Have We Been Crushed Enough In Crude?

Monday’s 5% one day up move in crude oil prices have certainly caused the “US$200 WTI” crowd to re-emerge from their parents’ basements! It certainly got this little 🐿️’s heart racing.

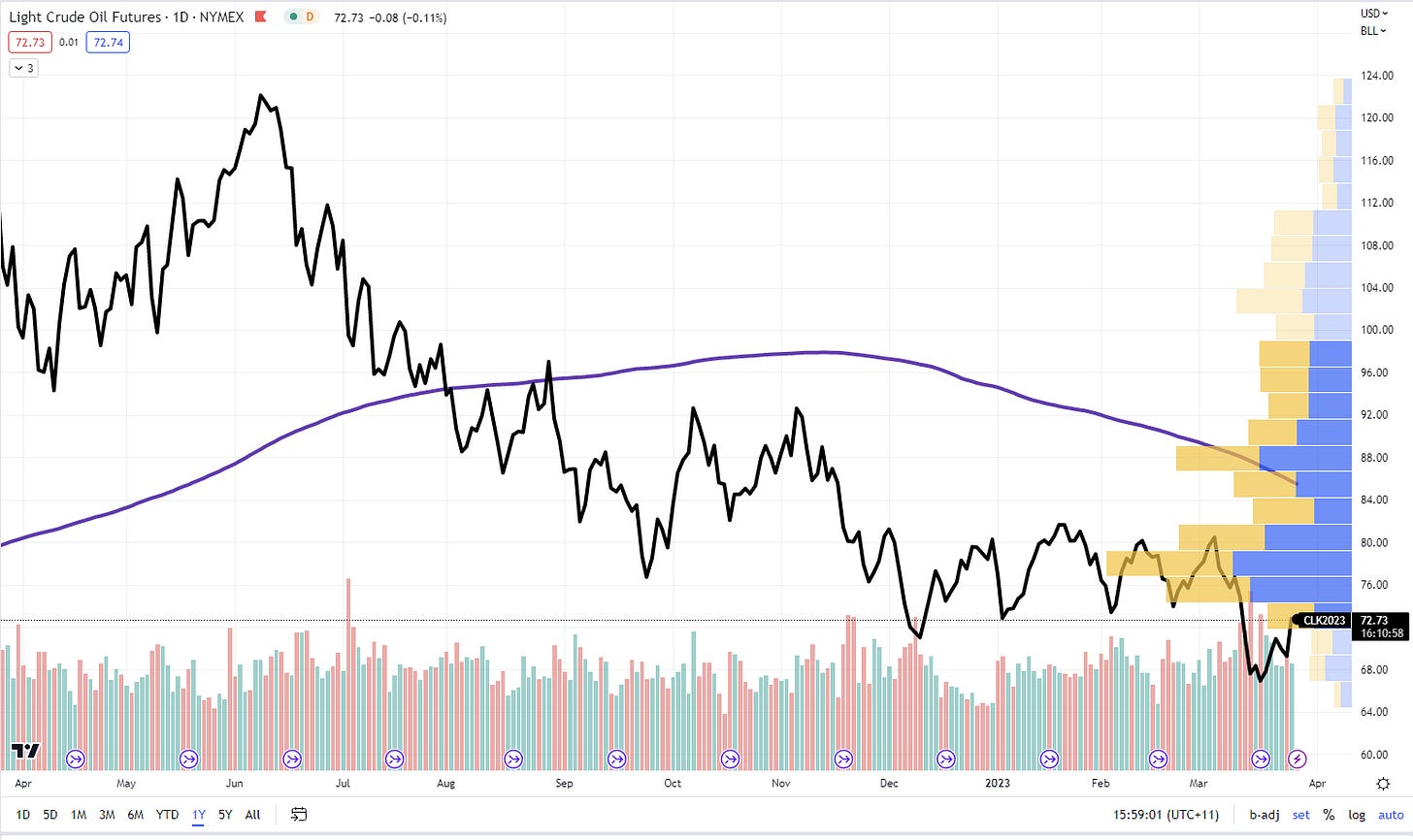

An exciting move, but the chart has plenty of work still to do. WTI spot is still US$12/ bbl away from its 200-day SMA (purple line below) with a chunky volume profile (blue and yellow bars below) a few dollars above acting as firm potential resistance.

WTI Futures (continuous). Daily Chart. Source: Tradingview.

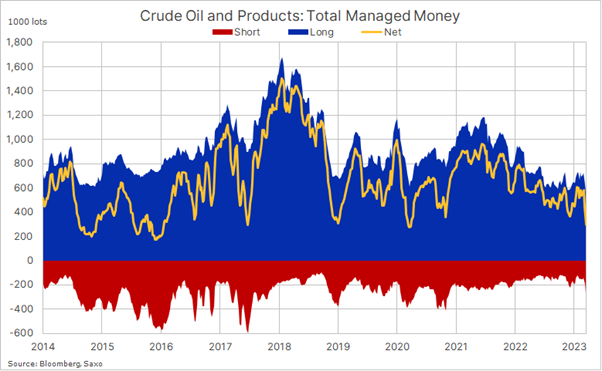

Perhaps that final flush down off the back of the carnage in short term interest rate markets has marked a low. Yesterday’s moves would have been hellish for any fresh shorts highlighted in the most recent “Commitment of Traders” report.

Crude oil futures positioning from Saxo’s Ole Hansen

Risk / reward from here would certainly seems to favor the bulls. The impact of continued supply of ‘Russia Barrels’, President Biden’s extensive SPR releases and disappointment around the extent of the ‘Great China Re-opening’ must now surely be all fully priced?

The final argument of the bears is that rising interest rates and injured banks choking credit supply are going to tip global economies into a deep recession that crushes demand.

We are not convinced that this happens in the run up to a US Presidential election year. In theory, we just need to bide our time while global oil and product inventories start to draw consistently and the physical market begins tightens up.

Harris Kupperman’s weekend Kuppy's Kliff Notes shared an interesting thought on the impact of rising interest rates on commodity carry trades. He observes that years of ‘free money’ has eroded working capital discipline throughout commodity supply chains.

What if all the year-to-date inventory builds we have been seeing are not reflections of a significant reduction in end-user demand, instead…

“Is a gas station that used to fill up the tanks to the top, now saying “only fill me half-way”?”.

This certainly makes sense if you are now paying 7%+per annum to hold inventory. Kuppy sees this effect pushing multiple markets in to contango. This comment got me doing a bit more digging and I was directed by @conchofarmer on Kuppy’s member Discord to a couple of recent articles from veteran oil analyst, Phil Verleger (here and here).

Verleger writes about what he calls ‘The Great Inventory Liquidation’. He wrote the following 3 weeks ago:

“Given the change in industry structure and the willingness of governments to step in to meet shortages, we must expect to see commercial stocks decline sharply. The great inventory liquidation has begun. Do not be surprised if global commercial stocks are down by 400 million barrels by the end of 2023.”

He argues for inventory liquidation due to rising interest rates, structural changes in oil’s market structure (due to divestitures of refining assets by integrated firms since the last period of high interest rates), and the willingness of consuming nations to intervene (with SPR releases - to the extent that they still can). Per-barrel oil storage cost now exceeds $1, and lenders (in a credit squeeze) are scrutinizing every request.

Furthermore, the G7 ‘cap’ on Russian oil prices also potentially discourages large crude inventories. This is because refiners and marketers in Europe, North America, and OECD Asian nations worry that their competitors in India and China will take advantage of lower priced crude and products from Russia to boost production and dump products back into their markets.

If he is right, this is is potentially going to keep a lid on crude prices. I do not run Valero and so have no idea, but I can be sure that skinny crude inventories (SPR and private) is not good for overall market resiliency. The risk of a massive ‘super spike’ in prices as a result of a geo-political event will have gone up dramatically.

In the meantime, is this working capital adjustment being viewed as actual reduction in ‘end demand’ by the market and how does the market price this effect? Either way, inventory liquidation, if it continues, should impact crude demand in the front contract delivery months.

The front end of the curve could well continue to see some crazy volatility, with extremes (in both directions!). We are focused on the longer term structural undersupply story for oil, and our main exposure is further out on the curve (via December 2024 and 2025 futures contracts).

We also retain a small exposure to an event driven potential ‘super spike’ in prices via ‘lottery ticket’ style call options on BNO (OptionStrat link here), the US-listed Brent Crude ETF. This structure also works as a hedge for our other energy (WTI focused) positions against any (crazy) crude export ban by the US.

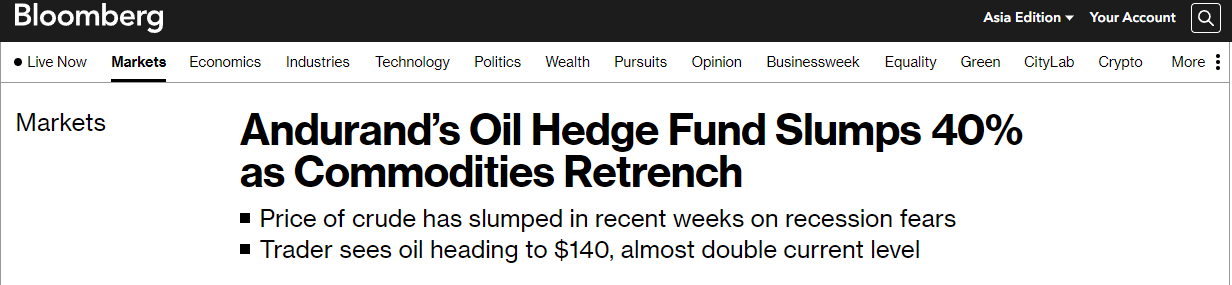

We are long term oil bulls, but this energy trade ain’t going to be easy. The best trades never are. Ask Pierre Andurand, and he is definitely one of the best in this game!

More By This Author:

Footballing In No Man’s Land

Scrooge McSquirrel; Monetizing Polarization; A Convex Play On Gold

CoCo Pops: Only Half Price? Some Thoughts On Bank Capital

Disclosure: We are long call options on BNO.

Disclaimer: Please see full disclaimer at more

What's your current take?