Gold Stocks & Gold A Bullish Divergence

As the Roman empire burned, the silliest citizens (with lots of tin and little gold) had a pipedream, which was that their favorite politicians would put out the fire.

(Click on image to enlarge)

In America, the silliest citizens (who enjoy owning no gold) imagine that fiat-oriented politicians can replace gold, stop the inferno, and resurrect what is already ashes.

Sadly, that can’t happen any more than one plus one can soon equal three, but citizens can do the simple math, and buy some gold.

Dare I say… lots of gold?

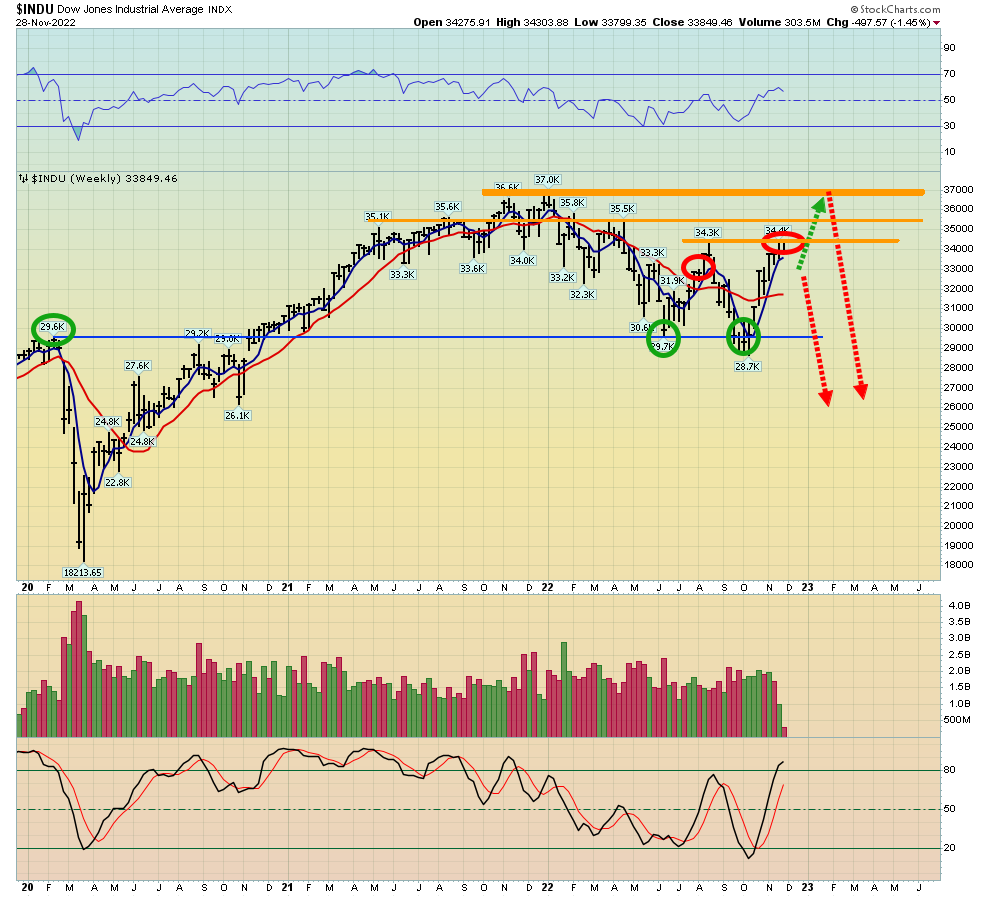

The old/basic/main economy Dow index could rise to a new high while the Nasdaq wallows (for decades) in a stagflationary gulag… but for the remaining 20-30 years of the American fiat empire, it’s all about gold.

What about the next 100 years?

The next century will look like a super-sized version of America’s 1880s “Golden Age”.

India’s GIFT city is set to become the world’s main gold price discovery hub, dwarfing the COMEX, LBMA, and China’s SGE. Mining stocks will become an institutional darling asset class as that happens.

The gold charts look fantastic.

(Click on image to enlarge)

Yesterday’s meltdown in the US stock market saw some selling in gold, but all that did was further sculpt a majestic right shoulder on what already looks like the work of Michelangelo!

A look at the weekly chart,

(Click on image to enlarge)

On this chart, all the technical lights are green.

To view some key moving averages,

(Click on image to enlarge)

A fresh buy signal is in play for the 5,15 series moving averages. These signals have a solid track record.

Also, there’s a slight broadening pattern in play. These patterns suggest situations that are out of control.

On that note,

In parts of Europe, inflation is out of control.

The ECB is trying to fight 8%-10% inflation with 1%-2% interest rates. That’s a strategy doomed to increase inflation rather than reduce it.

Lagarde acts shocked that her silly policy has failed… instead of stating that she’s ashamed.

The lockdowns in China are adding to supply chain inflation. The Foxconn protests (riots?) are adding to concerns. Apple bills itself as a wonderful woke company, but thousands of its Chinese workers look more like caged (and enraged) animals and slaves.

Western governments are waving China-bashing flags and the fiat-oriented citizens of the West are cheering as instructed, but many Western companies are beginning to wonder if their own Chinese suppliers could turn mean.

(Click on image to enlarge)

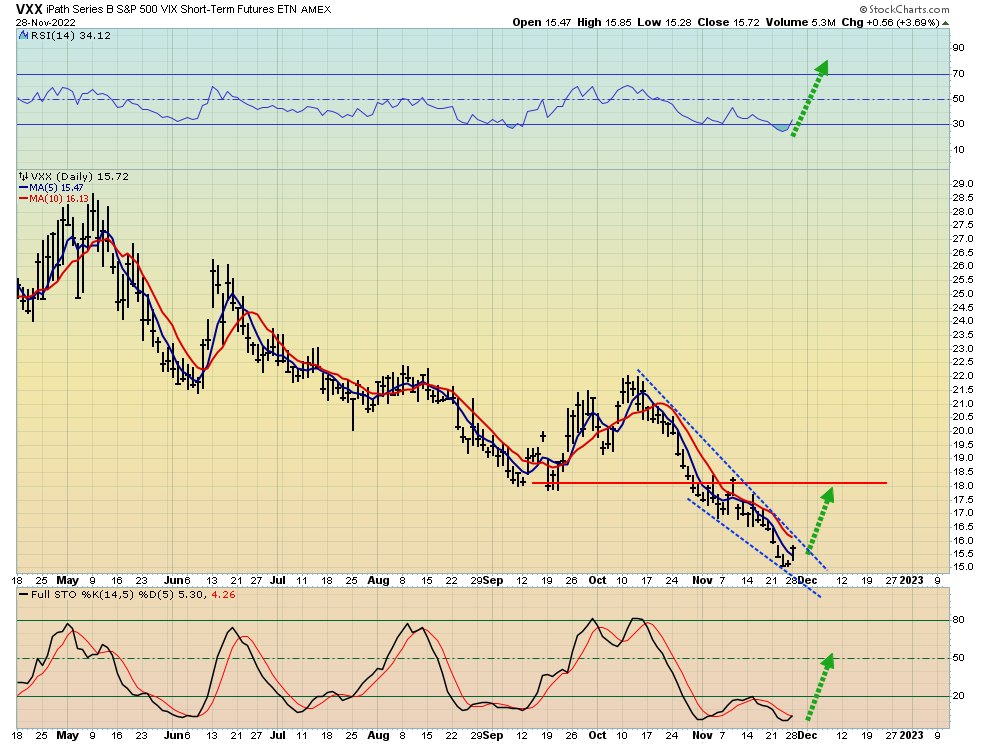

When the world goes out of control, of course, gold rises… and so does financial markets volatility. VXX is a great tool to profit from the action.

A US rail strike is still possible, and if it happens, VXX could stage a “rocket blast” higher! Even without the strike, the US stock market is currently skating on very thin ice.

Gold looks stellar on all the charts and mining stocks allow investors to leverage the gold price action… without borrowing money.

A look at a key GDX chart,

(Click on image to enlarge)

Note the two blue circles on the chart; GDX has risen above its July high, while gold has not.

That’s a significant bullish divergence. Also, there’s not much overhead resistance for gold, meaning it’s now quite likely that GDX can push through its $29-$30 resistance zone with “less effort than expected”.

(Click on image to enlarge)

The situation is similar for GOAU; higher highs are in play and the chart is bullish!

The US jobs report is on Friday and gold is often soft ahead of the report… and then it rallies nicely in the days that follow. The current consolidation in the miners is creating an ideal entry point for gold and silver stock enthusiasts around the world!

More By This Author:

Gold & Oil: Another Inflationary Wave?

Gold Charts: A Bullish Shine

The U.S. Election And A Vote For Gold