Gold Prices Outlook: Central Banks Could Send Gold Surging

Image Source: Unsplash

Central Banks Making a Case for Higher Gold Prices

Central banks will play a big role in where gold prices go next. They are clear that more gold is needed for their reserves, and this factor could send gold prices much higher in the coming months and quarters.

A bold statement, but it’s worth making: we could be looking at a gold price of $2,300 an ounce in a few years and saying, “That was cheap!”

Don’t rule out $3,000-an-ounce gold price just yet.

Now some perspective…

Regular Lombardi Letter readers know this well: central banks have been persistent buyers of gold since 2010.

For those who are new, know this: between 2010 and 2023, central banks purchased over 7,800 tonnes of gold. Also, 2022 and 2023 marked two years in a row that they bought over 1.000 tonnes of the precious metal.

This momentum has continued in 2024. In the first quarter, central banks purchased 290 tonnes of gold. Assuming that it continues at a similar pace, then 2024 could be another year when central banks buy over 1,000 tonnes of gold. (Source: “Gold Demand Trends Q1 2024,” World Gold Council, April 30, 2024.)

Central Banks to Keep on Buying Gold

What will central banks do in coming years?

You guessed it; they are planning to buy more.

The World Gold Council does a survey of central banks each year, asking them about the status of/plans for their gold reserves. The results of Central Bank Gold Reserves (CBGR) survey are out for 2024, and they are great in favor of gold bugs.

Out of the total of 70 central banks that responded, 29% intend to increase their gold reserves in the next 12 months. This is the highest percentage in the history of the survey!

And when the central banks were asked why they are planning to increase their gold holding, what did they say?

Their reasons include preferred strategic level of gold holdings, domestic gold production, and financial market concerns, including crisis risk and inflation. (Source: “2024 Central Bank Gold Reserves Survey,” World Gold Council, June 18, 2024.)

Massive Upside Still Ahead for Gold

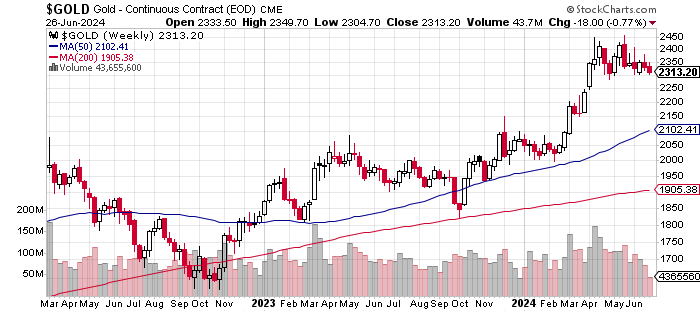

Dear reader, over the past few months, gold prices have stalled a bit—the yellow metal has traded in a range, now sitting at the bottom of the range. This could be making some investors nervous.

Looking at the charts only, if the price of gold breaks below $2,300, sellers could come in and take it down to about $2,150. That would be downside of about $150.00 in the near term.

Chart Courtesy of StockCharts.com

However, those who can be patient might learn that the near-term sell-off in gold prices (if it happens) is nothing but a minor hiccup. I believe that there’s still massive upside ahead. I think $3,000-an-ounce gold is a very achievable target sooner than later. Gold even has the potential to go higher.

I create my targets based on what central banks are doing.

I have said it before, and I will say it again: I imagine central banks like an elephant trying get into a filled pool unnoticed. No matter how swiftly the animal tries to get in, the water will get displaced. The water in this case, of course, is gold prices.

You see, the demand for gold prices was already robust. Central banks stepping into the market has really changed the dynamics and made the outlook for the yellow precious metal a lot better.

Where’s the Opportunity When Gold Prices Hit $3,000 an Ounce?

It almost seems like the gold miners haven’t gotten the memo that gold is trading near all-time highs. A large number of gold mining companies are trading at rock-bottom valuations relative to where gold prices currently are, and to where they could be headed in the next few years.

Investors have ignored mining stocks because they fear the costs of production have increased, which could hurt miners’ profitability.

My view is that miners are worth a close look. They are not really in favor these days, but when the price of gold is soaring, they could be the place to be. That’s when we could see some mining stocks doubling, tripling, or going up even more very quickly.

More By This Author:

Simple Reason Why Silver Prices Could Surge To $50/Ounce

Big Disparity In Stock Market: Where The Risks And Opportunities Are

5 Risks That Could Derail The Stock Market

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more