How Long Will Gold Defend Itself From The Strong Dollar Impact?

While the GDXJ suffered after the FOMC meeting, gold and silver held their ground. How long will they last in the face of a stronger USDX?

The PMs were divided on Sep. 22, as gold and silver rallied by 0.32% and 0.70%, respectively, while the GDX and GDXJ ETFs declined by 0.38% and 1.20%. Moreover, with the S&P 500’s 0.84% decline supporting the latter’s movements, mining stocks fell alongside the U.S. equity benchmark.

Conversely, the USD Index and the U.S. 10-Year real yield hit new 2022 highs, which are ominous developments for the PMs. As such, the price action across asset classes largely unfolded as expected.

Yields Unhinged

With the S&P 500 and the GDXJ ETF suffering in unison on Sep. 22, hawkish realities continue to upend risk assets. Moreover, while gold and silver were relative outperformers, the implications of higher nominal and real interest rates should prove problematic in the months ahead.

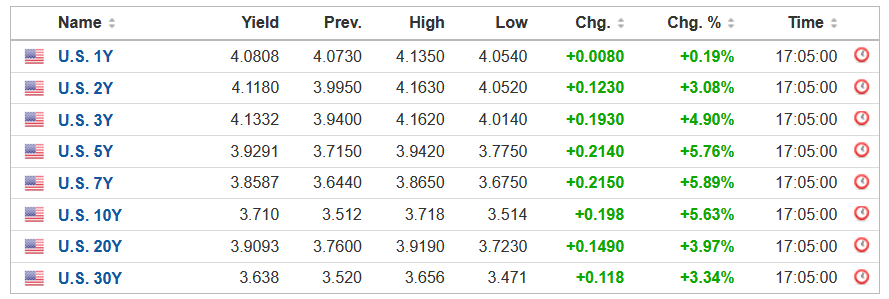

Please see below:

Source: Investing.com

To explain, the U.S. yield curve remains on fire, as Treasury yields rose sharply on Sep. 22. Furthermore, with the U.S. 10-Year Treasury yield ending the session at 3.70% (StockCharts' data), the benchmark has rallied by more than 100 basis points from its August low.

More importantly, with the U.S. 10-Year breakeven inflation rate ending the Sep. 22 session at 2.41%, the U.S. 10-Year real yield soared to 1.29%, its highest level since 2011. As a result, financial conditions continue to tighten, and the ramifications are profoundly bearish for gold, silver, and mining stocks.

In addition, the USD Index hit the new 2022 intraday and closed highs on Sep. 22, and the dollar basket remains poised for further gains. Therefore, the PMs' main fundamental adversaries continue to perform as expected, and their medium-term outlooks are bright as inflation keeps the Fed's foot on the hawkish accelerator.

Please see below:

To that point, the Kansas City Fed released its Tenth District Manufacturing Activity Survey on Sep. 22. The headline index decreased from 3 in August to 1 in September. However, the report revealed that “most month-over-month (MoM) indexes increased in September, except for supplier delivery time, materials inventories, and finished goods inventories.”

Also, the data showed that inflation and employment remained resilient, which is profoundly bullish for future Fed policy.

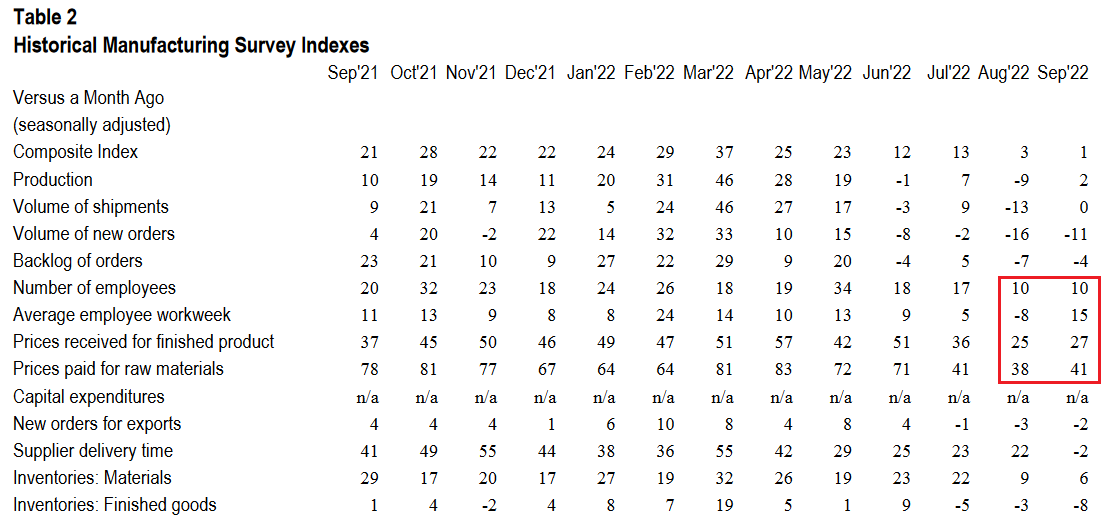

Please see below:

Source: KC Fed

To explain, the table above tracks the monthly readings for all of the KC Fed's manufacturing indexes. If you analyze the red box on the right side, you can see that prices paid, prices received and the average employee workweek all increased MoM.

Thus, KC manufacturing firms experienced higher inflation and increased their operating hours in September versus August. Similarly, the number of employees index remained constant at 10, which signals that KC firms are not laying off their workers as the U.S. labor market remains tight.

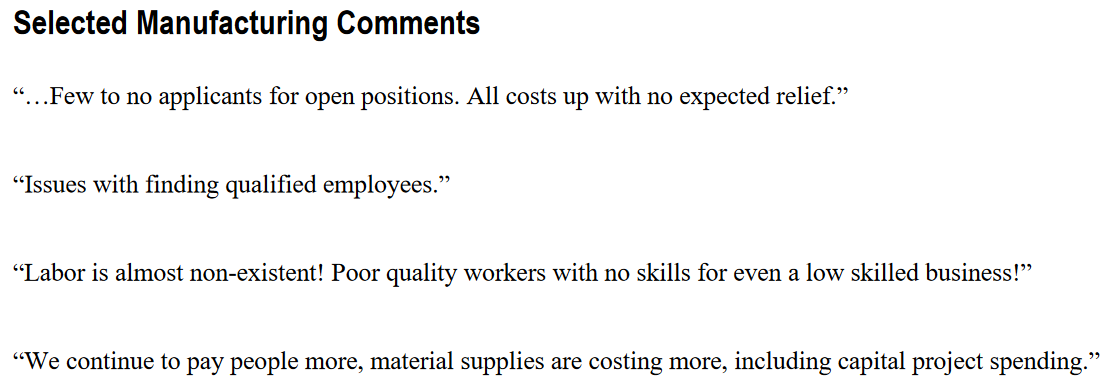

As evidence, KC firms' anecdotal comments highlight why wage inflation is unlikely to abate anytime soon.

Please see below:

Source: KC Fed

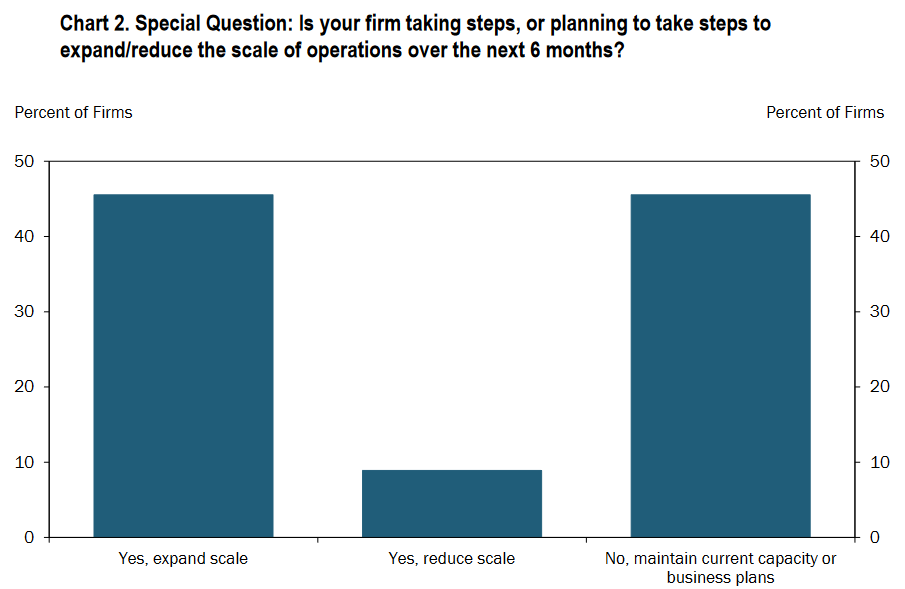

On top of that, the overwhelming majority of KC firms plan to increase or maintain their current capacity over the next six months. As such, the demand destruction needed to alleviate inflation still awaits us. The report stated:

“In September, nearly half of firms reported they were taking steps, or planning to take steps, to expand the scale of operations over the next six months, while only a handful expected to decrease capacity. The steps firms reported to expand scale included adding to workforce size, capital expansion, and expanding into new or existing markets.”

Please see below:

Source: KC Fed

In addition:

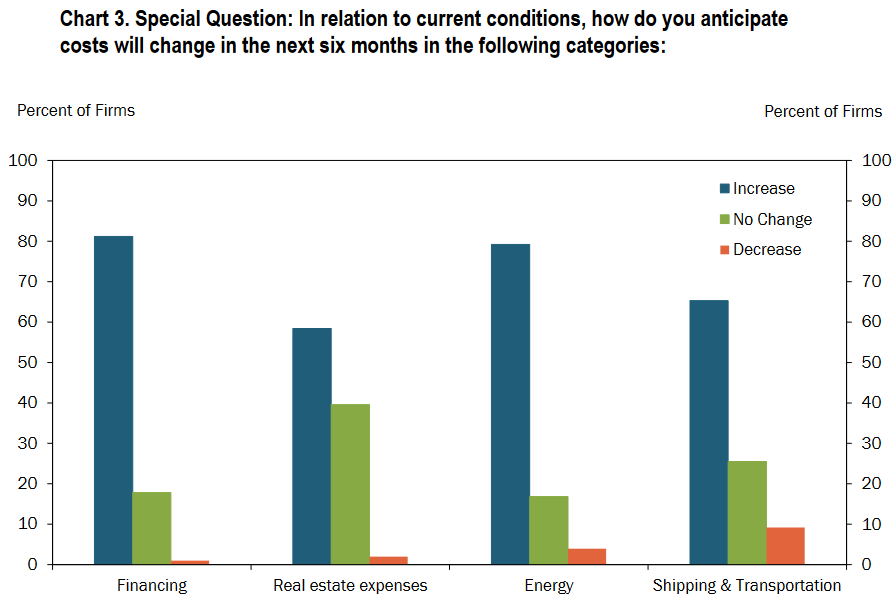

“In relation to current conditions, a majority of firms anticipated costs will increase in the next six months across all categories, especially for financing and energy-related costs.”

Please see below:

Source: KC Fed

Thus, with most KC firms struggling to find qualified workers and also expecting other input costs to increase over the next six months, the inflationary findings are bullish for future rate hikes. Likewise, with more than 90% of KC firms either expanding or maintaining their operations over the next six months, we’re far from the demand destruction that would allow the Fed to pivot.

As such, more rate hikes should commence in the coming months, and the liquidity drain is profoundly bearish for gold, silver, and mining stocks.

More Hawkish Data

While the consensus continuously cites supply-chain disruptions, I’ve warned on numerous occasions that demand is much stronger than the crowd realizes. Therefore, resilient consumer spending keeps inflation uplifted and requires a higher U.S. federal funds rate (FFR) to normalize the pricing pressures.

To that point, while the fall season has arrived and pent-up demand should be in the rearview, Americans remain eager to spend their money.

Please see below:

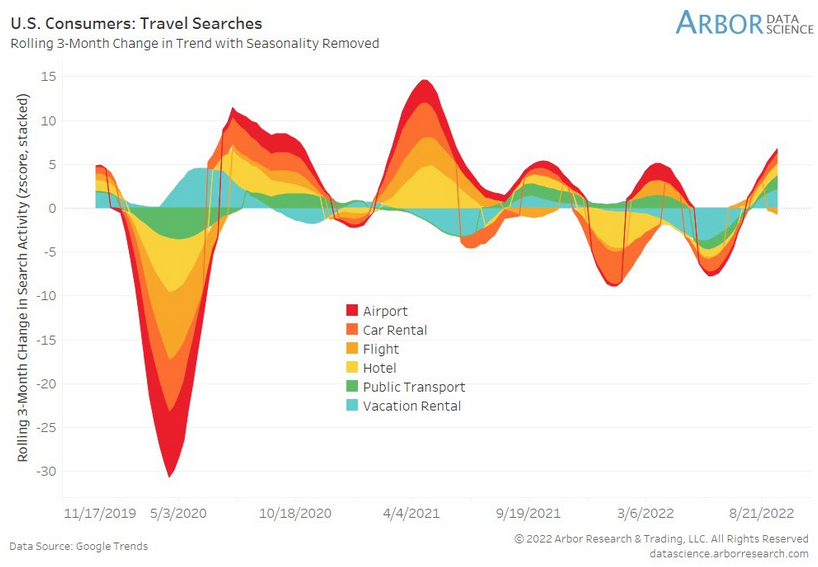

To explain, the shaded areas above track the z-score of the three-month rolling change in Americans’ Google Search activity for travel-related items. For context, these include flights, hotels, car rentals, etc.

If you analyze the right side of the chart, you can see that overall search activity remains decidedly elevated. Thus, despite higher inflation, Americans are still planning vacations, and material wage growth affords them this ability. Moreover, with households’ checkable deposits hitting a record high in Q2, Americans’ ability and willingness to spend makes the Fed’s inflation fight extremely difficult.

To explain, I wrote on Sep. 19:

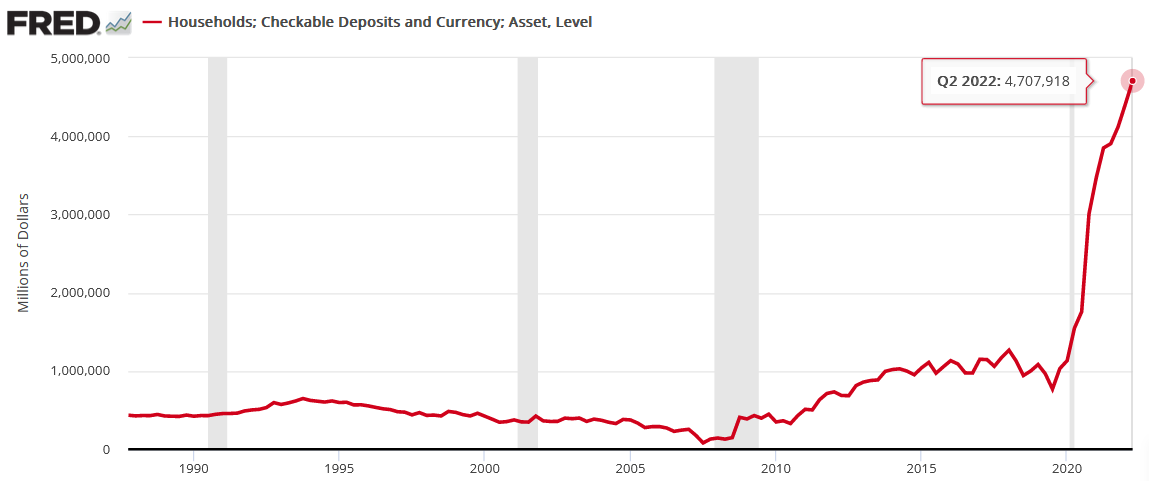

The Fed updated the data on Sep. 9; and with the metric hitting another all-time high, American households have nearly $4.708 trillion in their checking accounts (as of Q2), a 357% increase from Q4 2019. Furthermore, the Q2 figure is 6.7% higher than Q1.

Please see below:

Also noteworthy, General Mills released its first-quarter earnings on Sep. 21. For context, it has a nearly $50 billion market cap and is one of the largest food & beverage companies in the U.S. CFO Kofi Bruce said during the Q1 earnings call:

“We are modestly higher on inflation in the front half and modestly is probably appropriate. But I think on balance, it is still a relatively balanced year in terms of our inflation call between 14% and 15%.”

Moreover, CEO Jeff Harmening added that price increases are the necessary cure:

“We will start to roll over more meaningful pricing in the back half of this year; and obviously, we saw a strong price/mix come through in Q1 that's likely similar in Q2, and then it decelerates as we start comparing more meaningful step-ups last year.”

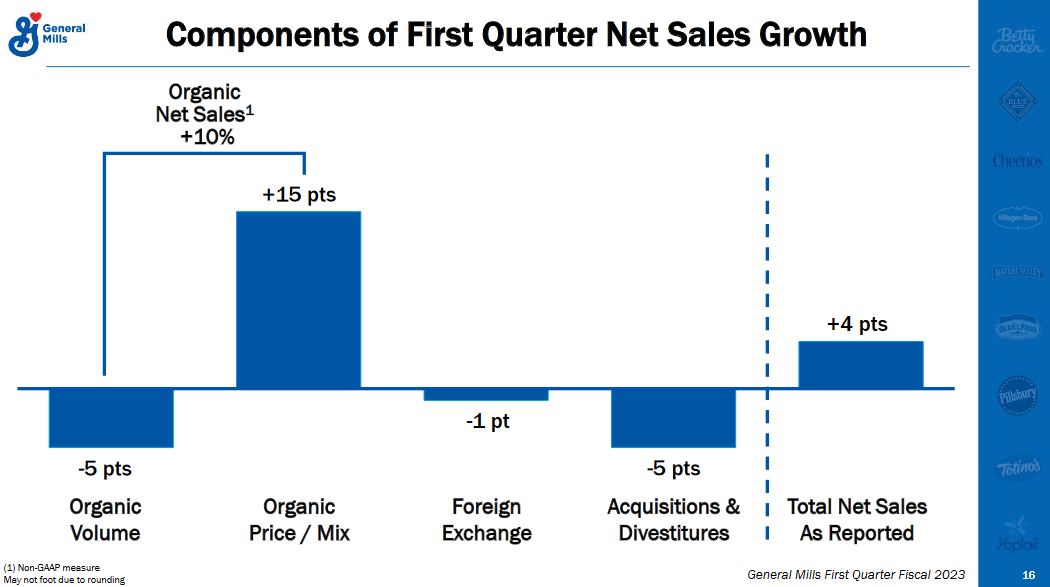

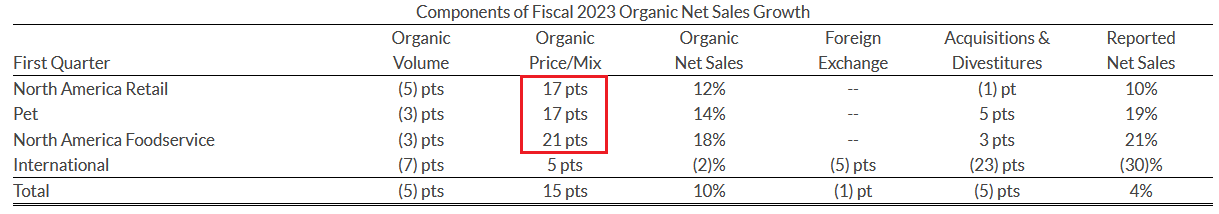

Please see below:

To explain, General Mills broke down its organic net sales, which excludes the impact of acquisitions, divestitures, and FX. If you analyze the left side of the chart, you can see that organic volume declined by 5% in Q1. However, organic net sales were up by 10% on the back of a 15% increase in price/mix. As a result, the company increased its prices by up to 15% in Q1.

But if we ignore General Mills’ international segment and focus on North America, the organic price increases were higher than the 15% consolidated figure.

Please see below:

Source: General Mills

To explain, the red box above shows how General Mills' North American retail, food service, and pet segments enjoyed organic price/mix increases of 17%, 21%, and 17%, respectively.

Moreover, with volume down across all segments, the data highlights how price increases were the primary driver of General Mills' top-line organic growth. Therefore, the Fed is still miles away from solving its inflation conundrum.

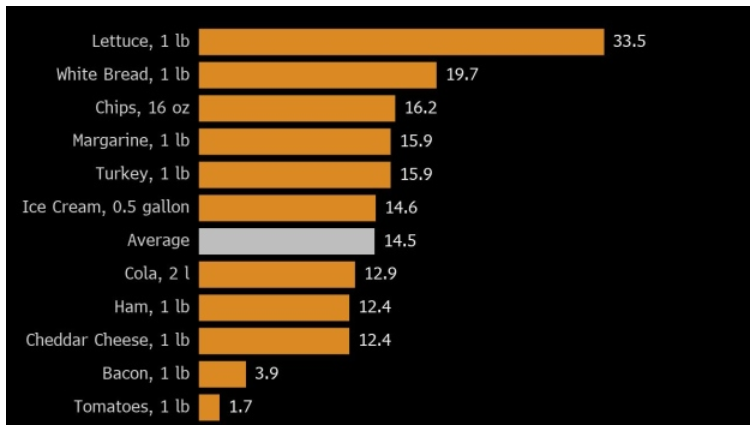

Finally, Bloomberg revealed on Sep. 22 that its American Diner Index increased by 13% year-over-year (YoY). For context, the index "includes ingredients for the tooth-picked club sandwich, as well as the accompanying potato chips, ice cream, and soda." In addition, its purpose is to gauge "how much more expensive it's become to assemble a basic meal." Thus, the food inflation story stretches far beyond General Mills.

Source: Bloomberg

The Bottom Line

With the bond market sell-off intensifying on Sep. 22, the S&P 500 continues to suffer. However, while the PMs have been relative outperformers recently, the impact of higher real yields and a stronger USD Index should weigh heavily on their performance over the medium term. Furthermore, while the general stock market’s decline has been rather orderly, a true bout of panic could intensify the pace of the PMs’ likely drawdowns – especially silver and mining stocks.

In conclusion, the PMs were mixed on Sep. 22, as mining stocks followed the S&P 500 lower. Likewise, with the fundamental pain poised to persist, the implications of rapidly rising interest rates are far from priced in. As a result, gold, silver, and mining stocks’ medium-term outlooks remain profoundly bearish.

More By This Author:

Gold Confirmed Its Breakdown By Not Returning Above 1,700 USDWill The Fed’s Rate Hike Delay The Fall In The Gold Market?

Wall Street Has Figured Out What It Takes to Fight Inflation

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more