Soaring Juniors And Soaring Excitement – What’s Next?

In yesterday’s analysis, I wrote that there will be no regular Alert today, but I think that you’d still appreciate at least some information, as PMs moved higher yesterday.

In short, what I wrote in yesterday’s intraday Gold & Silver Trading Alert remains up-to-date. Quoting:

Just a quick note as things are moving quite fast in the PMs.

The GDXJ moved sharply higher after the session started, and at the moment of writing these words, it moved to the upper border of the previous, early-May price gap. Please note that it was my original target for the previous long positions, and it was just reached.

It doesn’t change the outlook here. When we took profits from the long positions and re-entered short ones, I wrote that we are doing so, not because it was clear that the top was in, but because the risk to reward ratio changed dramatically. And that was indeed case. The fact that juniors rallied today doesn’t change it. In my view it was a good decision to switch the positions then based on the data that we had at that time.

Anyway, the medium-term trend remains down, and it seems that we’ll see another – very powerful – downswing shortly.

As always, we’ll keep you - our subscribers - informed.

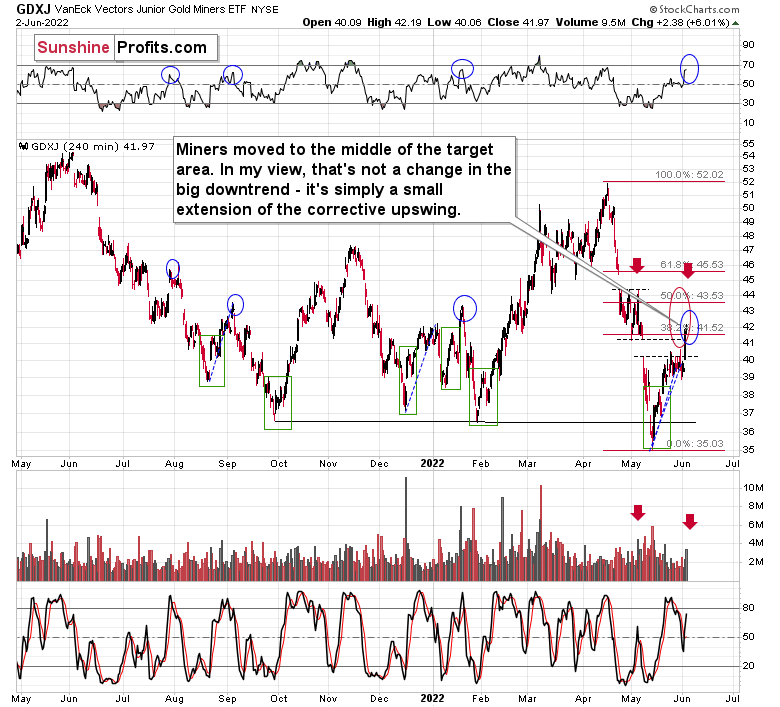

Let’s take a look at the chart for details.

The price of the GDXJ ETF – a proxy for junior miners – moved sharply higher yesterday, and this got many people excited. High volume confirms that. It’s natural for most investors and traders to view rallies as bullish, but let’s keep in mind that most traders tend to lose money… It’s not that simple. After all, the best shorting opportunities are at the tops, which – by definition – can only be formed after a rally.

The particularly interesting thing about high volume readings in the GDXJ ETF is that they quite often mark local tops. Remember the late-April – early-May consolidation? It ended when GDXJ finally rallied on high volume. That was the perfect shorting opportunity, not a moment to panic and exit the short position.

The GDXJ-based RSI indicator is also quite informative right now. It moved well above 50, but it’s not at 70 yet. Why would that be important? Because that’s when many of the previous corrections ended.

And when one digs deeper, things get even more interesting. You see, when we consider corrections that started after RSI was very oversold (after forming a double bottom below 30), it turns out that in all those cases the tops formed with RSI between 50 and 70. I marked those situations with blue ellipses on the above chart.

So, while it’s easy to “follow the action”, it’s usually the case that remaining calm and analytical leads to bigger profits in the end.

Also, let’s use yesterday’s move as something useful. If this single-day move higher made you really uncomfortable and almost made you run for the hills, it might be a sign that the size of the position that you have is too big. It’s your capital and you can do with it what you wish, but if the above was the case, it might serve as food for thought.

The big trend (as well as the reasons for it) remains down, which means that the enormous profit potential remains intact.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more