Big Disparity In Stock Market: Where The Risks And Opportunities Are

Disparity in the Stock Market Creating an Illusion

There’s a big disparity in the stock market that’s been creating the illusion that everything is great when it isn’t. It may not end well for the major stock indices, but it could open doors to many other opportunities.

So, what’s been happening?

As it stands, the key stock indices are really distorted. A few companies have been causing the indices to soar while many companies traded on the stock market may not be doing too well.

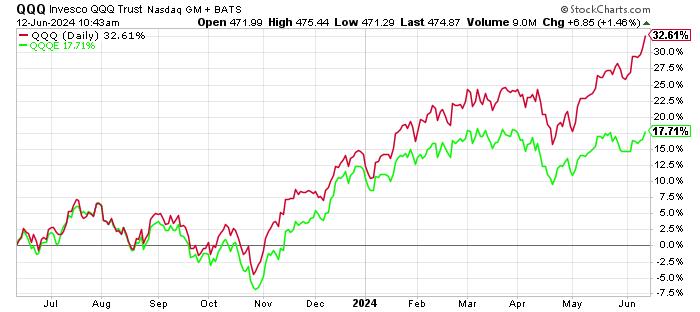

For some perspective, take a look at the chart below. It plots the price performances of Invesco QQQ Trust (Nasdaq: QQQ) and Direxion NASDAQ-100 Equal Weighted Index Shares (Nasdaq: QQQE) over the past year.

Invesco QQQ Trust is an exchange-traded fund (ETF) that tracks the Nasdaq-100 index. The Nasdaq-100 is a weighted index, which means valuable companies have higher weights than lower-value companies.

Direxion NASDAQ-100 Equal Weighted Index Shares is also an ETF that tracks the Nasdaq-100 but gives the companies in the index an equal weight.

The Nasdaq-100 comprises 100 of the largest non-financial companies traded on the Nasdaq. It includes technology giants like Microsoft Corp (Nasdaq: MSFT), Apple Inc (Nasdaq: AAPL), NVIDIA Corp (Nasdaq: NVDA), and Amazon.com Inc (Nasdaq: AMZN).

As the following chart shows, there was a huge difference between the performances of Invesco QQQ Trust and Direxion NASDAQ-100 Equal Weighted Index Shares. While QQQ increased by more than 32%, QQQE increased by 17.1%. That means QQQ outperformed QQQE by 84% over the past year.

Chart courtesy of StockCharts.com

Could This Disparity Lead to a Stock Market Crash?

As I said earlier, the disparity we see in the stock market nowadays gives the illusion that everything is great when it isn’t. Essentially, it means investors have paid way too much attention to a few of the biggest companies on the stock market and have relatively ignored everything else.

With that said, it has to be asked: What will happen once this trade runs out of gas?

You see, big tech names that have been driving the stock indices higher are starting to become expensive from a valuation perspective. Eventually, there will be a time when investors don’t make as much money from those stocks, so they’ll look for other opportunities and sell those high-flying stocks.

If this happens, we could see a rigorous stock market crash, since the big companies could also be a key driver of the indices on the downside.

Disparity Creating Opportunities

Dear reader, while the disparity in the stock market could cause a sharp decline in indices, it could also mean opportunities for those who are patient.

I’ve long argued that, no matter what kind of market conditions we’re experiencing, there are always opportunities out there. The disparity I’ve highlighted above is saying it could be time to look at shares of smaller companies and shares of companies that don’t get too much attention but have strong businesses in place and are doing well.

Here’s what I think the next move could be once investors find themselves not making much money from the biggest names on the stock market: in their chase for returns, they could sell their shares of the biggest names and buy stocks that haven’t been doing well.

I think stock picking could become more important in the next few quarters. Investing in shares of an index fund might not be as fruitful as investing in certain individual stocks. That’s because investors selling their shares of big names could drag the indices lower.

If investors pick the right individual stocks, they could get some capital preservation and actually generate solid returns over time.

More By This Author:

5 Risks That Could Derail The Stock Market

Investors Beware: Could Yield Curve Be Hinting A Stock Market Crash Is Ahead?

Central Banks Buy More Gold: Outlook For Gold Prices Gets Shinier

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more