Lithium: A Commodity In Perpetual Deficit

Image source: Pixabay

Lithium is not as widely discussed as some other metals, but it should be. Lithium's price has more than doubled since the start of 2021, and it's likely going to go a lot higher in upcoming years. Lithium powers batteries in just about every laptop, tablet, and mobile phone around the globe, but that's not where the surge in demand is coming from. Whereas the metal experiences continuous demand from these segments, lithium is seeing a demand surge due to the booming electric vehicle ("EV") segment. Infrastructure in the lithium segment seems ill-equipped to handle the demand rush, and the market looks like it will be in a state of perpetual deficit for years. Several well-positioned enterprises with significant lithium exposure should benefit substantially and see significant appreciation in their share price over the next several years.

The Lithium Market

As more and more EVs hit the roads, the global lithium-ion battery market is expected to expand from roughly $44.2 billion in 2020 to around $94.4 billion in 2025. Despite supply getting set to increase substantially, it's not likely enough to keep up with the burgeoning demand.

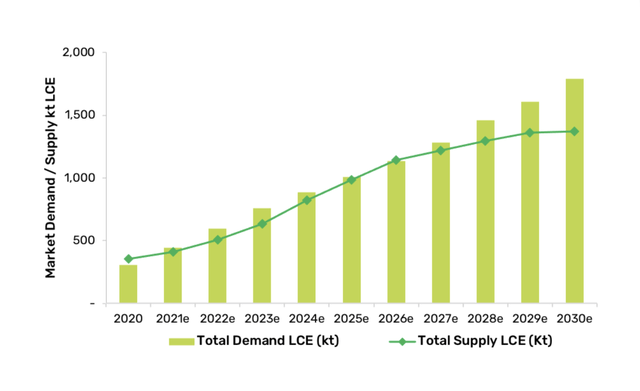

Source: globallithium.com

Supply was ahead of demand in 2020 due in large part to the coronavirus pandemic. However, the lithium market looks like it's entering a state of perpetual deficit. Demand is likely going to outstrip supply substantially toward the end of this decade. This dynamic of significantly more demand than the lithium segment can deliver will likely lead to higher lithium prices and a substantial expansion in the lithium sector in general.

Where The Demand is Coming From

The massive demand surge for lithium is primarily coming from the EV segment, and it's not likely going to slow down any time soon. We're still in the very early innings of the EV cycle, and growth should remain robust for many years.

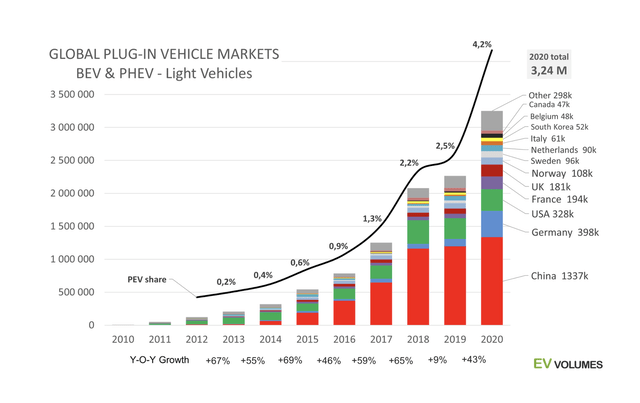

Source: ev-volumes.com

Just look at this remarkable growth. The EV market went from essentially zero cars on the roads in 2010 to around 3.24 million total EV sales in 2020, and this stellar growth looks set to continue. EVs have an enormous market share to capture as the EV segment accounted for fewer than 5% of total car sales last year.

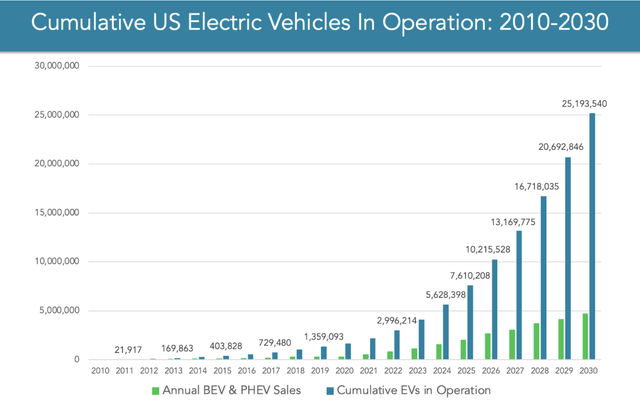

Source: evadoption.com

Projections illustrate that EVs in the U.S. should skyrocket from about 2 million in 2020 to over ten times that in 2030. Naturally, it's not just in the U.S., as demand for EVs is very likely to continue to explode on a global scale.

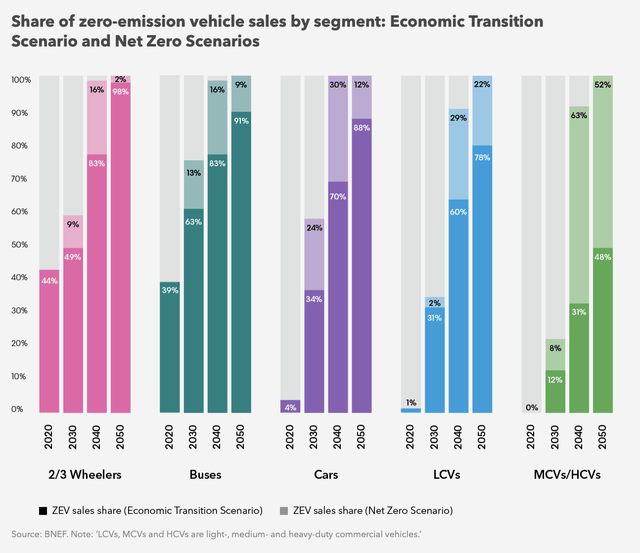

Source: about.bnef.com

We see that EV sales should continue to spike in just about all market areas, but if we stick to just cars, growth is about to explode from just around 4% of the market to 34-58% by the end of 2030. The massive demand spike for lithium-ion batteries will drive many stock prices significantly higher over the next several years.

Here are Some Top Names:

1. Lithium Americas Corp (LAC)

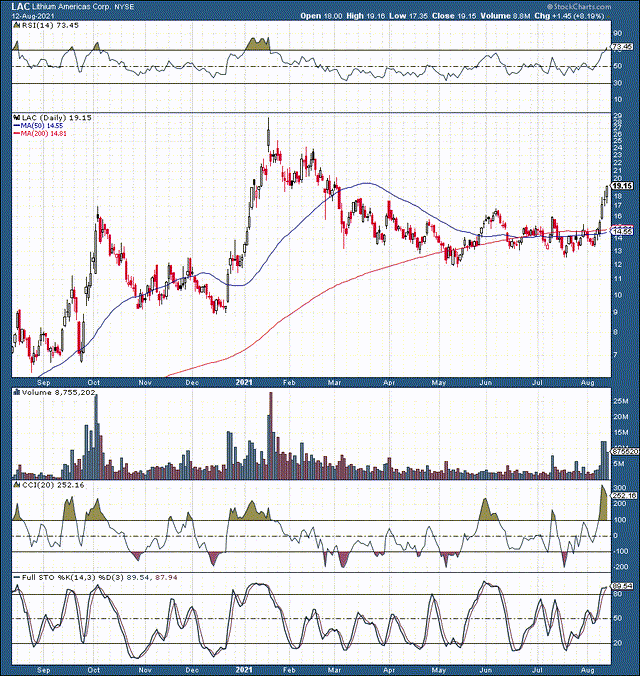

Source: stockcharts.com - With the RSI above 70 now, LAC is getting technically overbought here. It's difficult to predict what a volatile stock like LAC will do daily, but we may see a pullback if it doesn't penetrate the $20 level. I own this name and plan to hold shares for the long term.

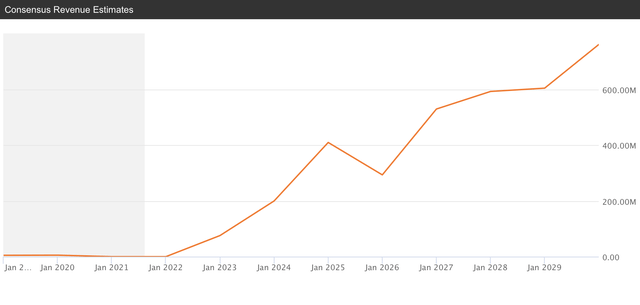

Lithium Americas is a Canadian smaller cap lithium miner that has a great deal of potential ahead. While the company is not profitable yet, it is likely to become very successful in future years. Analysts expect the company to increase revenues by about tenfold between next year and 2029. LAC is working on two world-class lithium projects in Argentina and the U.S. The stock has appreciated by nearly 50% in recent sessions, and while there's likely going to be some volatility ahead, LAC should trend substantially higher in future years.

Source: seekingalpha.com

2. Sociedad (SQM)

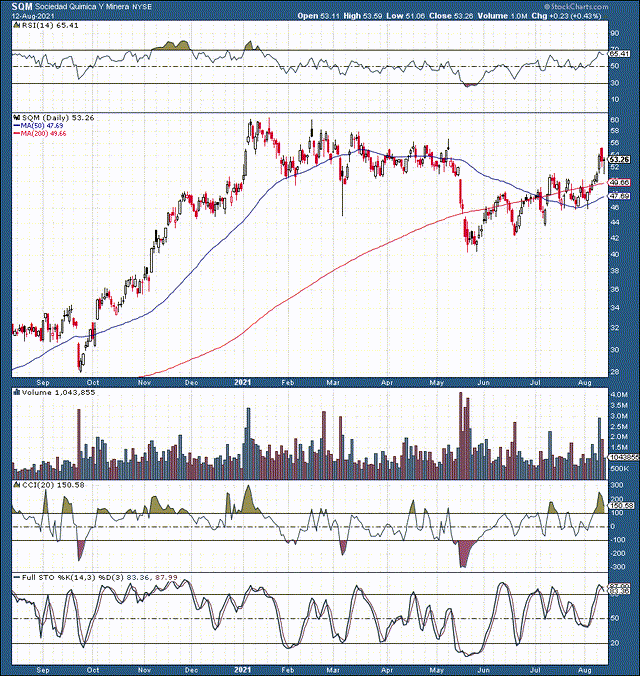

Source: stockcharts.com - Technically, SQM got a little overheated in recent sessions. We see a bit of a pullback, but I think SQM is a good buy around the $52-50 level.

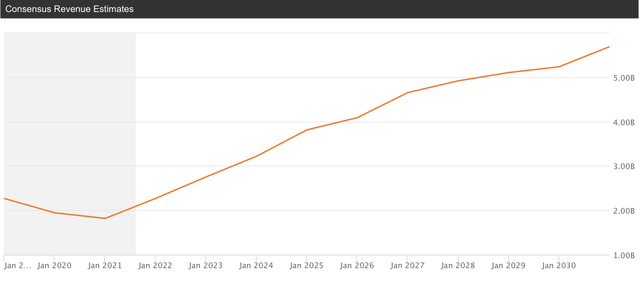

Sociedad is a more prominent miner based out of Chile. The company trades at about 25 times 2022's consensus EPS estimates and is expected to increase revenues and EPS substantially in future years. Analysts anticipate revenues to nearly triple between now and 2030.

Source: seekingalpha.com

3. Albemarle (ALB)

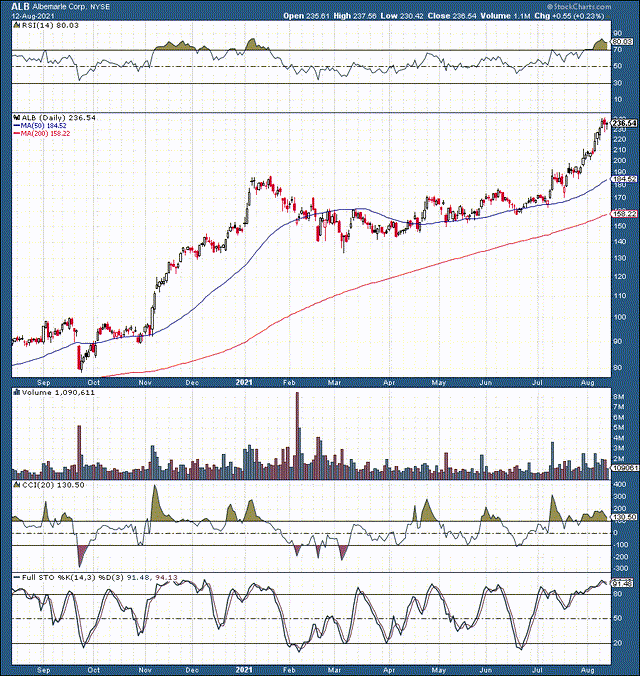

Source: stockcharts.com - Technically, the stock is quite overextended now. We can probably get a pullback closer to 50-day moving average support. I'm a buyer of this name around the $200-190 support level.

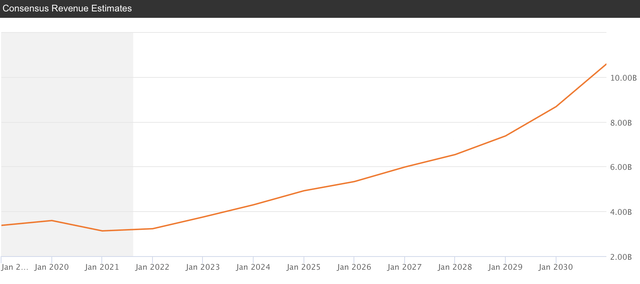

With 2020 revenue coming in at over $3 billion, Albemarle is a top global lithium producer. While its forward P/E ratio is around 47, its EPS should double over the next few years. Moreover, analysts expect the company's revenues to triple by the end of the decade.

Source: seekingalpha.com

4. Livent Corp (LTHM)

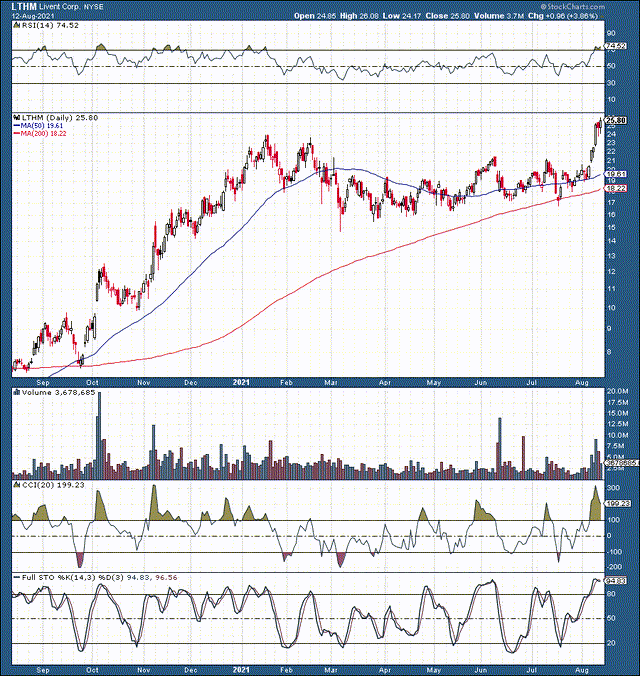

Source: stockcharts.com - LTHM also exploded higher recently. We can probably see a bit of a pullback, and this stock looks like an attractive buy around the $20-22 support level.

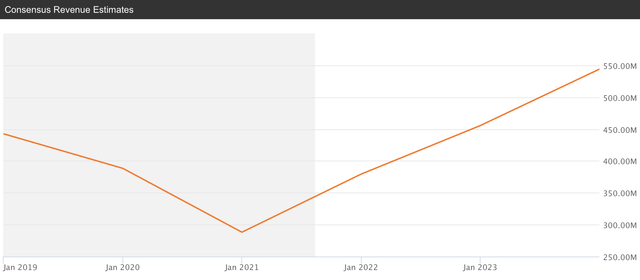

Livent is a leading company that manufactures and sells lithium products primarily used in lithium-based batteries. While analysts expect the company to earn $0.37 in 2022, its EPS should roughly double in 2023, and earnings have a clear trajectory much higher. Revenues should expand by about 20% YoY for some time.

Source: seekingalpha.com

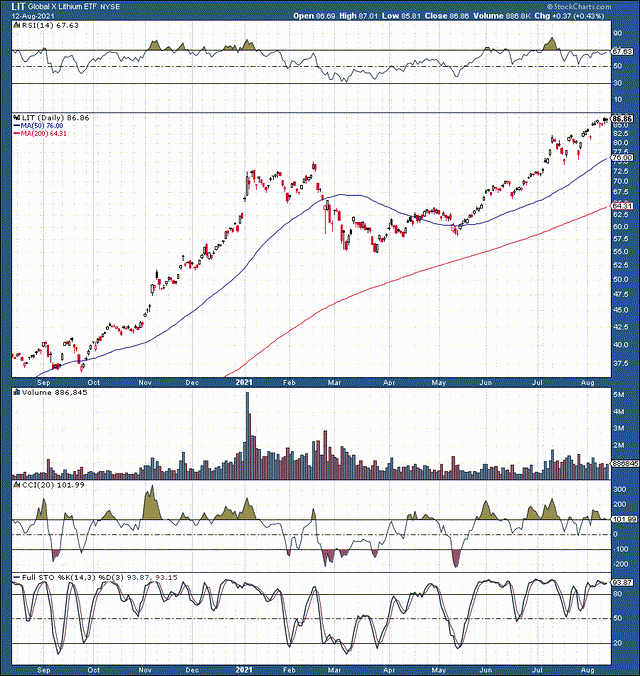

5. Global X Lithium ETF (NYSEARCA: LIT)

Source: stockcharts.com - Like many other names in the lithium field, LIT had a significant run-up recently. However, I have been long this ETF for about a year now and remain long for the long term.

LIT is comprised of 46 names. LIT is top-heavy, as its top 10 holdings account for about 62% of the ETF's total weight. At around 13%, the top holding is Albemarle. China's Ganfeng Lithium comes in at 7.2% of the ETF's weight. Other top names include NAURA, Yunnan, BYD (OTCPK: BYDDF), Samsung SDI (OTCPK: SSDIY), and others.

The Lithium Market Has Enormous Growth Potential

There are not many big players in lithium yet. However, with surging demand, the leading companies in the lithium space are likely to grow and expand notably in futures years. Higher production rates and rising lithium prices should enable the top companies in this space to increase revenues and income significantly. Along with rising income and EPS, the leading players in the lithium space should also see substantial gains in share price. Some of my top picks in this sector include Lithium Americas Corp, Sociedad, Albemarle, Livent Corp, and the Global X Lithium ETF.

Disclosure: I/we have a beneficial long position in the shares of LAC, LIT either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more