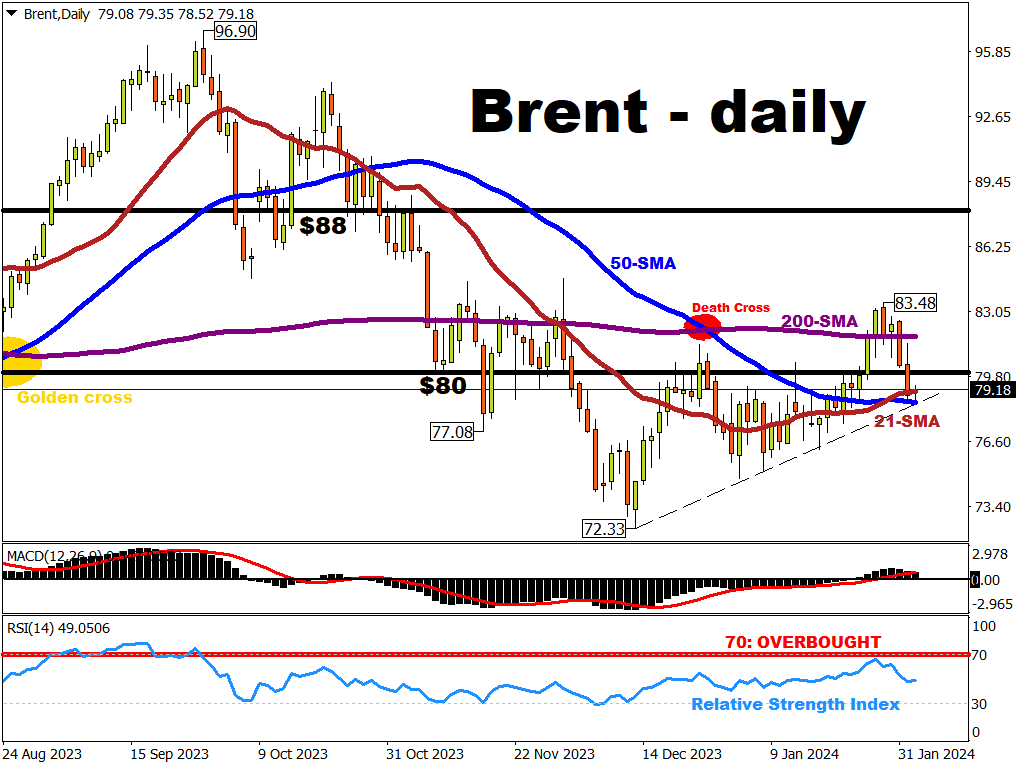

Brent Tumbles Back Below $80

Brent has faltered back into sub-$80/bbl levels as markets unwind the geopolitical risk premiums from benchmark oil prices.

Markets are noting the positive developments surrounding a potential ceasefire in the Israel-Hamas war, which could dilute supply-side risks.

Despite OPEC+ sticking to its lowered output levels for this quarter, bullish sentiment may have also been further eroded this week after Fed Chair Jerome Powell said that a March rate cut appears unlikely.

At the time of writing, oil prices are testing technical support around its 21-day and 50-day simple moving averages (SMA).

Additional support can also be drawn from the rising trendline from that December 13th, 2023 intraday low of $72.33.

A sustained recovery in oil benchmarks would require :

- steeper OPEC+ production cuts

- evidence of more policy support for the US and Chinese economy

- another escalation in the ongoing tensions in the Middle East

However, if the bullish catalysts listed above fail to progress, then Brent may be forced to keep languishing in sub-$80/bbl waters in the interim.

More By This Author:

Solana Briefly Touches Below 21-Period SMAUSD Trades Above 200-SMA Ahead Of Fed Meeting

Can S&P 500 Reach 5,000 By February?

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more