Japan Hit By Inflation: What's It Got To Do With Us?

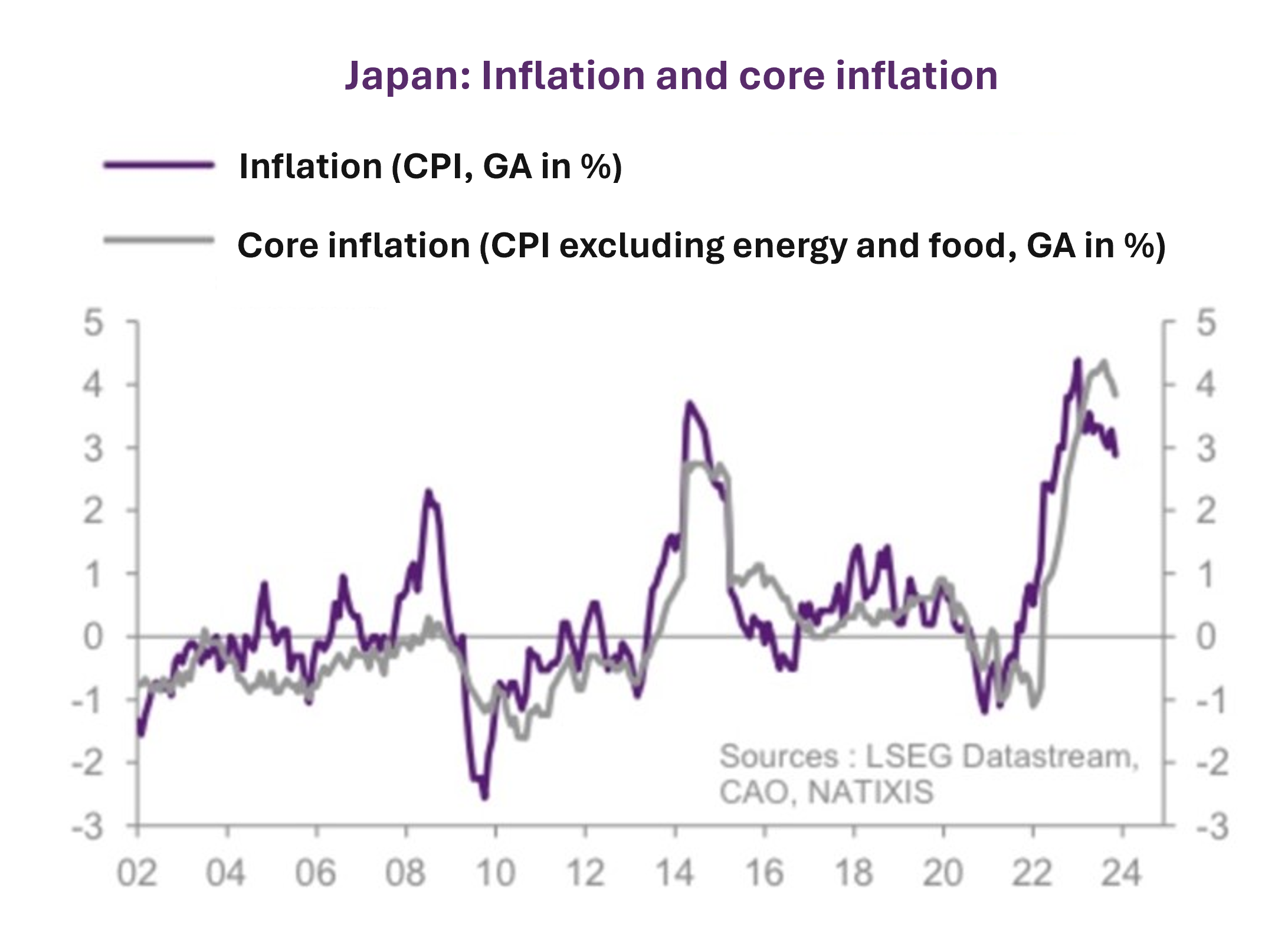

Inflation takes off at around 4% in Japan, a significant level for a country which, apart from the 2014 surge, has generally recorded inflation rates close to zero, or even negative, since the turn of the century.

For the Natixis research department, this figure "is the result of both rapid wage growth and falling productivity". Of course, this phenomenon is more or less the same in Europe (stagnant productivity, moderate wage growth). This is indeed a driver of inflation, but it reveals a deeper problem in the form of a loss of competitiveness.

But is this explanation sufficient? Given that nominal per capita wages rose by just 2% in 2023, shouldn't we also be looking at public debt, which exceeds 250% of GDP (more than double that of France), and is rising steadily (140% of GDP in 2002)? This debt is acquired by Japanese savers and the central bank via the printing press, which is inflationary (as it is money created without any counterpart in the real economy). We have seen this in Europe with the ECB's use of money printing to finance the colossal costs of lockdowns. That's where inflation came from, even if it was later exacerbated by the energy crisis. At some point, the devil comes out of the woodwork.

The burden of this debt (the interest payable each year and entered into the government budget) remains moderate (1.4% of GDP), as it is essentially made up of bonds issued at zero interest. But the rise in interest rates, made necessary by inflation, will soon increase the debt burden.

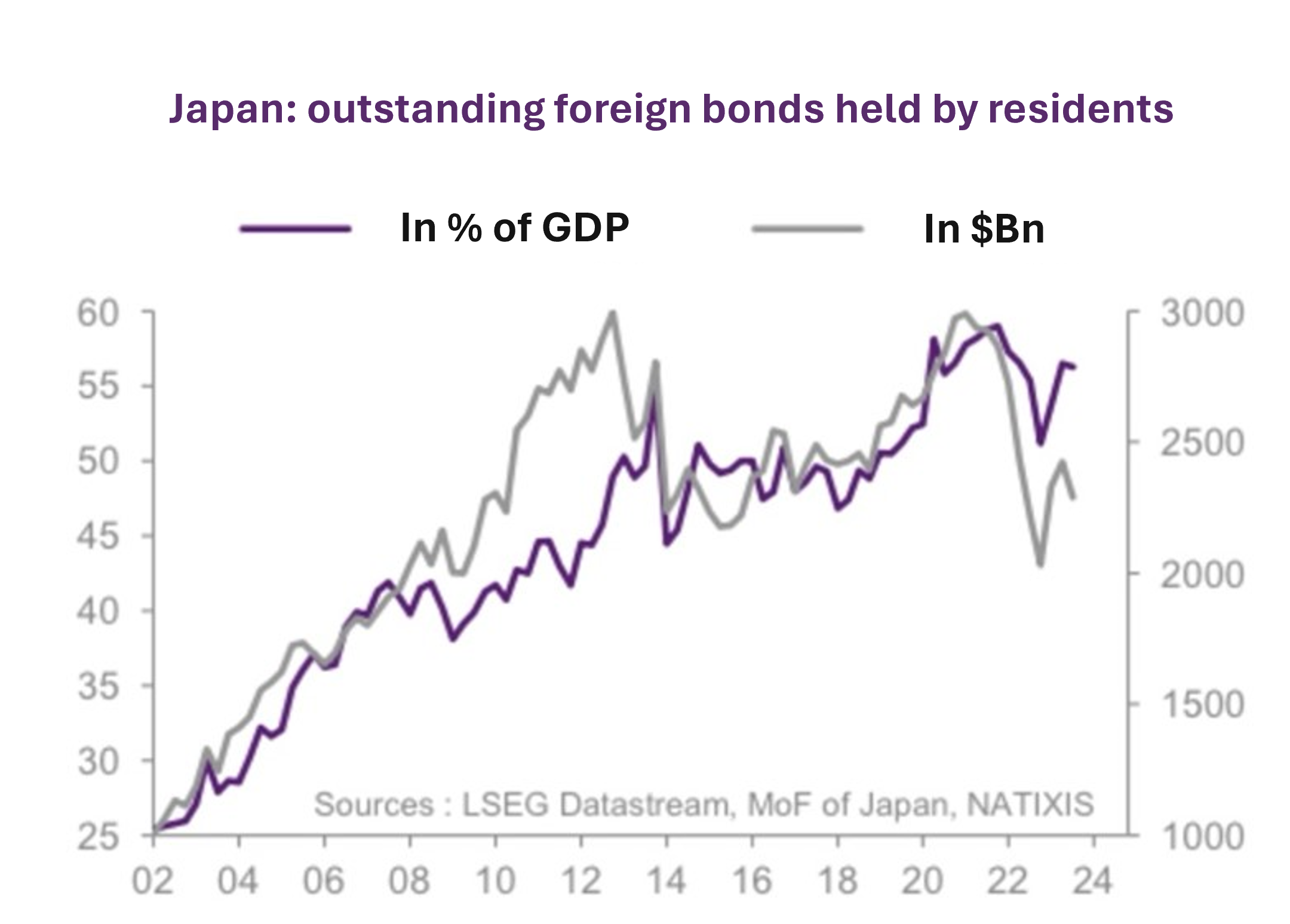

Another effect of this burgeoning inflation could concern us directly. Japan holds huge quantities of foreign bonds, the equivalent of $2.5 trillion, mainly from the United States and Europe. This accumulation stems mainly from trade surpluses prior to 2010 (since then, the balance has barely been achieved), but above all, because Japanese savers want yield when local debt offers zero or even negative interest rates.

If interest rates on Japanese bonds rise, the Japanese will get rid of these bonds issued by the USA and eurozone countries... Will this trigger a bond crisis? These sales would provide the Fed and ECB with yet another reason to start printing money again, the main reason being the massive budget deficits in the USA and several European countries (including France). This would be very bad news, as inflation would take off again... So we need to keep a close eye on what's happening in Japan. And no, we're not done with inflation yet.

More By This Author:

Towards A Radical Paradigm Shift In The Investment World?What Is The Economic Outlook For 2024?

2024 Is Likely To Be A Volatile Year Due To The Debt Wall

Disclosure: GoldBroker.com, all rights reserved.