Will The Fed’s Rate Hike Delay The Fall In The Gold Market?

While the 2013 analogy remains valid, the expected decline in gold stocks will probably be delayed. It depends on the decision of the US central bank.

If you read yesterday’s and/or Friday’s analyses, you know that the markets expect the rates to be increased by at least 0.75% this week. As they are increased by 0.75%, some market participants are likely to be surprised, and the overall implications could be bullish for the stock market and for other markets (including junior miners).

The above could be preceded by a powerful slide. The thing is that this huge slide has not happened so far this week. This means that perhaps the markets want to react in a different way. Please remember that no matter how well-researched a given forecast is, there’s no guarantee that it will be realized. It’s best to keep one’s eyes open and adjust the forecast frequently, based on new information.

In the current situation, the “new information” is that the decline in precious metals and stocks is not materializing this week.

This suggests that the markets might want to react differently than I described them in my recent analyses.

So, I’ve been thinking if there’s a way for the situation to develop in line with 2013 that doesn’t involve immediate decline, but at the same time makes sense in light of the upcoming rate hike.

I found such a scenario.

First of all, history doesn’t have to repeat itself to the letter, but rather it can rhyme. So, while the decline materialized immediately after similar price patterns in 2013, a 1 or 2 week of delay doesn’t change much, if anything, in the case of the analogy.

Second, I think I focused too much on the stock market’s performance in connection with the midterm elections in the US. Voters are most concerned with inflation. Period.

Consequently, instead of some kind of dovish message from the Fed, we could get a hawkish one in order to make people think that the powers that be are pushing hard to fight inflation.

In fact, if the stock market declines now, before the elections, but the powers that be can brag about some inflationary success, it could be framed as a situation in which “the people” are most important and “the wealthy” are made to help “the people.” After all, stocks are mostly owned by the wealthy, and inflation is a concern for everyone (but many research papers point to lower-income families being hit hardest).

So, actually, it might make sense to now hit hard on inflation at the stock market’s expense.

The third and final point here is that the markets sometimes wait for a certain announcement before they get back to their original trends. We’ve seen this numerous times in the precious metals market. In this case, sometimes it doesn’t even matter what the news is – the key thing is that the tension and uncertainty regarding the news are gone once it’s announced.

Combining all the above provides us with a scenario in which not much happens until Wednesday’s rate hike announcement, and then, regardless of the initial reaction, the big decline in the precious metals market continues. And yes, the “initial reaction” could mean that we’d get a 1-2 day (or so) rally.

Let’s check how this fits the GDXJ’s and gold’s charts.

(Click on image to enlarge)

Gold is consolidating below $1,700. It closed below this level for three consecutive trading days, and we saw a weekly close below this level. This has not happened previously. Each attempt to break back below this level (since 2020) was quickly invalidated.

This time is already different.

Technically, this is extremely bearish.

So, why doesn’t gold slide from here? Probably due to the uncertainty surrounding the interest rate hike.

(Click on image to enlarge)

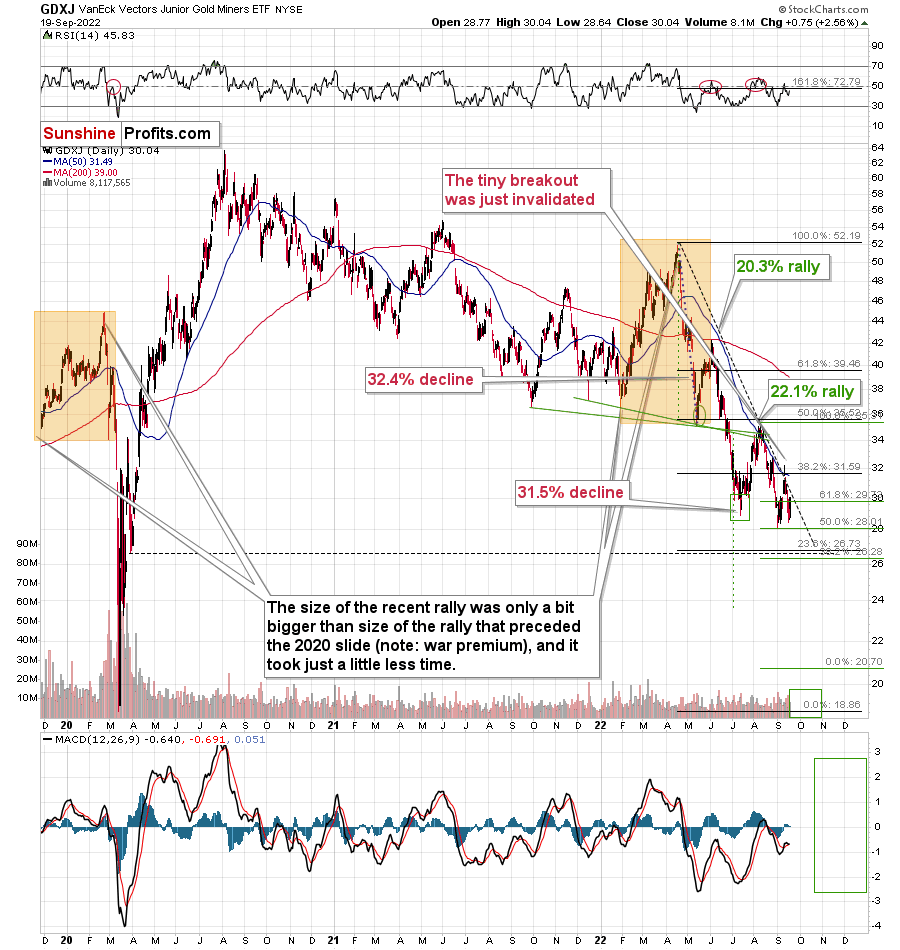

While gold prices are consolidating below their previous lows, the GDXJ is not below the early-September lows, which might appear bullish. However, is it?

The early-September low is not the only reference point out there. The lows through which gold broke are the 2021 lows. The GDXJ ETF is trading many dollars below those analogical lows. It’s not strong relative to gold, even though the last couple of days might indicate this.

The thing is that the GDXJ simply rallied substantially in the first half of September, likely due to the stock market’s rally. Thus, it resumed the decline from a relatively high price level (about $32).

(Click on image to enlarge)

Stocks are not below their early-September low at this moment, so it’s not that odd to see junior miners there as well.

While the stocks-juniors link might have had a positive impact on GDXJ’s prices recently, it’s likely to make them decline more in the future. Remember how stocks plunged in 2008? Or in 2020? And in what manner were they destroyed?

There’s one more interesting thing on the above S&P 500 futures chart. Namely, there’s a triangle-vertex-based reversal scheduled for tomorrow. This perfectly fits the scenario in which stocks move higher today or tomorrow (or they could do pretty much nothing), and then they slide in the following part of the week after the rates are increased.

The implications for the very near term (next 1-3 days) are unclear, but they are bearish for the coming days.

(Click on image to enlarge)

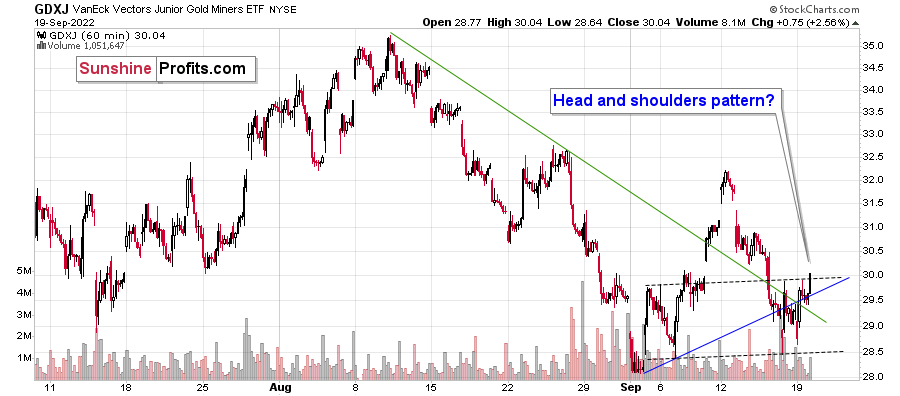

Also, looking at the 1-hour candlestick GDXJ chart, we see that the price might be forming a head-and-shoulders pattern, which is bearish – once it’s completed. In this case, it would take a decline below $28.5 for the formation to be completed, and the price would be likely to decline to at least $25. Based on other charts, the most possible target is about $20.

All in all, I wouldn’t bet the farm on a situation in which the precious metals sector declines immediately, but I continue to think that keeping short positions in the GDXJ at this time is very much justified from the risk-to-reward point of view. We’re aiming to profit from a huge decline here, not on day trading – at least that’s my approach. Naturally, you can do with your capital whatever you want, but in my view, the big move provides the greatest risk to reward-ratio.

More By This Author:

Wall Street Has Figured Out What It Takes to Fight InflationGold Fell Under Its 2021 Lows; Ready For The Real Slide?

Do Investors Still Believe That The Fed Is A Miracle Worker?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more