It’s Not About Inflation: We Want To Know If We Can Afford To Live

Inflation is big news in the headlines right now, but for the average Joe’s like you and I, the price is always right.

We’re concerned about the price.

Even when the world is shocked by annualized inflation spiking up to more than 8%…

We must pay the price…

For whatever the juice boxes, bread, and sandwich meat cost for our kid’s lunch.

For whatever our car insurance is to get to work.

For whatever the heating bill to stay warm at night.

Price matters because…

We want to know how much we can buy for the dollars we earn.

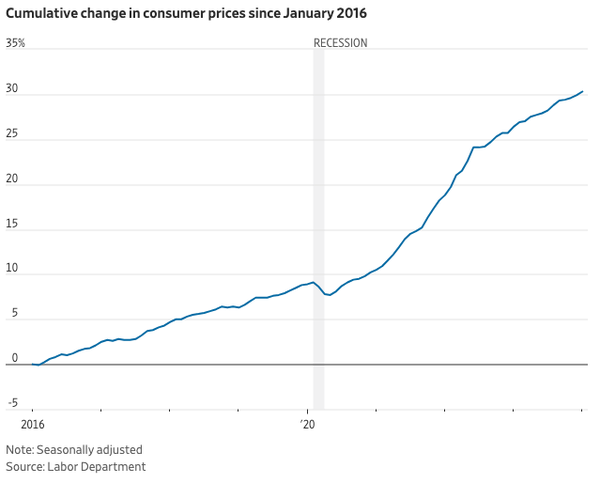

If we take the long view and zoom out over the last seven years we see an overall 30% cumulative change in consumer prices.

Most of the change happened since the 2020 recession.

There’s been a 23% cumulative change in consumer prices.

What matters most here, isn’t inflation.

It’s the result of inflation:

It’s the price measured in the currency you are using to pay for the goods and services you need.

But when you want to measure value outside of your currency, say, in gold… inflation doesn’t matter so much.

Gold, silver, real estate, Bitcoin, and your own business will all hold value outside of a currency.

When inflation rises, their value will also rise but, only as measured inside the currency.

That’s where the price is always the price.

So you can pay the price from the currency in your bank account that came from your paycheck.

So how are those paychecks looking?

Here’s the latest chart on annualized Avg. Hourly Wages:

Since the Federal Reserve rapidly increased interest rates in 2022, the percentage change in average hourly earnings has been trending down.

Ideally, wages would match inflation, but after this week’s inflation numbers… we see increasing inflation, while wages are only slightly moving upwards.

We might be worried when we see inflation numbers, but what we’re actually thinking about is:

“Will I be able to afford to live in the next few months?

A year?”

It depends…

“All this can be yours, if the price is right.”

More By This Author:

Recession Watch: Inflation Won't Die Until The Economy Kills ItThe Student Loan Debt Spiral Starts: Credit Card And Auto Loan Delinquencies Highest For Millennials

Household Debt Tops $17.5 Trillion and Americans Are Feeling the Strain