a time in which some of the profits now being taken in Big Tech flow in this direction.

A lot of miners will report their Q4 results in the coming month, validating (or not) the thesis that rising gold translates into rising miner earnings. Newmont’s February 22 report will be a big one, so stay tuned.

More By This Author:

It’s Not About Inflation: We Want To Know If We Can Afford To Live

Recession Watch: Inflation Won't Die Until The Economy Kills It

The Student Loan Debt Spiral Starts: Credit Card And Auto Loan Delinquencies Highest For Millennials