Inflation On Steroids Could Double The Price Of Gold

Introduction

The destroyer of wealth, inflation, has arrived, vigorously ravaging savings and effectively reducing the purchasing power of money on a monthly basis. The UK has just reported a jump in the rate to 10.1%, up from 9.4% for the month of June. The Bank of England's forecast of a peak of 13.2% in October may turn out to be a tad ambitious. An economist at U.S. bank Citigroup (C) said recently that British consumer price inflation is set to peak at 18.6% in January 2023.

In the U.S., the rate is around 8.5% and the FOMC has hiked the federal-funds rate to a range of 2.25% to 2.5%. There is no doubt that the central banks are now between a rock and a hard place. Hiking rates has slayed the inflationary dragon in the past and could do so again, but for the problem of the giant-sized debt that many nations are carrying. As rates rise, future borrowing costs rise, and so the choice is between either large interest rate repayments or inflation is allowed to go a lot higher and the populous takes it on the chin.

It is a delicate balancing act, but a high level of inflation would go some way to shrinking the debt, and that may be the better of the two evils for the central bankers.

Knowing where to shelter in these difficult inflationary times is the question we all wrestle with. Hard assets generally perform a little better in an inflationary environment, than other market sectors. So we would look to land, property, fine art, precious metals, etc. No doubt you are familiar with the term "the everything bubble." Most sectors of the market have been at record levels of late, reflecting this phenomenon.

However, the precious metal sector is lagging behind most of the other sectors and has some ground to make up.

Gold and silver are well below earlier all-time highs.

The associated precious metals mining stocks are unloved unwanted and undervalued in my opinion and that's where I am concentrating my efforts.

Central bank intervention via interest rate hikes tends to make a currency more attractive and as the charts below show the U.S. Dollar has been the beneficiary of such rate increases.

If the Feds decide to continue with an aggressive hiking monetary policy, then the economy will slow down and possibly go into a recession, even a depression. If they adopt a "go gently" approach, then inflation will become rampant and wage demands will jump. Strikes are happening right now in some parts of the world, and we could experience some dreadful civil unrest.

The Gold Chart

The chart below shows gold's performance over the last 12 months, and as we can see it has fallen considerably from its March high of $2075/Oz. It has also failed to hold the $1800/Oz support level, and it is lagging behind other commodities, some of which are at all-time highs.

Coming up shortly, we have Labor Day in the United States, signaling the end of the vacation season. Usually, the second half of the year is better for precious metals, so we may see gold perform better in the next six months than it has during the last six months.

Gold 12 Months Progress (StockCharts)

The US Dollar Chart

The chart below depicts the rise in the value of the U.S. dollar index against a basket of other currencies. It was 93 twelve months ago and has risen to 109, so the impact of an aggressive monetary policy stance has driven the U.S. dollar to greater heights.

US Dollar 12 Months Progress (StockCharts)

Some investors may consider that the U.S. dollar is also a safe haven in this economic environment, others have moved their cash to the sidelines while they figure out their next course of action. However, holding U.S. dollars even at an interest rate of 6 or 7% is a sure-fire loser if inflation is above 10%, which will force investors to move that hard-earned cash into something that protects it from the ravages of inflation.

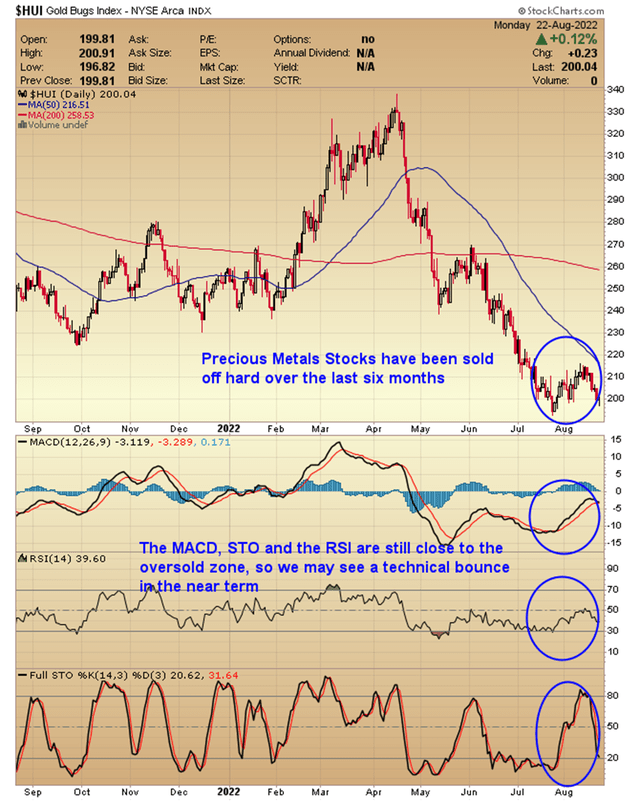

HUI Gold Bugs Index Chart

The chart below shows just what a dismal 6 months it has been for those who invest in the precious metals mining sector. The Index has fallen from 330 to 200 and is 68% off its high (630-200) made in 2011. These stocks I've been battered and remain unloved and unwanted, which suggests to me that the weak hands have finally left this sector. That old intangible of gut feel tells me that the upside potential is now greater than the downside.

Gold Bugs Index (HUI) 12 Month Chart (StockCharts)

I do own a number of gold and silver mining stocks. I'm not selling any of them, and I'm looking for an opportunity to increase my exposure to this sector. Maybe not at once, but fairly soon, as this could be the bargain basement that we have so patiently waited for and an opportunity not to be missed.

Conclusion

Rate hikes will be moderated and have little impact on inflation.

The powers that will throw money at every problem they see, and that will add fuel to the inflationary fire.

Think about protecting yourself and devise a plan to minimize the economic pain that is coming our way right now.

Give some thought to acquiring the hard assets that best suit your needs and acquire them.

Having experienced the inflation of 1979-1980, I expect the inflation rate to surpass the 20% mark. When that figure becomes headline news, gold will double and the stocks will rise in leaps and bounds.

Your comments would be very much appreciated, and I will do my best to address each and every one of them.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector.

More By This Author:

The Gold Bugs Index the (HUI) Takes A Hit

Silver: Buy Now While Stocks Last

Gold Stocks After The Flash Crash

Disclaimer: Gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or ...

more