Keep Calm And Stay On The Short Side Of Junior Miners

A price jump on a given day doesn’t mean you should give up your short position. Let’s look at the context by examining what happened in the junior mining stocks.

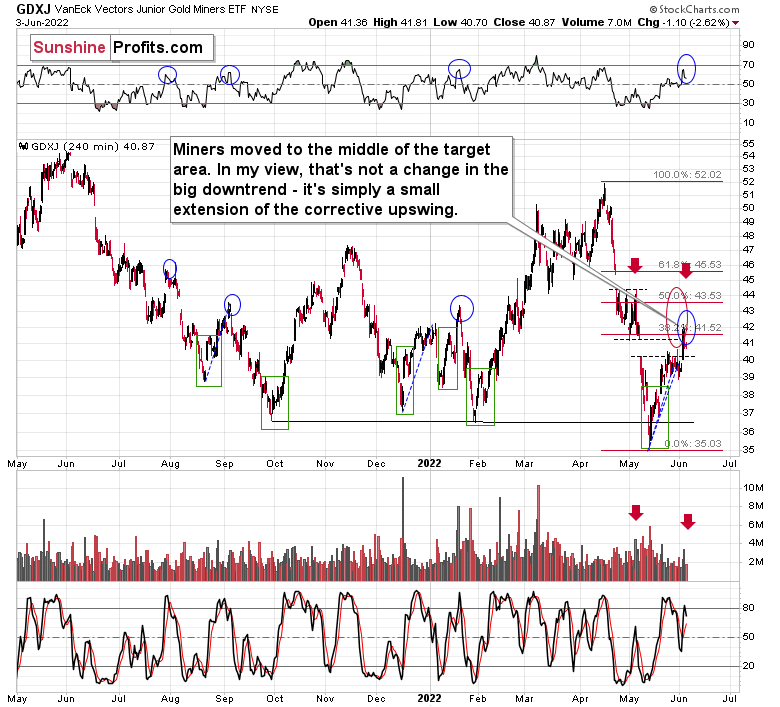

(Click on image to enlarge)

In Friday’s Gold & Silver Trading Alert, I commented on Thursday’s (June 2) rally in the following way:

The price of the GDXJ ETF – a proxy for junior miners – moved sharply higher yesterday, and this got many people excited. High volume confirms that. It’s natural for most investors and traders to view rallies as bullish, but let’s keep in mind that most traders tend to lose money… It’s not that simple. After all, the best shorting opportunities are at the tops, which – by definition – can only be formed after a rally.

The particularly interesting thing about high volume readings in the GDXJ ETF is that they quite often mark local tops. Remember the late-April/early-May consolidation? It ended when GDXJ finally rallied on high volume. That was the perfect shorting opportunity, not a moment to panic and exit the short position.

The GDXJ-based RSI indicator is also quite informative right now. It moved well above 50, but it’s not at 70 yet. Why would that be important? Because that’s when many of the previous corrections ended.

When one digs deeper, things get even more interesting. You see, when we consider corrections that started after the RSI was very oversold (after forming a double bottom below 30), it turns out that in all those cases, the tops formed with the RSI between 50 and 70. I marked those situations with blue ellipses on the above chart.

So, while it’s easy to “follow the action,” it’s usually the case that remaining calm and analytical leads to bigger profits in the end.

Also, let’s use yesterday’s move as something useful. If this single-day move higher made you really uncomfortable and almost made you run for the hills, it might be a sign that the size of the position that you have is too big. It’s your capital and you can do with it what you wish, but if the above were the case, it might serve as food for thought.

The big trend (as well as the reasons for it) remains down, which means that the enormous profit potential remains intact.

Friday’s decline confirms the above. While the GDXJ closed above the upper border of the previous price gap on Thursday, it closed back below it on Friday, thus invalidating the small breakout. This is a bearish sign, especially in light of what I wrote above. The top might be already in.

Remember, the strong medium-term downtrend remains intact.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Seems like you were completely right about this.

Oh man.

You should have followed this author, his recent short advice on $GDXJ was extremely profitable!

I don't agree. Charts are not the only tool here, for example world events and macroeconomics. And certainly not in this market unless you are doing an oversold swing. #Gold will explode by the end of this month!

I think you are right. Check out this Washington Post article, it is just one huge reason the dollar will suffer and gold will increase. There are many factors at play. It’s just a matter of time.

https://www.washingtonpost.com/world/2022/05/24/eu-russian-gas-putin-rubles/