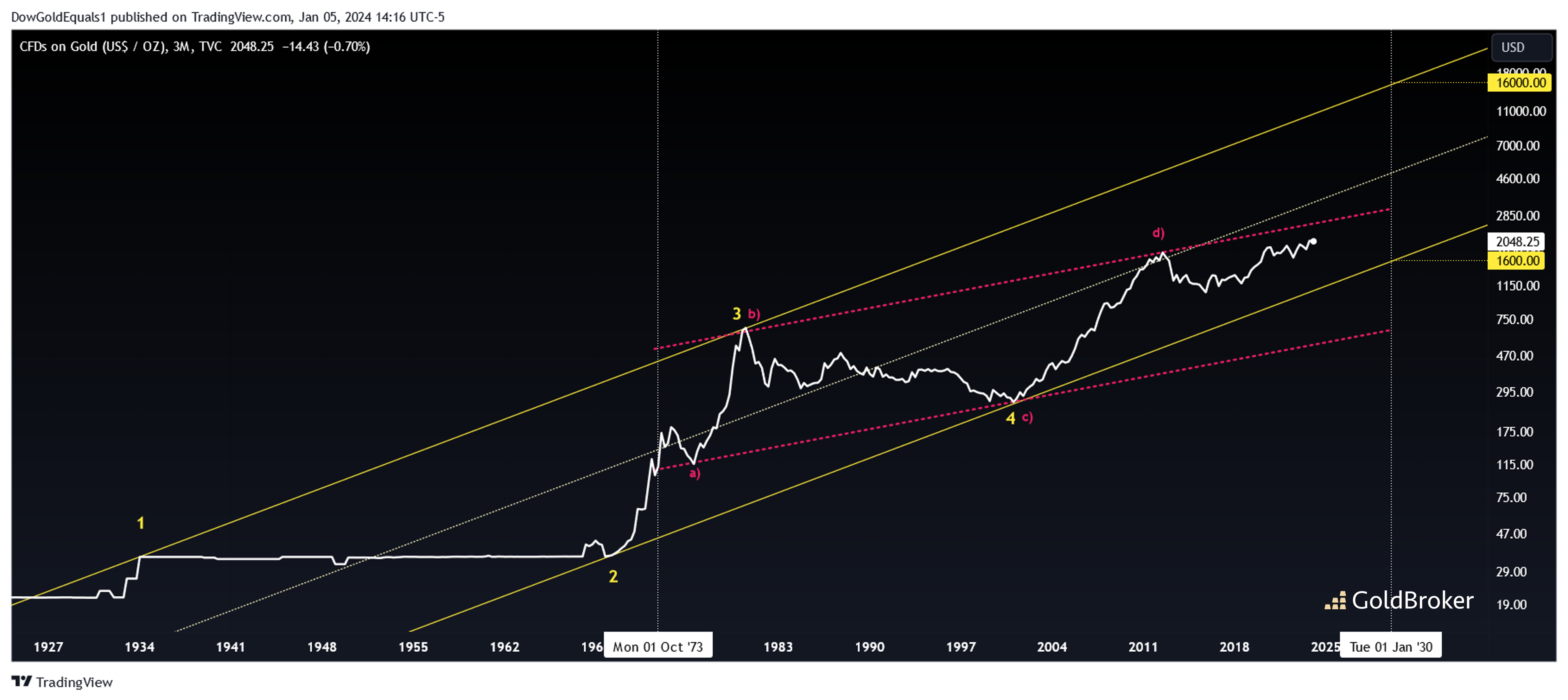

Gold's Channels Hint At Much Higher Prices By 2030

(Click on image to enlarge)

This week we will look at gold's price as a series of large ascending channels that will provide a framework for where price could go by the end of the decade. We will begin by looking at gold in the broadest of terms - a huge channel with fascinating touchpoint dates. Touch Point 1 was in 1934, a historically significant date when the price was revalued from $20.67 to $35 under the United States' Gold Reserve Act. Touch Point 2 came in 1970 and marked a historic low just months before President Nixon officially closed the "Gold Window" in 1971. Touch Point 3 was the 1980 blowoff top, and Touch Point 4 was the historic low of 2001 that marked the end of a brutal 20-year secular bear market and the beginning of the current secular bull.

Looking out to the year 2030, we can see that if the price is to remain in this 100-year channel, it will be no lower than $1,600 but could rise to as high as $16,000. That provides a maximum downside of about 20% and a maximum upside of about 8X. Should the price get back to the midline by then, it would be about $5,000. Note the secondary pink channel that began in 1973. Breaking out of this channel will certainly be key to activating higher price targets within the yellow channel.

(Click on image to enlarge)

The second chart zooms in on the pink channel and includes a smaller blue channel that thus far has been a near perfect fractal in an angle of ascent and overall placement of touch points. Also interesting to note is that the two yellow resistance lines noted are of the exact same angle. Gold has recently broken above its recent yellow resistance line after a lengthy battle, which could portent an impulse move higher to the $2,500-$3,000 range over the next couple of years - a move that could finally enable price to break out of the pink channel.

More By This Author:

The Fed Has Not Won The War On Inflation

Japan Hit By Inflation: What's It Got To Do With Us?

Towards A Radical Paradigm Shift In The Investment World?

Disclosure: GoldBroker.com, all rights reserved.