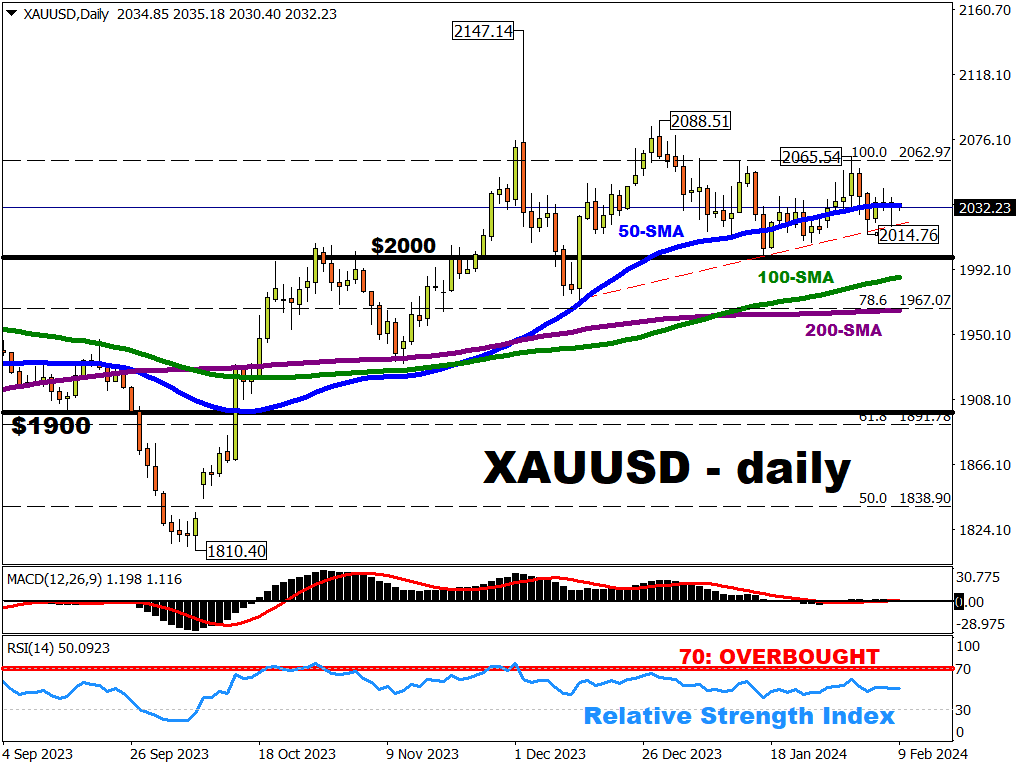

Gold Stays Close To 50-Day SMA Ahead Of CPI Signals

Gold has seen relatively muted price action in recent sessions.

Markets continue to wait for greater clarity on the expected Fed rate cuts, before making another big move in spot gold.

Although markets have greatly reduced bets for the Fed to commence its policy pivot in March, futures still point to a 72% chance for the Fed to lower US rates in May.

Amid the indecision, since Tuesday's close ...

Spot gold has not strayed far from its 50-day simple moving average (SMA).

The US CPI revisions later today (Friday, Feb 9th), as well as next Tuesday’s January inflation data, could trigger gold’s next big move.

- Evidence that US inflation is not slowing as quickly as policymakers would like should force markets to further push back expectations for Fed rate cuts, which in turn could dampen bullion further.

- Signs that US inflation is taking meaningful steps towards the Fed’s 2% target should help this precious metal revert to recent heights.

More By This Author:

Disney To Climb Above $100?

USDCAD Is Testing Key Resistance Level At 200-Period SMA

Brent Tumbles Back Below $80

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more