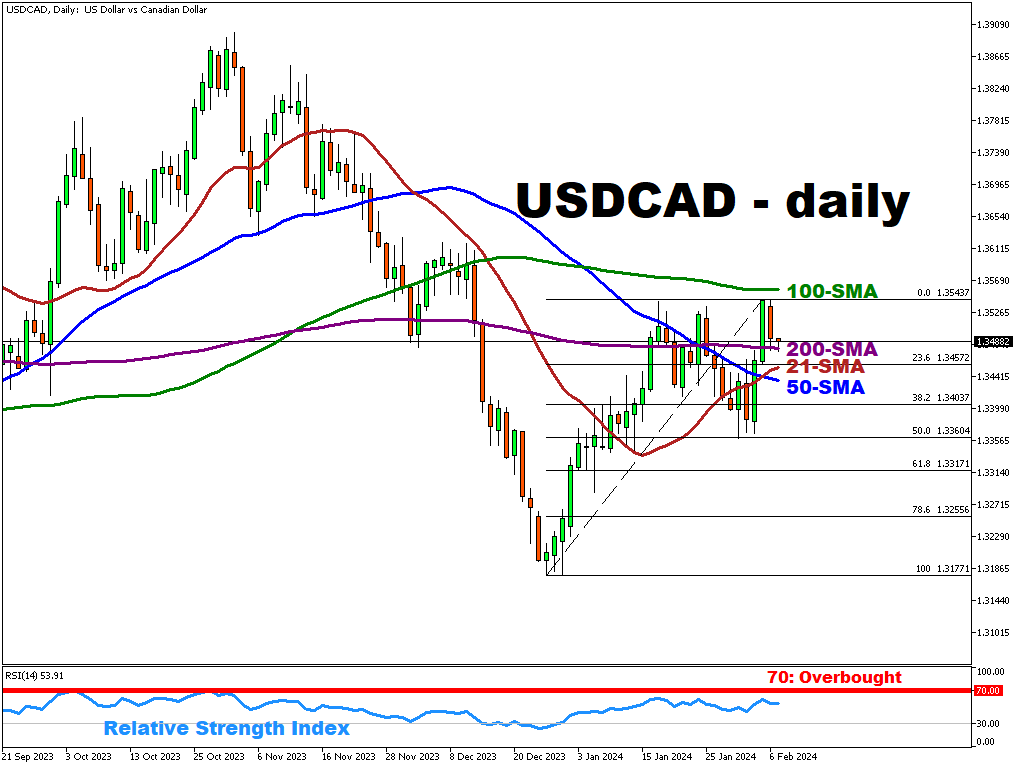

USDCAD Is Testing Key Resistance Level At 200-Period SMA

USDCAD continues to fall for the second day in a row on Wednesday after hitting this year’s high (1.35437) on Monday.

USD bulls are actively testing the 200-period SMA (~1.347908).

A break below this important level could drag the pair lower towards potential support levels: (1) 21-period SMA (1.345324) and (2) 23.6 (1.34572) Fibonacci level.

If another lower bottom is formed at the end of today’s trading session, it could signal a continuation of the downtrend.

An attached Fibonacci tool (1.31771 to 1.35437) has identified 3 potential targets for the USDCAD bears.

- 23.6 (1.34572)

- 38.2 (1.34037)

- 50.0 (1.33604)

The relative strength index’s positioning at 53.91 underscores the market’s current state of uncertainty, so the potential for a bullish reversal may not be completely off the table.

More By This Author:

Brent Tumbles Back Below $80Solana Briefly Touches Below 21-Period SMA

USD Trades Above 200-SMA Ahead Of Fed Meeting

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more